InvestNow News – 2nd July – Harbour Asset Management – Back to Core Banking

Article written by Andrew Bascand, Harbour Asset Management – 1st July 2021

A virtual tour through Australian banking issues

- More tailwinds for the banking sector

- Medium term, the banking sector faces pressure to continue to invest heavily in their digital consumer platforms

- Differentiated strategies are appearing as banks rebuild their client focus

Bank shares have just had their best annual performance in more than two decades. Share prices have been propelled higher by stronger economic activity, better loan growth, and higher net interest margins. Also significant was the start of a writing back of provisions, taken more than a year ago, when economists feared double digit unemployment and a collapse in housing prices.

Through the recovery, to varying degrees, banks have accelerated development of their digital customer engagement platforms. Further heavy technology investment seems likely as the banking system continues to address many of the core threats at work prior to COVID-19.

In the near term, the current economic expansion seems likely to place an upward bias on interest rates. A rising rate environment, together with a buoyant housing market, seems likely to continue to lend support for higher bank sector profits and a return to healthy dividends.

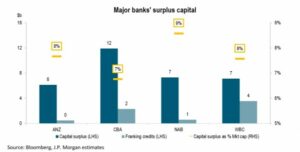

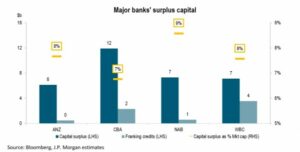

Some banks may also have excess capital that could eventually be returned to shareholders. JP Morgan estimates that the major banks may have up to $34bn of excess capital. However, given significant uncertainty in the economic outlook, it seems highly unlikely that shareholders will experience buybacks over the next few years anywhere near a quarter of that level. In part, because Australian banking sector franking credits only total a little over $7bn.

Figure 1. Surplus bank capital

However, both traditional macro-economic forces and capital management issues are well understood. From here, it seems less likely that shareholders will respond to write-backs of provisions or even capital management.

We think that the next phase for the banking sector may be more mundane. This is because banks are retreating to core banking. They take in deposits, lend to households and businesses, and take an interest rate margin; basic banking is back. The major Australian banks are swiftly returning to their core banking businesses and focusing on the client experience. Increasingly, this is about each banks’ digital capability, service levels and brand perception.

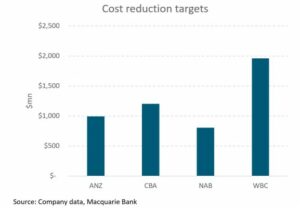

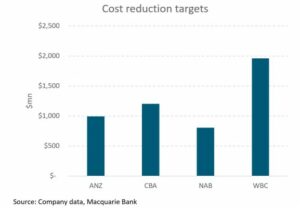

There is a strong focus on talking about cost management, with targeted cuts in costs of between $800mn to $2,000mn across the largest banks.

Figure 2. Cost reduction is a key focus

Beyond these targeted reductions in the cost of delivering consumer, business and institutional services, the larger banks have been selling life and general insurance businesses, along with wealth and financial asset management businesses. The old adage of cross-selling is now removed from the lexicon of Boards and senior management. It has been replaced by a focus on digitisation, the technology platform and expanding responsible lending. To simplify their businesses, some overseas bank subsidiaries have been exited, however New Zealand exits seem off the agenda for now with Westpac calling off its proposed demerger of their New Zealand subsidiary.

Structural influences: technology, culture and capital

There are three powerful forces still at work for the banking sector. How each bank strategically responds seems more likely to determine winners and losers.

First, technology is disrupting many aspects of traditional payments and consumer banking interactions. Legacy bank technology platforms and historically weak consumer digital offerings have allowed new entrants to create new avenues for consumer and mortgage banking. A key example is the market share gains made by smaller banks that have fast processing times for mortgage applications. Additionally, interactive merchant to consumer purchase and payment “rails” are capturing revenue in the payments system, while point-of-sale and buy now pay later innovation has started to make inroads into consumer finance and traditional bank credit card transactional business.

Second, the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services industry identified at its core that banks had lost touch with their clients, especially with respect to their focus on sales above providing advice and considering client outcomes. The introspection of the banks on these findings, together with a regulatory response to providing financial advice has contributed to a rapid exit by the banks from wealth and financial advice businesses in Australia.

Finally, an ongoing change in capital requirements across both Australia and New Zealand, is leading to a shift in the allocation of capital in the banking system. For instance, banks allocating capital to insurance businesses makes little sense. In addition, higher regulatory capital requirements in New Zealand, together with a tougher requirement to onshore critical infrastructure may change the economics for ownership of New Zealand banking subsidiaries, albeit Westpac have elected to keep their New Zealand business as a core franchise. The likely changes, flagged by regulators, to risk weights on loans (which define the amount of capital banks need to allocate to various types of lending), are further changing the economics of banking.

Banks are far less active in pursuing consumer finance and are likely to be less attracted to interest-only and investor mortgage lending, while lending to smaller businesses might become more appealing. These shifts are encouraging partnerships and new investments. For instance, in the consumer segment Westpac has partnered with Afterpay and CBA has invested in competing buy now pay later service Klarna and, in a move indicating the strong interest in this space, CBA recently announced the launch of their own consumer service proposition, StepPay.

In business banking, partnerships with accounting software companies Xero and MYOB are highlighting the increasing importance of data in providing credit risk assessments. For small business lending, rapid loan offers tied to digitised risk analysis speeds up the decision-making and lowers the cost. The tie-ups also provide transaction support through direct invoicing and internet banking.

These forces combine to push banks to partially outsource some of their current revenue streams to fintech companies as they take their businesses back to the core. The core, however, is an important place to build trust and develop strong brands. For instance, CBA is well-advanced in the digital platform strategy, recently announcing tie-ups and investment with a digital retail marketplace, an electricity price application, point-of-sale technology and their new StepPay product. This is all about customer engagement, lifting brand awareness and client retention, and it seems to be working with net promotor scores continuing to climb.

Move closer to customers through focus on core banking

Banks are fighting similar revenue opportunities with technology disruptors. And, for the most part, they have ceded significant ground to mortgage brokers and digital banks in the mortgage and consumer finance markets. For the time being the current macro-economic backdrop may continue to be favourable for bank earnings and dividends, and investors seem likely to go with the good news for a little longer.

The good news is that employment levels are now higher in Australia and New Zealand than prior to the COVID-19 crisis. House prices are significantly higher, and banks have better capital and provisioning than at any time in the last few decades. It seems also likely that higher interest rates might see margins improve a little. With loan growth gradually rising in the next few years banks seem likely to continue to grow earnings, dividends, and also generate excess capital.

For bank investors however, a lot of that news is in the price. In the next phase, discerning which banks have the right strategy for getting closer to the customer will most likely determine the winners. This is because simply competing on price for term deposits and mortgages is a race for market share, not necessarily differentiated and profitable growth.

In our view, the banks that have used the disruption of COVID-19 to make large gains in their core technology and the digital platform that interacts with clients are likely to see the largest sustainable gains in client satisfaction. The path to success is through customer engagement.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.

InvestNow News – 2nd July – Harbour Asset Management – Back to Core Banking

Article written by Andrew Bascand, Harbour Asset Management – 1st July 2021

A virtual tour through Australian banking issues

- More tailwinds for the banking sector

- Medium term, the banking sector faces pressure to continue to invest heavily in their digital consumer platforms

- Differentiated strategies are appearing as banks rebuild their client focus

Bank shares have just had their best annual performance in more than two decades. Share prices have been propelled higher by stronger economic activity, better loan growth, and higher net interest margins. Also significant was the start of a writing back of provisions, taken more than a year ago, when economists feared double digit unemployment and a collapse in housing prices.

Through the recovery, to varying degrees, banks have accelerated development of their digital customer engagement platforms. Further heavy technology investment seems likely as the banking system continues to address many of the core threats at work prior to COVID-19.

In the near term, the current economic expansion seems likely to place an upward bias on interest rates. A rising rate environment, together with a buoyant housing market, seems likely to continue to lend support for higher bank sector profits and a return to healthy dividends.

Some banks may also have excess capital that could eventually be returned to shareholders. JP Morgan estimates that the major banks may have up to $34bn of excess capital. However, given significant uncertainty in the economic outlook, it seems highly unlikely that shareholders will experience buybacks over the next few years anywhere near a quarter of that level. In part, because Australian banking sector franking credits only total a little over $7bn.

Figure 1. Surplus bank capital

However, both traditional macro-economic forces and capital management issues are well understood. From here, it seems less likely that shareholders will respond to write-backs of provisions or even capital management.

We think that the next phase for the banking sector may be more mundane. This is because banks are retreating to core banking. They take in deposits, lend to households and businesses, and take an interest rate margin; basic banking is back. The major Australian banks are swiftly returning to their core banking businesses and focusing on the client experience. Increasingly, this is about each banks’ digital capability, service levels and brand perception.

There is a strong focus on talking about cost management, with targeted cuts in costs of between $800mn to $2,000mn across the largest banks.

Figure 2. Cost reduction is a key focus

Beyond these targeted reductions in the cost of delivering consumer, business and institutional services, the larger banks have been selling life and general insurance businesses, along with wealth and financial asset management businesses. The old adage of cross-selling is now removed from the lexicon of Boards and senior management. It has been replaced by a focus on digitisation, the technology platform and expanding responsible lending. To simplify their businesses, some overseas bank subsidiaries have been exited, however New Zealand exits seem off the agenda for now with Westpac calling off its proposed demerger of their New Zealand subsidiary.

Structural influences: technology, culture and capital

There are three powerful forces still at work for the banking sector. How each bank strategically responds seems more likely to determine winners and losers.

First, technology is disrupting many aspects of traditional payments and consumer banking interactions. Legacy bank technology platforms and historically weak consumer digital offerings have allowed new entrants to create new avenues for consumer and mortgage banking. A key example is the market share gains made by smaller banks that have fast processing times for mortgage applications. Additionally, interactive merchant to consumer purchase and payment “rails” are capturing revenue in the payments system, while point-of-sale and buy now pay later innovation has started to make inroads into consumer finance and traditional bank credit card transactional business.

Second, the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services industry identified at its core that banks had lost touch with their clients, especially with respect to their focus on sales above providing advice and considering client outcomes. The introspection of the banks on these findings, together with a regulatory response to providing financial advice has contributed to a rapid exit by the banks from wealth and financial advice businesses in Australia.

Finally, an ongoing change in capital requirements across both Australia and New Zealand, is leading to a shift in the allocation of capital in the banking system. For instance, banks allocating capital to insurance businesses makes little sense. In addition, higher regulatory capital requirements in New Zealand, together with a tougher requirement to onshore critical infrastructure may change the economics for ownership of New Zealand banking subsidiaries, albeit Westpac have elected to keep their New Zealand business as a core franchise. The likely changes, flagged by regulators, to risk weights on loans (which define the amount of capital banks need to allocate to various types of lending), are further changing the economics of banking.

Banks are far less active in pursuing consumer finance and are likely to be less attracted to interest-only and investor mortgage lending, while lending to smaller businesses might become more appealing. These shifts are encouraging partnerships and new investments. For instance, in the consumer segment Westpac has partnered with Afterpay and CBA has invested in competing buy now pay later service Klarna and, in a move indicating the strong interest in this space, CBA recently announced the launch of their own consumer service proposition, StepPay.

In business banking, partnerships with accounting software companies Xero and MYOB are highlighting the increasing importance of data in providing credit risk assessments. For small business lending, rapid loan offers tied to digitised risk analysis speeds up the decision-making and lowers the cost. The tie-ups also provide transaction support through direct invoicing and internet banking.

These forces combine to push banks to partially outsource some of their current revenue streams to fintech companies as they take their businesses back to the core. The core, however, is an important place to build trust and develop strong brands. For instance, CBA is well-advanced in the digital platform strategy, recently announcing tie-ups and investment with a digital retail marketplace, an electricity price application, point-of-sale technology and their new StepPay product. This is all about customer engagement, lifting brand awareness and client retention, and it seems to be working with net promotor scores continuing to climb.

Move closer to customers through focus on core banking

Banks are fighting similar revenue opportunities with technology disruptors. And, for the most part, they have ceded significant ground to mortgage brokers and digital banks in the mortgage and consumer finance markets. For the time being the current macro-economic backdrop may continue to be favourable for bank earnings and dividends, and investors seem likely to go with the good news for a little longer.

The good news is that employment levels are now higher in Australia and New Zealand than prior to the COVID-19 crisis. House prices are significantly higher, and banks have better capital and provisioning than at any time in the last few decades. It seems also likely that higher interest rates might see margins improve a little. With loan growth gradually rising in the next few years banks seem likely to continue to grow earnings, dividends, and also generate excess capital.

For bank investors however, a lot of that news is in the price. In the next phase, discerning which banks have the right strategy for getting closer to the customer will most likely determine the winners. This is because simply competing on price for term deposits and mortgages is a race for market share, not necessarily differentiated and profitable growth.

In our view, the banks that have used the disruption of COVID-19 to make large gains in their core technology and the digital platform that interacts with clients are likely to see the largest sustainable gains in client satisfaction. The path to success is through customer engagement.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.