InvestNow News – 18th September – Harbour Asset Management – Negative cash rates – The afterburner for asset prices

Article written by Hamish Pepper & Andrew Bascand, Harbour Asset Management – 11th September 2020

- The RBNZ’s stated preference for a negative OCR, should further stimulus be required, has encouraged the New Zealand market to expect negative wholesale cash interest rates next year

- This forward guidance on the potential for negative rates has led to large declines in retail interest rates and is having a powerful and positive impact on all asset prices

- This week a New Zealand government bond closed with a negative yield for the first time

When Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr recently reiterated his preference for negative interest rates as a potential tool to deliver more stimulus, markets listened.

“The Committee expressed a preference for considering a package of a negative OCR and a ‘Funding for Lending Programme’ in addition to the current Large Scale Asset Purchase (LSAP) programme.”

– RBNZ August 2020 MPS, summary record of meeting

This focus on the potential for a negative Official Cash Rate (OCR) has encouraged the New Zealand interest rate market to price negative wholesale interest rates in 2021, implying an OCR of -0.2% in one year’s time. Forward interest rates based on the OCR (known as Overnight Index Swaps, or OIS) are negative for most time periods from April 2021.

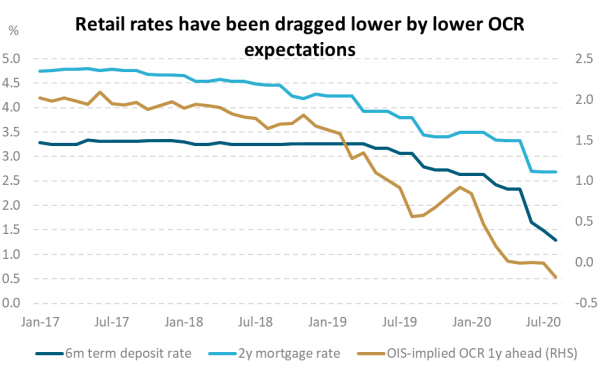

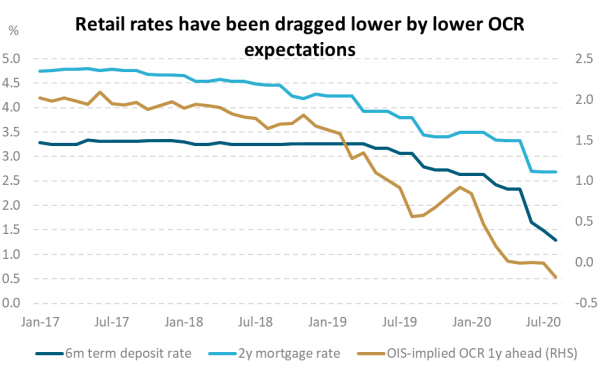

Financial markets use OIS to partly determine interest rates for a broad range of bonds, loans and deposits. That is why term deposit and mortgage rates have dipped so sharply in recent months. This week a New Zealand government bond closed with a negative yield for the first time (the April 2023 bond).

Note: 2y mortgage rate is “special” rate for loan-to-value less than 80%. Source: Reserve Bank of New Zealand, Bloomberg.

Since the RBNZ cut the OCR by 0.75% to 0.25% on 16 March 2020 and launched its quantitative easing programme one week later, 6-month term deposit rates have dropped from 2.6% to 1.3%. More than half of that decline has happened in the past three months, as the market has priced an increasing probability of a negative OCR next year. Mortgage rates have also fallen significantly. The average two-year mortgage rate, for example, has reduced from 3.5% to 2.7% this year.

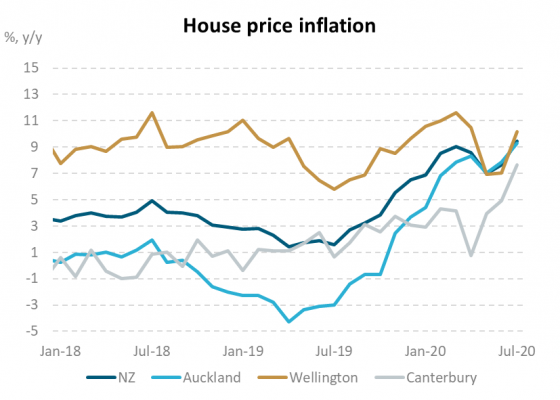

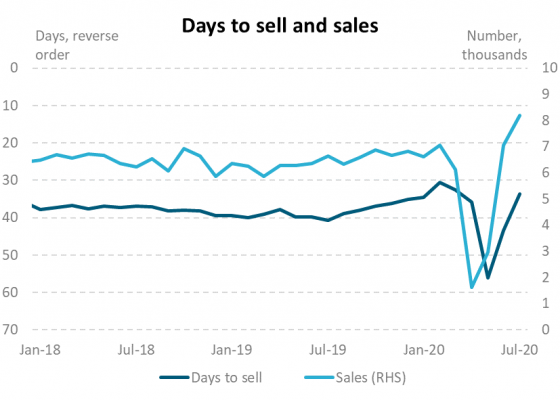

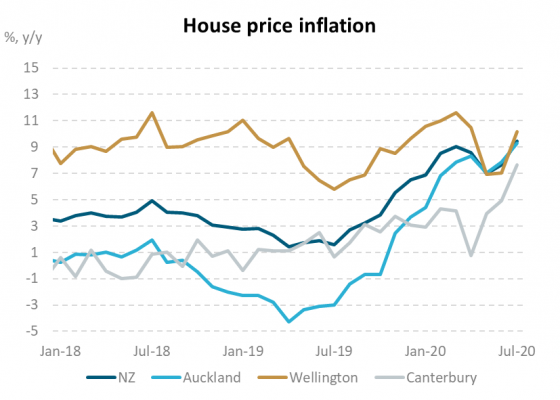

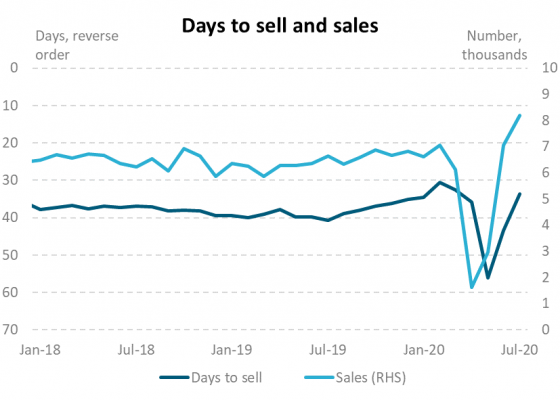

The housing market has rebounded in response to lower interest rates. Household loan growth picked up in July and house prices have recovered from declines seen in April and May. For instance, according to the Real Estate Institute of New Zealand (REINZ), New Zealand house prices (on a like-for-like and seasonally adjusted basis) have increased almost 3% since their low in May and have reached new all-time highs. Average days to sell dropped to 34 days in July, from 56 in May, and there were more than 8,000 houses sold in July, versus less than 2,000 in April.

Source: REINZ and ANZ.

In the listed aged care sector, similar trends have been evident. Summerset noted with their recent profit result, that new unit sales were up 50% in May on the prior year while resales jumped 30%. This may reflect, in part, pent-up demand from lockdown, and also the broader trend of a sharp recovery in the property market.

It’s not just the housing market that is expressing the potential impact of negative interest rates. Equity prices have been rising almost across the board, especially for both growth companies and quality stable dividend-yielding companies. Since the trough on 23 March, the New Zealand equity market has risen by 40% to 31 August and is now up almost 4% for the year.

Whether the RBNZ decides to cut the OCR next year may not matter as much as its broader guidance about monetary policy settings. Its commitment to protect against downside risks reflects a “least regret” mindset and signals that rates can stay low for an extended period. Forward-looking asset markets may be taking as much note of that signal as the decision about rate cuts in early 2021. Lower bond yields, for example, influence the valuation of corporate bonds and equities, as higher yielding assets are sought after by investors.

This is especially the case for those equities where earnings are stable or growing and not influenced by uncertainty or the potential for a recession. Typically, companies in the technology and healthcare sectors provide growing and relatively stable earnings streams. The collapse in interest rates is, in part, behind the outperformance of the NASDAQ index this year (+25% year to date) and the run in many technology stocks listed in Australia and New Zealand. However, volatility in interest rates can cut both ways. If economic activity improves, and the market stops believing that negative interest rates are a probability, equity prices may see more volatility.

Many commentators have noted the premium pricing of some growth stocks. Valuations become critical when growth stocks miss a beat or ease up on the ability to compound earnings. However, the outlook for interest rates could be equally important. If it turns out that the economy runs into a further weak patch, we suspect that many investors may still be attracted to strong-yielding companies and higher growth equities. We also think investors may consider diversified funds as an alternative to term deposits or leaving their money in the bank.

Our key point is not that bond yields, corporate bonds, house prices or equity price valuations are attractive, it is that forward guidance on the potential for negative interest rates is having a powerful and positive impact on all asset prices by reducing the discount applied to the associated future earnings or income.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.

InvestNow News – 18th September – Harbour Asset Management – Negative cash rates – The afterburner for asset prices

Article written by Hamish Pepper & Andrew Bascand, Harbour Asset Management – 11th September 2020

- The RBNZ’s stated preference for a negative OCR, should further stimulus be required, has encouraged the New Zealand market to expect negative wholesale cash interest rates next year

- This forward guidance on the potential for negative rates has led to large declines in retail interest rates and is having a powerful and positive impact on all asset prices

- This week a New Zealand government bond closed with a negative yield for the first time

When Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr recently reiterated his preference for negative interest rates as a potential tool to deliver more stimulus, markets listened.

“The Committee expressed a preference for considering a package of a negative OCR and a ‘Funding for Lending Programme’ in addition to the current Large Scale Asset Purchase (LSAP) programme.”

– RBNZ August 2020 MPS, summary record of meeting

This focus on the potential for a negative Official Cash Rate (OCR) has encouraged the New Zealand interest rate market to price negative wholesale interest rates in 2021, implying an OCR of -0.2% in one year’s time. Forward interest rates based on the OCR (known as Overnight Index Swaps, or OIS) are negative for most time periods from April 2021.

Financial markets use OIS to partly determine interest rates for a broad range of bonds, loans and deposits. That is why term deposit and mortgage rates have dipped so sharply in recent months. This week a New Zealand government bond closed with a negative yield for the first time (the April 2023 bond).

Note: 2y mortgage rate is “special” rate for loan-to-value less than 80%. Source: Reserve Bank of New Zealand, Bloomberg.

Since the RBNZ cut the OCR by 0.75% to 0.25% on 16 March 2020 and launched its quantitative easing programme one week later, 6-month term deposit rates have dropped from 2.6% to 1.3%. More than half of that decline has happened in the past three months, as the market has priced an increasing probability of a negative OCR next year. Mortgage rates have also fallen significantly. The average two-year mortgage rate, for example, has reduced from 3.5% to 2.7% this year.

The housing market has rebounded in response to lower interest rates. Household loan growth picked up in July and house prices have recovered from declines seen in April and May. For instance, according to the Real Estate Institute of New Zealand (REINZ), New Zealand house prices (on a like-for-like and seasonally adjusted basis) have increased almost 3% since their low in May and have reached new all-time highs. Average days to sell dropped to 34 days in July, from 56 in May, and there were more than 8,000 houses sold in July, versus less than 2,000 in April.

Source: REINZ and ANZ.

In the listed aged care sector, similar trends have been evident. Summerset noted with their recent profit result, that new unit sales were up 50% in May on the prior year while resales jumped 30%. This may reflect, in part, pent-up demand from lockdown, and also the broader trend of a sharp recovery in the property market.

It’s not just the housing market that is expressing the potential impact of negative interest rates. Equity prices have been rising almost across the board, especially for both growth companies and quality stable dividend-yielding companies. Since the trough on 23 March, the New Zealand equity market has risen by 40% to 31 August and is now up almost 4% for the year.

Whether the RBNZ decides to cut the OCR next year may not matter as much as its broader guidance about monetary policy settings. Its commitment to protect against downside risks reflects a “least regret” mindset and signals that rates can stay low for an extended period. Forward-looking asset markets may be taking as much note of that signal as the decision about rate cuts in early 2021. Lower bond yields, for example, influence the valuation of corporate bonds and equities, as higher yielding assets are sought after by investors.

This is especially the case for those equities where earnings are stable or growing and not influenced by uncertainty or the potential for a recession. Typically, companies in the technology and healthcare sectors provide growing and relatively stable earnings streams. The collapse in interest rates is, in part, behind the outperformance of the NASDAQ index this year (+25% year to date) and the run in many technology stocks listed in Australia and New Zealand. However, volatility in interest rates can cut both ways. If economic activity improves, and the market stops believing that negative interest rates are a probability, equity prices may see more volatility.

Many commentators have noted the premium pricing of some growth stocks. Valuations become critical when growth stocks miss a beat or ease up on the ability to compound earnings. However, the outlook for interest rates could be equally important. If it turns out that the economy runs into a further weak patch, we suspect that many investors may still be attracted to strong-yielding companies and higher growth equities. We also think investors may consider diversified funds as an alternative to term deposits or leaving their money in the bank.

Our key point is not that bond yields, corporate bonds, house prices or equity price valuations are attractive, it is that forward guidance on the potential for negative interest rates is having a powerful and positive impact on all asset prices by reducing the discount applied to the associated future earnings or income.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not consider any person’s particular financial situation or goals and, accordingly, does not constitute personalised advice under the Financial Advisers Act 2008. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.