InvestNow Market Wrap-Up: June 2023

Written by Jason Choy, InvestNow Senior Portfolio Manager

Welcome to InvestNow’s first edition of the monthly Market Wrap-Up!

Financial markets can often be unnecessarily noisy and complicated – with so many headlines clamouring for our attention, it’s hard to keep up with what’s actually relevant to each of our investing journeys.

Well, InvestNow’s here to help! Each month we’ll distill everything you need to know in the wide world of investments into digestible bites curated for the Kiwi investor. At InvestNow, we think an important guiding principle of being a successful investor is to stay informed, but avoid the noise. So, make sure you keep abreast of what is happening in markets, but resist the urge to change your long-term strategy in response to market volatility and noise.

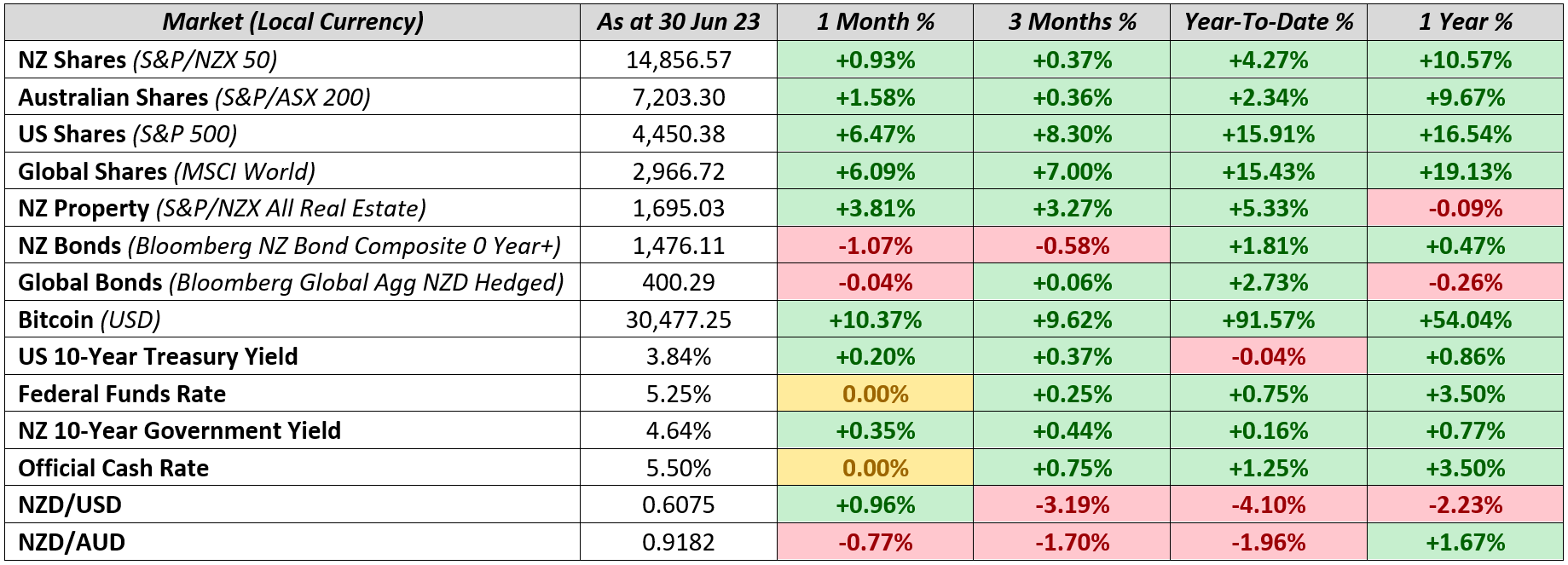

Market Dashboard

Global Markets Summary: June 2023

US share markets stage massive recovery in 2023: After a difficult 2022 where many major share markets entered bear market territory (defined as being 20% off their previous highs), 2023 has been a godsend for global share investors. The S&P 500 was up a healthy 16% year-to-date, while the technology-heavy NASDAQ Index ascended 32% – its best first-half return in 40 years. The rally was fueled by the meteoric rise of ChatGPT and more broadly Artificial Intelligence (AI), Wall Street’s latest buzzword, alongside rampant inflation that is finally starting to ease, with the US Consumer Price Index reading 4% over the month – its lowest level since March 2021.

Not out of the woods yet: While the encouraging inflation reading was enough for the US Federal Reserve to finally pause its interest rate hiking cycle for the first time in 15 months, the Fed is wary that inflation is still double their 2% target, and is pencilling in two more rate hikes to finish off the year. Other global economic issues keeping investors up at night include continued recessionary concerns, sky-high mortgage rates and the cost-of-living crisis. This has caused many market watchers to second guess whether the stock market’s first-half rally was a tad overenthusiastic, with many analysts forecasting a much more muted second half to the year.

Global share markets also joined in on the fun: More broadly, the MSCI World Index was up 15% in the first half of the year, with Japan being the best performing major equity market both over the quarter (+14%) as well as year-to-date (+23%), largely off the back of weakness in the yen bolstering profits generated abroad. European stocks were also up a chunky 14% for the year, as inflation is expected to cool down to a more manageable 5.5%, off from a peak of 10.6% late last year. UK equities were down over Q2 and more muted so far this year, as the Bank of England reintroduced the 50bp rate hike lever in June after an initial decision to slow it down to 25bp in March proved ineffective, with UK inflation still at an eye-watering 8.7% annual rate.

Over in global fixed income markets, government bond yields continue to rise: All major central banks continued to raise rates over Q2, although notable standouts included UK and Australia, who both showed greater resolve in their tightening cycles to combat higher-than-expected inflation. The bellwether US 10-Year yield climbed up 20bp over the month to 3.84%, while the 2-Year finished June at 4.87%, marking a further inversion of the yield curve, which is traditionally the signal of an upcoming recession.

Key Updates for the Kiwi Investor

New Zealand equity markets were robust in June: The S&P/NZX 50 advanced 0.9% over the month, supported by better-than-expected local company updates and encouraging sentiment regarding inflation, with consumer inflation expectations falling sharply from 4.8% to 4.3%. Despite official inflation figures still being a fair while away (due to NZ’s quarterly, rather than monthly reporting cycle), the Reserve Bank of New Zealand (RBNZ) surprised many by signalling that the Official Cash Rate (OCR) had reached its peak of 5.5% following its latest 0.25% hike in May. Overall, the first half of 2023 saw the local share market return 4.27%, which compared favourably to the 2.34% generated by our Trans-Tasman counterpart over in the ASX 200.

Local bond markets were weaker: As the Bloomberg NZ Bond Composite 0+ Yr Index declined -1.1% in June, in part reflective of the global market sentiment that central banks are still a fair while away from cutting rates, along with jitters around government spending increasing while tax revenues decline. This contributed to the New Zealand Government Bond yield increasing 35bps to 4.64% over the month.

New Zealand is officially in a recession: Two consecutive quarters of negative GDP growth in December (-0.7%) and March (-0.1%) means that the mainstream media now have license to drop the ‘r’-word in every opinion column. Although the knee-jerk reaction many Kiwis have when they read the word ‘recession’ is to immediately think that the share market is dropping off a cliff, this isn’t necessarily the case.

The NZ share market went up in the days immediately following the news of the recession: This is because financial markets are forward-looking, so markets were already expecting this and largely priced it in. And again, because the market is forward-looking, the eventual share market recovery will likely also occur before the economy actually improves – so it may not be a good idea to try and time the market by selling off your holdings, as you might miss out on the market’s eventual recovery.

Most investors will be best off navigating the recession by staying the course: Given all the uncertainty out there fueled by fearmongering headlines, it is understandable to feel the need to take action now that we’re in a recession. However, often it’s investors that stay calm and stick to their long-term investment plans who end up getting the best results (recall the many investors who sold off their holdings at the first signs of Covid and missed out on the market’s remarkable subsequent rally). Stay invested, stay informed, and stay vigilant in reviewing your investment goals and constraints, and most Kiwi investors will find that they’ll be well-placed to weather any storm.

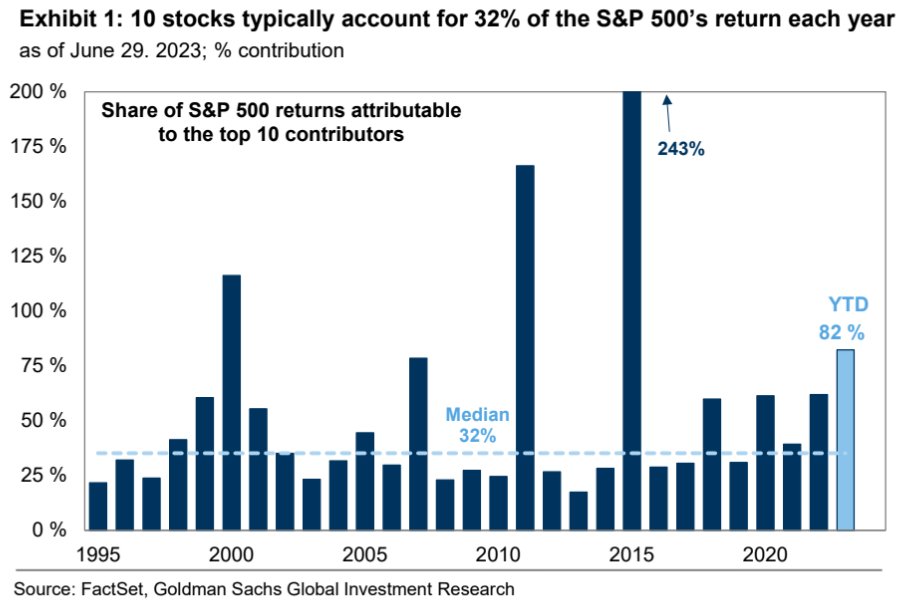

Chart of the Month

Our Chart of the Month is from Goldman Sachs Global Investment Research, who note that on average, just 10 stocks account for around 32% of the S&P 500’s return each year. Since 1990, if we were to exclude the top 10 contributors, the S&P 500 would only return 8% each year, versus 1.5x times more at 12% if we were to include the whole index.

In 2023 the top 10 contributors to the S&P 500 account for roughly 12% of the index’s ~15% return. In other words, you lose out on 80% of the S&P 500’s performance by not being invested in just 2% of the 500 names in the index. 80-20 rule? More like the 80-2 rule!

This reflects that performance of the market has largely been driven by only a handful of stocks – with each year’s handful being different! For example, so far in 2023, the index has been powered by mega-cap tech stocks, or the so-called “Magnificent Seven” – Apple (+50%), Amazon (+55%), Microsoft (+43%), Alphabet (+36%), Meta (+139%), Tesla (+113%) and Nvidia (+190%). While those same tech stocks were at the bottom of the performance charts just last year, averaging close to a -50% return in 2022 alone!

This goes to show that it is incredibly difficult to pick the winners each year, as market cycles will favour certain stocks and sectors from year-to-year. Picking the wrong stocks and missing out on just a handful of names can mean missing out on serious gains.

Investors that remain invested in the entire broader market, however, won’t miss out on these gains! History has proven time and again that maintaining broad market exposure such as through a low-cost index fund is often one of the most effective ways to generate long-term, sustainable investment returns.

What we’ve been reading

- Salt’s Global Outlook 2023

- Harbour’s Top 10 Risks and Opportunities for 2023 – A Mid-Year Reflection

- Russell Investment’s Q3 Global Market Outlook

- Fund Manager Diversification – The Power of ‘And’

- MJW Report: Men risk more, have more in KiwiSaver

- MoneyKing: Why you shouldn’t open a KiwiSaver Account for your Kids

InvestNow Market Wrap-Up: June 2023

Written by Jason Choy, InvestNow Senior Portfolio Manager

Welcome to InvestNow’s first edition of the monthly Market Wrap-Up!

Financial markets can often be unnecessarily noisy and complicated – with so many headlines clamouring for our attention, it’s hard to keep up with what’s actually relevant to each of our investing journeys.

Well, InvestNow’s here to help! Each month we’ll distill everything you need to know in the wide world of investments into digestible bites curated for the Kiwi investor. At InvestNow, we think an important guiding principle of being a successful investor is to stay informed, but avoid the noise. So, make sure you keep abreast of what is happening in markets, but resist the urge to change your long-term strategy in response to market volatility and noise.

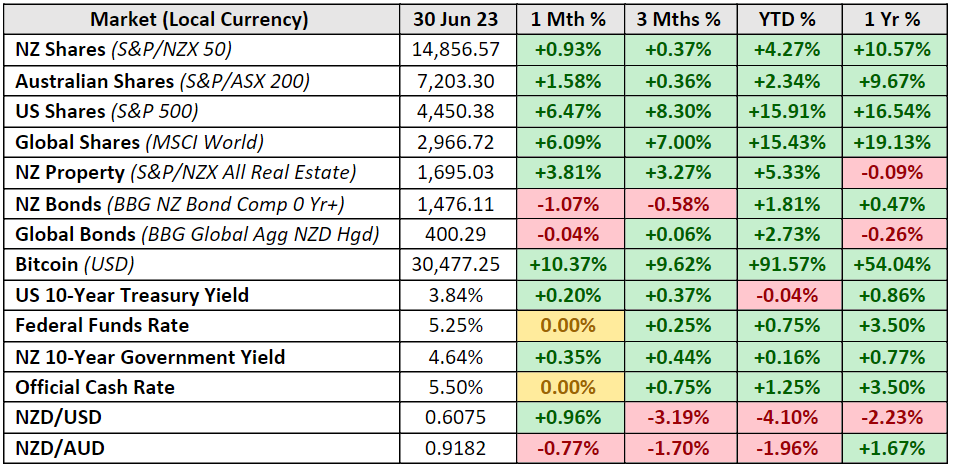

Market Dashboard

Global Markets Summary: June 2023

US share markets stage massive recovery in 2023: After a difficult 2022 where many major share markets entered bear market territory (defined as being 20% off their previous highs), 2023 has been a godsend for global share investors. The S&P 500 was up a healthy 16% year-to-date, while the technology-heavy NASDAQ Index ascended 32% – its best first-half return in 40 years. The rally was fueled by the meteoric rise of ChatGPT and more broadly Artificial Intelligence (AI), Wall Street’s latest buzzword, alongside rampant inflation that is finally starting to ease, with the US Consumer Price Index reading 4% over the month – its lowest level since March 2021.

Not out of the woods yet: While the encouraging inflation reading was enough for the US Federal Reserve to finally pause its interest rate hiking cycle for the first time in 15 months, the Fed is wary that inflation is still double their 2% target, and is pencilling in two more rate hikes to finish off the year. Other global economic issues keeping investors up at night include continued recessionary concerns, sky-high mortgage rates and the cost-of-living crisis. This has caused many market watchers to second guess whether the stock market’s first half-rally was a tad overenthusiastic, with many analysts forecasting a much more muted second half to the year.

Global share markets also joined in on the fun: More broadly, the MSCI World Index was up 15% in the first half of the year, with Japan being the best performing major equity market both over the quarter (+14%) as well as year-to-date (+23%), largely off the back of weakness in the yen bolstering profits generated abroad. European stocks were also up a chunky 14% for the year, as inflation is expected to cool down to a more manageable 5.5%, off from a peak of 10.6% late last year. UK equities were down over Q2 and more muted so far this year, as the Bank of England reintroduced the 50bp rate hike lever in June after an initial decision to slow it down to 25bp in March proved ineffective, with UK inflation still at an eye-watering 8.7% annual rate.

Over in global fixed income markets, government bond yields continue to rise: All major central banks continued to raise rates over Q2, although notable standouts included UK and Australia, who both showed greater resolve in their tightening cycles to combat higher-than-expected inflation. The bellwether US 10-Year yield climbed up 20bp over the month to 3.84%, while the 2-Year finished June at 4.87%, marking a further inversion of the yield curve, which is traditionally the signal of an upcoming recession.

Key Updates for the Kiwi Investor

New Zealand equity markets were robust in June: The S&P/NZX 50 advanced 0.9% over the month, supported by better-than-expected local company updates and encouraging sentiment regarding inflation, with consumer inflation expectations falling sharply from 4.8% to 4.3%. Despite official inflation figures still being a fair while away (due to NZ’s quarterly, rather than monthly reporting cycle), the Reserve Bank of New Zealand (RBNZ) surprised many by signalling that the Official Cash Rate (OCR) had reached its peak of 5.5% following its latest 0.25% hike in May. Overall, the first half of 2023 saw the local share market return 4.27%, which compared favourably to the 2.34% generated by our Trans-Tasman counterpart over in the ASX 200.

Local bond markets were weaker: As the Bloomberg NZ Bond Composite 0+ Yr Index declined -1.1% in June, in part reflective of the global market sentiment that central banks are still a fair while away from cutting rates, along with jitters around government spending increasing while tax revenues decline. This contributed to the New Zealand Government Bond yield increasing 35bps to 4.64% over the month.

New Zealand is officially in a recession: Two consecutive quarters of negative GDP growth in December (-0.7%) and March (-0.1%) means that the mainstream media now have license to drop the ‘r’-word in every opinion column. Although the knee-jerk reaction many Kiwis have when they read the word ‘recession’ is to immediately think that the share market is dropping off a cliff, this isn’t necessarily the case.

The NZ share market went up in the days immediately following the news of the recession: This is because financial markets are forward-looking, so markets were already expecting this and largely priced it in. And again, because the market is forward-looking, the eventual share market recovery will likely also occur before the economy actually improves – so it may not be a good idea to try and time the market by selling off your holdings, as you might miss out on the market’s eventual recovery.

Most investors will be best off navigating the recession by staying the course: Given all the uncertainty out there fueled by fearmongering headlines, it is understandable to feel the need to take action now that we’re in a recession. However, often it’s investors that stay calm and stick to their long-term investment plans who end up getting the best results (recall the many investors who sold off their holdings at the first signs of Covid and missed out on the market’s remarkable subsequent rally). Stay invested, stay informed, and stay vigilant in reviewing your investment goals and constraints, and most Kiwi investors will find that they’ll be well-placed to weather any storm.

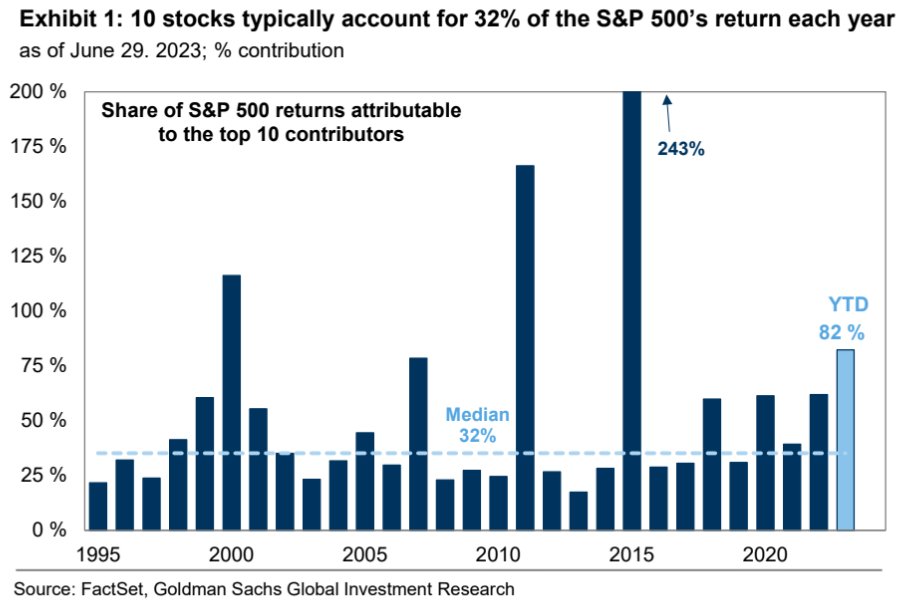

Chart of the Month

Our Chart of the Month is from Goldman Sachs Global Investment Research, who note that on average, just 10 stocks account for around 32% of the S&P 500’s return each year. Since 1990, if we were to exclude the top 10 contributors, the S&P 500 would only return 8% each year, versus 1.5x times more at 12% if we were to include the whole index.

In 2023 the top 10 contributors to the S&P 500 account for roughly 12% of the index’s ~15% return. In other words, you lose out on 80% of the S&P 500’s performance by not being invested in just 2% of the 500 names in the index. 80-20 rule? More like the 80-2 rule!

This reflects that performance of the market has largely been driven by only a handful of stocks – with each year’s handful being different! For example, so far in 2023, the index has been powered by mega-cap tech stocks, or the so-called “Magnificent Seven” – Apple (+50%), Amazon (+55%), Microsoft (+43%), Alphabet (+36%), Meta (+139%), Tesla (+113%) and Nvidia (+190%). While those same tech stocks were at the bottom of the performance charts just last year, averaging close to a -50% return in 2022 alone!

This goes to show that it is incredibly difficult to pick the winners each year, as market cycles will favour certain stocks and sectors from year-to-year. Picking the wrong stocks and missing out on just a handful of names can mean missing out on serious gains.

Investors that remain invested in the entire broader market, however, won’t miss out on these gains! History has proven time and again that maintaining broad market exposure such as through a low-cost index fund is often one of the most effective ways to generate long-term, sustainable investment returns.

What we’ve been reading

- Salt’s Global Outlook 2023

- Harbour’s Top 10 Risks and Opportunities for 2023 – A Mid-Year Reflection

- Russell Investment’s Q3 Global Market Outlook

- Fund Manager Diversification – The Power of ‘And’

- MJW Report: Men risk more, have more in KiwiSaver

- MoneyKing: Why you shouldn’t open a KiwiSaver Account for your Kids