InvestNow News – 23rd October – Milford – Early innings for e-commerce

Article written by Stephanie Perrin, Milford – 30th September 2020

With the US share market up +45% since the lows in late March, and shares of companies like Amazon up +79% from the lows and +62% year-to-date, you would be forgiven for asking “what global pandemic?”.

It is clear that despite many industries being severely impacted by COVID-19, there are also many which have benefitted. E-commerce is one of these COVID-19 beneficiaries, and a key theme that the Milford Global Equity Funds have exposure to.

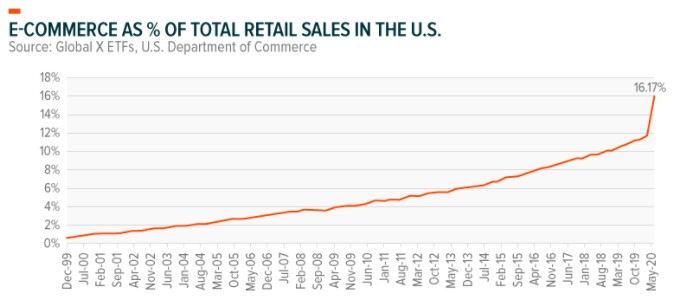

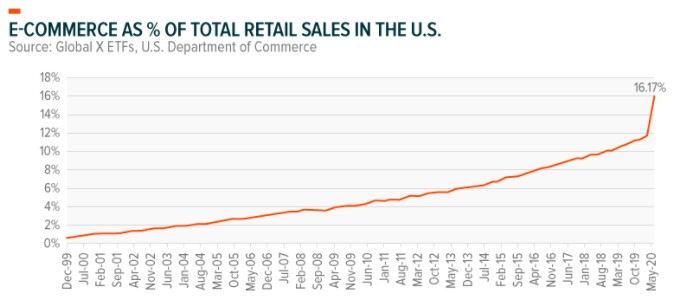

To put this acceleration in context, prior to COVID-19, e-commerce was growing in the low-to-mid teens and made up around 11% of total retail spend in the US. As COVID-19 took hold, we saw e-commerce growth accelerate to more than 100% year on year in some months[1], driving penetration of e-commerce to around 16% of total retail sales[2].

Which companies are winning the race?

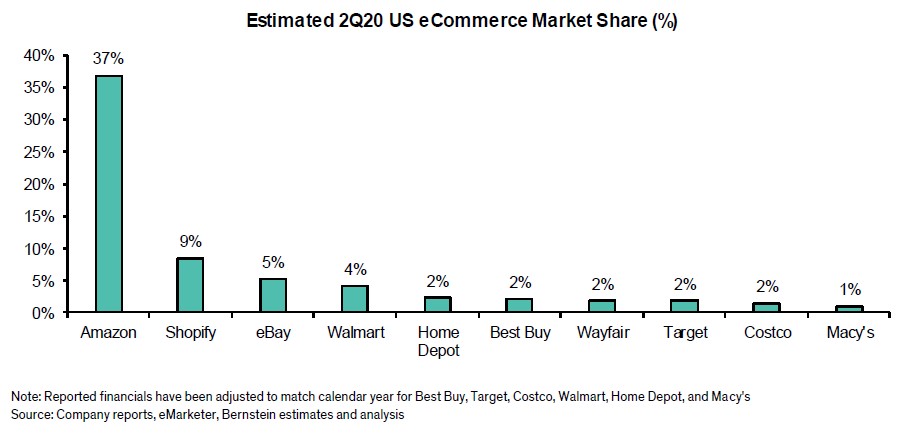

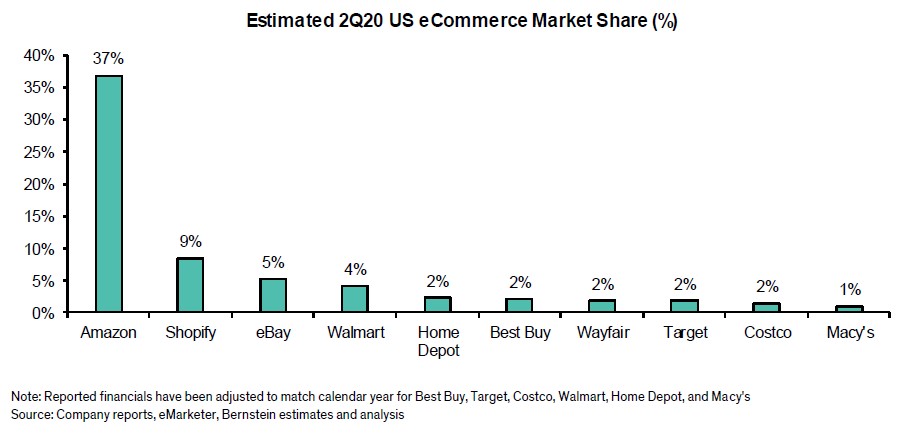

US$1 million is now spent online every minute, and Amazon ships an astounding 6,659 packages every minute to keep up with this demand[3]. Amazon continues to invest in this space, recently announcing plans to hire 100,000 additional workers (on top of the 33k current job openings in corporate and technology roles, and the 125,000 full-time additions earlier in the year), and to open 100+ new delivery and fulfilment centres which equates to a 50% year on year growth in capacity. In addition, Amazon plans to open 1,000 small neighbourhood delivery hubs to bring products closer to consumers. With 37% of the US e-commerce market, Amazon is the clear leader in e-commerce, and sits in a prime position to benefit from the growth in online shopping.

Today, having a solid online presence can be the difference between a retailer’s success or failure. With the largest shopping footprint in the world, the US is often thought of as the epicentre of the “retail apocalypse” – images of empty malls and shuttered storefronts spring to mind. The country has ~25 square feet of shopping space per person, almost 50% higher than Canada, the second highest[4]. While initially thought of as a disadvantage in this changing world, some traditional brick & mortar retailers used their extensive store networks to their advantage during the peak of the pandemic. Big box home improvement retailer Home Depot quickly pivoted to offer customers curbside pickup or click-and-collect to limit time spent in-store, and was able to convert parts of its supply chain to direct fulfilment centres for online orders. As a result, Home Depot’s online sales doubled in its most recent quarterly results. The importance of having an omnichannel strategy is also reflected in the fact that more than 50% of customers who purchase online still choose to come into a Home Depot store to complete their purchase.

Is the shift sustainable?

The shift to e-commerce is thought to have been pulled forward by up to five years[5], and there are several key changes that give us more confidence that this is a permanent inflection.

First, older generations who previously hadn’t embraced online shopping, were forced to adapt during the pandemic in order to prioritise health. As the war against COVID-19 continues, this demographic will become more entrenched as e-commerce users, particularly as they begin to appreciate the ease of use and convenience that comes with it.

Second, there has been a step change in the growth of categories that hadn’t previously gained much traction in the shift to online. Supermarkets, for example, with thousands of stock keeping units (SKU’s), perishable goods, and stores designed around the psychology of shopping (browsing and impulse buying) have largely lagged the technological change. However, COVID-19 has changed this, as grocery delivery services increased five-fold and customers spent a whopping 558% more at the peak in April compared to the prior year[6]. We expect these industries to continue to adapt and join the online revolution.

Lastly, as discussed, companies are investing heavily in e-commerce infrastructure and technology which, in turn, improves the customer experience and cements e-commerce as the consumer’s method of choice in the future. While the global pandemic will one day end, we believe there is a more enduring and sustainable shift occurring in e-commerce. And with a long runway for growth remaining, it could still be early innings for e-commerce.

[1] https://www.globalxetfs.com/e-commerce-entering-the-next-wave-of-growth/

[2] https://www.forbes.com/sites/jiawertz/2020/08/01/3-emerging-e-commerce-growth-trends-to-leverage-in-2020/#2ef6967e6fee

[3] https://www.visualcapitalist.com/every-minute-internet-2020/

[4] IBM’s US Retail Index.

[5] Bernstein, “eCommerce Outlook: Just how permanent is the pull forward?”, 15th September 2020.

[6] https://www.visualcapitalist.com/how-u-s-consumers-are-spending-differently-during-covid-19/

Disclaimer: The material contained herein is based on information believed to be accurate and reliable although no guarantee can be given that this is the case. This is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Before making any financial decisions, you may wish to seek independent financial advice.

Disclosure of interests: Milford holds shares in Amazon and Home Depot on behalf of clients.

InvestNow News – 23rd October – Milford – Early innings for e-commerce

Article written by Stephanie Perrin, Milford – 30th September 2020

With the US share market up +45% since the lows in late March, and shares of companies like Amazon up +79% from the lows and +62% year-to-date, you would be forgiven for asking “what global pandemic?”.

It is clear that despite many industries being severely impacted by COVID-19, there are also many which have benefitted. E-commerce is one of these COVID-19 beneficiaries, and a key theme that the Milford Global Equity Funds have exposure to.

To put this acceleration in context, prior to COVID-19, e-commerce was growing in the low-to-mid teens and made up around 11% of total retail spend in the US. As COVID-19 took hold, we saw e-commerce growth accelerate to more than 100% year on year in some months[1], driving penetration of e-commerce to around 16% of total retail sales[2].

Which companies are winning the race?

US$1 million is now spent online every minute, and Amazon ships an astounding 6,659 packages every minute to keep up with this demand[3]. Amazon continues to invest in this space, recently announcing plans to hire 100,000 additional workers (on top of the 33k current job openings in corporate and technology roles, and the 125,000 full-time additions earlier in the year), and to open 100+ new delivery and fulfilment centres which equates to a 50% year on year growth in capacity. In addition, Amazon plans to open 1,000 small neighbourhood delivery hubs to bring products closer to consumers. With 37% of the US e-commerce market, Amazon is the clear leader in e-commerce, and sits in a prime position to benefit from the growth in online shopping.

Today, having a solid online presence can be the difference between a retailer’s success or failure. With the largest shopping footprint in the world, the US is often thought of as the epicentre of the “retail apocalypse” – images of empty malls and shuttered storefronts spring to mind. The country has ~25 square feet of shopping space per person, almost 50% higher than Canada, the second highest[4]. While initially thought of as a disadvantage in this changing world, some traditional brick & mortar retailers used their extensive store networks to their advantage during the peak of the pandemic. Big box home improvement retailer Home Depot quickly pivoted to offer customers curbside pickup or click-and-collect to limit time spent in-store, and was able to convert parts of its supply chain to direct fulfilment centres for online orders. As a result, Home Depot’s online sales doubled in its most recent quarterly results. The importance of having an omnichannel strategy is also reflected in the fact that more than 50% of customers who purchase online still choose to come into a Home Depot store to complete their purchase.

Is the shift sustainable?

The shift to e-commerce is thought to have been pulled forward by up to five years[5], and there are several key changes that give us more confidence that this is a permanent inflection.

First, older generations who previously hadn’t embraced online shopping, were forced to adapt during the pandemic in order to prioritise health. As the war against COVID-19 continues, this demographic will become more entrenched as e-commerce users, particularly as they begin to appreciate the ease of use and convenience that comes with it.

Second, there has been a step change in the growth of categories that hadn’t previously gained much traction in the shift to online. Supermarkets, for example, with thousands of stock keeping units (SKU’s), perishable goods, and stores designed around the psychology of shopping (browsing and impulse buying) have largely lagged the technological change. However, COVID-19 has changed this, as grocery delivery services increased five-fold and customers spent a whopping 558% more at the peak in April compared to the prior year[6]. We expect these industries to continue to adapt and join the online revolution.

Lastly, as discussed, companies are investing heavily in e-commerce infrastructure and technology which, in turn, improves the customer experience and cements e-commerce as the consumer’s method of choice in the future. While the global pandemic will one day end, we believe there is a more enduring and sustainable shift occurring in e-commerce. And with a long runway for growth remaining, it could still be early innings for e-commerce.

[1] https://www.globalxetfs.com/e-commerce-entering-the-next-wave-of-growth/

[2] https://www.forbes.com/sites/jiawertz/2020/08/01/3-emerging-e-commerce-growth-trends-to-leverage-in-2020/#2ef6967e6fee

[3] https://www.visualcapitalist.com/every-minute-internet-2020/

[4] IBM’s US Retail Index.

[5] Bernstein, “eCommerce Outlook: Just how permanent is the pull forward?”, 15th September 2020.

[6] https://www.visualcapitalist.com/how-u-s-consumers-are-spending-differently-during-covid-19/

Disclaimer: The material contained herein is based on information believed to be accurate and reliable although no guarantee can be given that this is the case. This is intended to provide general information only. It does not take into account your investment needs or personal circumstances. It is not intended to be viewed as investment or financial advice. Before making any financial decisions, you may wish to seek independent financial advice.

Disclosure of interests: Milford holds shares in Amazon and Home Depot on behalf of clients.