Tools to help you build your KiwiSaver portfolio

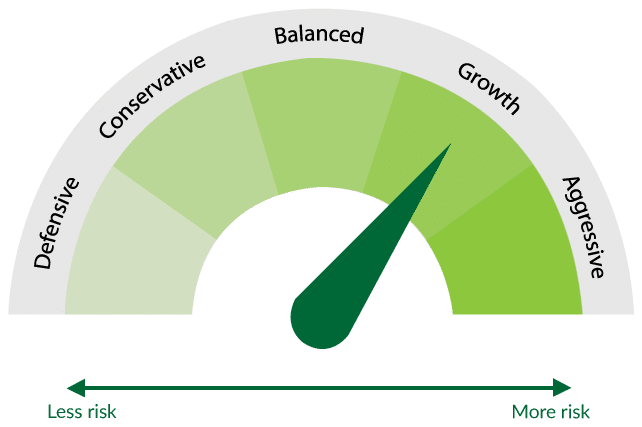

Investor Risk Profile Tool

Your Investor Risk Profile indicates how much investment risk you can bear, which will largely determine the type of assets or funds that may be appropriate for you to invest in. Using this tool you will find out which of the five Investor Risk Profiles you are – Defensive, Conservative, Balanced, Growth, or Aggressive. Each Risk Profile translates to a type of diversified fund, with each diversified fund having a different proportion of growth assets (like shares) relative to income assets (like bonds). It is suggested that the type of diversified funds that are best suited to you will match your Investor Risk Profile. However, what you choose to invest in is entirely your decision.

KiwiSaver Retirement Balance Calculator

Your KiwiSaver Retirement Balance is the amount of money you will have in your KiwiSaver portfolio when you reach retirement age (65 years old). The KiwiSaver Retirement Balance Calculator will use your information (current balance, age, salary, contributions, risk exposure etc.) to provide an estimated projection of your KiwiSaver Retirement Balance, based on standard assumptions set by the Government. Actual outcomes may differ.

Split your KiwiSaver investment across your choice of funds!

40+ Diversified & Single-Sector Funds to choose from

View and filter the full range of funds by various fund characteristics, including fee,

performance and product disclosure information here.

Things to know to help you do your KiwiSaver research…

Who manages your investment

The InvestNow KiwiSaver Scheme provides a vehicle for you to invest your KiwiSaver portfolio into investment options managed directly by leading New Zealand and global investment managers. These fund managers go through a detailed quality screening process to make sure they’re fit to handle your funds with care.

Learn more.

Historical fund performance

Each fund in the InvestNow KiwiSaver Scheme exists outside of KiwiSaver with the same fees and charges, and is expected perform in-line with the underlying fund. Your KiwiSaver investments are managed directly by the investment managers you choose in the InvestNow KiwiSaver Scheme.

Learn more.

Switching KiwiSaver providers

It takes less than 2 minutes to get started with the InvestNow KiwiSaver Scheme. You can choose your investments and submit your application online. Once your application is submitted, it takes approximately 10 days for the transfer from your current provider to be complete.

Start online application.