InvestNow News – 23rd October – Milford – Could the hunt for yield lead to alternative assets?

Article written by John Johnston, Milford – 15th October 2020

The economic crisis caused by the COVID-19 pandemic has been notable for a swift, coordinated reduction in wholesale funding rates by central banks worldwide. This reduction to historic lows has been largely passed on to retail and commercial borrowers, and further falls in interest rates are expected from here (in New Zealand, the Official Cash Rate (OCR) forward rate for August 2021 is 0.45% lower than the one month rate).

Together with massively increased quantitative easing programmes from central banks, these monetary policy initiatives intended to support business and consumers are having major effects in key asset markets. With term deposit rates falling, and potentially falling further in the coming months, cash savings are less attractive than ever in terms of providing a yield to the saver. Total term deposit balances in New Zealand have declined from $197 billion at August 2019 to $181 billion at August 2020.

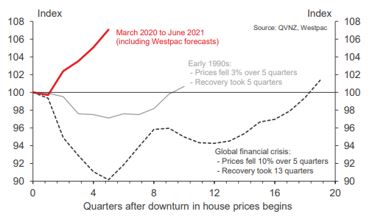

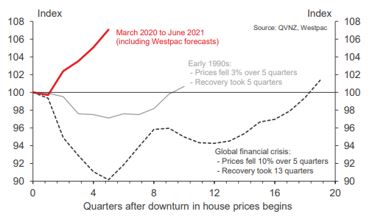

Cheap interest rates have fuelled a return to strong price growth in the New Zealand housing market. Nationwide, median house prices are up 11.1% over the 12 months to September.

On both a last 12 months and last three years view, yields on residential property have fallen in a large majority of New Zealand towns and cities.

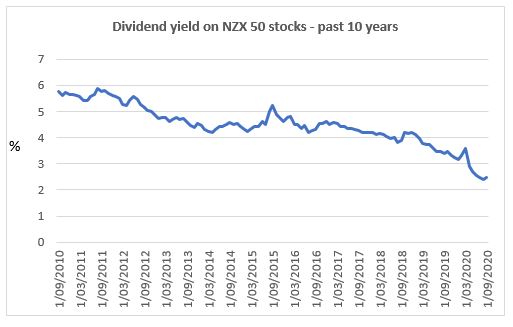

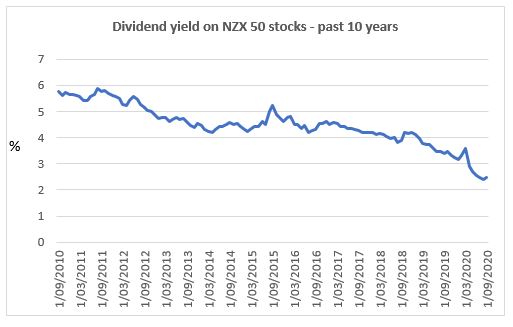

Similarly, wholesale funding rate reductions and quantitative easing programmes have been an important driver of the strong rebounds in global equity markets since the March 2020 sell-offs. A consequence of share prices rising in excess of the rate of growth in companies’ earnings is that the dividend yield on shares is, overall, declining. The following chart depicts the percentage dividend yield on the NZX 50 stock index, for the past 10 years:

Source: NZX

N.B.: The present very low yield is exacerbated by some companies suspending dividends due to COVID-19, however the downward trend is nonetheless material

In recent weeks, we have also seen commercial property transactions completing at low capitalisation rates, i.e. high prices on commercial property assets, in spite of COVID-19 uncertainties. This is not uniform across all commercial property sectors as some are more directly impacted by tourism or hospitality weakness caused by COVID-19, but for example in August two Countdown supermarkets sold on a cap rate under 5%, and in September hundreds of millions worth of Waikato and Bay of Plenty industrial property sold on cap rates of 5% and 6%.

Valuation of businesses or assets is typically a function of future cashflows from the business or asset, discounted to a present value at a notionally appropriate “cost of capital” or hurdle rate. Ever-lower funding costs reduce the cost of capital and therefore contribute to asset price inflation. In this environment, beyond listed equities, bonds, and commercial property there is the potential for privately owned assets that provide a dividend yield to become more attractive to investors than they have been in recent years. The New Zealand economy has several categories of alternative assets that could be expected to provide a yield over the medium term, potentially in excess of the appropriate cost of capital. These could be as diverse as infrastructure, forestry, financing businesses, or segments of the agriculture sector.

It could be that the coming period is a fruitful time to consider investing in alternative assets alongside active investment in traditional asset classes, in order to achieve yields that are now more difficult to obtain.

Disclaimer: The material contained herein is based on information believed to be accurate and reliable although no guarantee can be given that this is the case. This is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Before making any financial decisions, you may wish to seek independent financial advice.

InvestNow News – 23rd October – Milford – Could the hunt for yield lead to alternative assets?

Article written by John Johnston, Milford – 15th October 2020

The economic crisis caused by the COVID-19 pandemic has been notable for a swift, coordinated reduction in wholesale funding rates by central banks worldwide. This reduction to historic lows has been largely passed on to retail and commercial borrowers, and further falls in interest rates are expected from here (in New Zealand, the Official Cash Rate (OCR) forward rate for August 2021 is 0.45% lower than the one month rate).

Together with massively increased quantitative easing programmes from central banks, these monetary policy initiatives intended to support business and consumers are having major effects in key asset markets. With term deposit rates falling, and potentially falling further in the coming months, cash savings are less attractive than ever in terms of providing a yield to the saver. Total term deposit balances in New Zealand have declined from $197 billion at August 2019 to $181 billion at August 2020.

Cheap interest rates have fuelled a return to strong price growth in the New Zealand housing market. Nationwide, median house prices are up 11.1% over the 12 months to September.

On both a last 12 months and last three years view, yields on residential property have fallen in a large majority of New Zealand towns and cities.

Similarly, wholesale funding rate reductions and quantitative easing programmes have been an important driver of the strong rebounds in global equity markets since the March 2020 sell-offs. A consequence of share prices rising in excess of the rate of growth in companies’ earnings is that the dividend yield on shares is, overall, declining. The following chart depicts the percentage dividend yield on the NZX 50 stock index, for the past 10 years:

Source: NZX

N.B.: The present very low yield is exacerbated by some companies suspending dividends due to COVID-19, however the downward trend is nonetheless material

In recent weeks, we have also seen commercial property transactions completing at low capitalisation rates, i.e. high prices on commercial property assets, in spite of COVID-19 uncertainties. This is not uniform across all commercial property sectors as some are more directly impacted by tourism or hospitality weakness caused by COVID-19, but for example in August two Countdown supermarkets sold on a cap rate under 5%, and in September hundreds of millions worth of Waikato and Bay of Plenty industrial property sold on cap rates of 5% and 6%.

Valuation of businesses or assets is typically a function of future cashflows from the business or asset, discounted to a present value at a notionally appropriate “cost of capital” or hurdle rate. Ever-lower funding costs reduce the cost of capital and therefore contribute to asset price inflation. In this environment, beyond listed equities, bonds, and commercial property there is the potential for privately owned assets that provide a dividend yield to become more attractive to investors than they have been in recent years. The New Zealand economy has several categories of alternative assets that could be expected to provide a yield over the medium term, potentially in excess of the appropriate cost of capital. These could be as diverse as infrastructure, forestry, financing businesses, or segments of the agriculture sector.

It could be that the coming period is a fruitful time to consider investing in alternative assets alongside active investment in traditional asset classes, in order to achieve yields that are now more difficult to obtain.

Disclaimer: The material contained herein is based on information believed to be accurate and reliable although no guarantee can be given that this is the case. This is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Before making any financial decisions, you may wish to seek independent financial advice.