InvestNow News – 10th December – Devon – Navigating familiar themes

Article written by Greg Smith, Head of Retail, Devon – 2021

This month’s interest piece has been written by Devon’s Head of Retail, Greg Smith.

This month’s interest piece has been written by Devon’s Head of Retail, Greg Smith.

As we enter December and the final stanza of 2021, the year will be remembered as anything but dull. Markets have generally coped with a number of bolts from the blue, as economies have continued to rebound from the pandemic against the backdrop of the global reopening. Vaccine rollouts have provided cause for optimism, amidst a year still punctuated by lockdowns here and in various other parts of the globe.

Corporate earnings have been generally strong for not only pandemic beneficiaries but also companies that have been able to ‘pivot’ successfully within a Covid world. Governments have broadly remained supportive of their economies through significant stimulus programs, as have central banks, with only a handful (the RBNZ included) choosing to tighten monetary policy.

Bull markets climb “a wall of worry” as the saying goes, and there have been plenty of potential catalysts for investor angst. These have ranged from rising bond yields to concerns over a property-led downturn in China, pandemic-induced supply bottlenecks and surging inflation, which have all served to keep investors on their toes in 2021.

The arrival of a new variant in the form of Omicron is another challenge recently served up to investors during the year. Comments from the Federal Reserve about potential interest rate rises have also unsettled investors, but taking some perspective, central bank tightening plans have been on the market’s radar to varying degrees all year.

The US markets have led the way for long periods this year, notching up record highs with regular monotony. As things stand the Dow Jones Industrial Average has closed out November up 12.7% year to date, while the broader Nasdaq and S&500 indices have posted gains of 20.5% and 21.6% respectively. In contrast, the NZX50 is down around 2.8%, and struggled to get back to the pre-pandemic highs. Across the Tasman the ASX200 (which made a record high in August) has gained around 10% with a month to go in the year.

While there has been plenty for investors to digest again this year, a look back quarter by quarter reveals some recurrent themes.

Globally, the first quarter was generally strong for equity markets, with sentiment stoked by the roll-out of Covid-19 vaccines along with further news of US fiscal stimulus – President Biden confirmed a fiscal stimulus package of US$1.9 trillion, which was followed up with an additional promise of US$2 trillion in infrastructure spending.

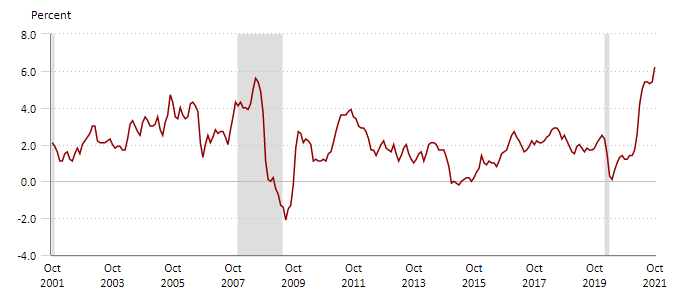

The inflationary consequences of ‘open cheque books’ were however already on the radar of markets with bond yields on the rise (it was the second worst quarter since 1980 for US Treasuries as the 10-year yield jumped from 0.91% to 1.74%). Cyclicals exposed to the reflation trade, including financials, performed well in this environment. In general, the markets looked through lockdowns, and rising Covid infection rates, as vaccine rollouts progressed. Against this backdrop the corporate sector was in profit recovery mode.

The prospect of rising bond yields is again on the market’s radar, as it was earlier in the year – the chart below shows US 10-year Treasury yields over the past 12 months.

Source: Tradingeconomics

The stock markets of countries that were ‘behind the eight ball’ with respect to their vaccination rollouts didn’t fare as well. This included New Zealand, where after having been free of Covid for five months, the country moved up alert levels twice during the month of February. Australia also had its fair share of lockdowns (and Melbourne much more so as it transpired), but the banking sector performed strongly. This was supported by the ongoing view of ‘better-than-feared’ economic scenarios in Australia and New Zealand, with the prospect of further Covid provisioning being released.

The second quarter saw another strong performance from global equity markets as the acceleration of vaccine programs helped to drive the economic rebound which boosted investor sentiment. Growth stocks were back in favour as bond yields drifted generally.

The latter was interesting given inflationary data prints were coming in hotter. In the US the May core consumer price index jumped from 3% to 3.8% year-on-year – the biggest increase since June 1992. Central bank officials, including the Fed, stuck to the notion (and continued to do so until the end of November) that ‘reopening’ inflationary pressures were going to be a ‘transitory’ phenomenon, with the notion of interest rate rises pushed down the track. Progress on vaccination programs meanwhile was leading to a loosening of Covid-restrictions in many parts of the globe.

In June President Joe Biden secured a deal on an infrastructure package worth about US$1 trillion to upgrade roads, bridges and broadband networks over the next eight years. While short of the planned $2.3 trillion, it boosted the prospect of other countries rolling out such initiatives as part of a post-Covid reboot. This boosted optimism around sectors exposed to the ‘reflation’ trade, including commodities where pricing was already being supported by strong demand, and constrained supply. This was epitomised by iron ore with prices progressing towards (and surpassing in July) fresh records above US$200 a tonne. Oil prices climbed above US$70, as OPEC stuck to its guns on output curbs.

This helped drive a strong performance for ‘resource centric’ economies such as Australia, and propelling earnings and dividends to record levels for sector bellwethers such as BHP. The ASX200 (+8%) had a very strong quarter. Overall, economically sensitive sectors – including property, amidst generally strong property markets – were very much back in vogue, as most of the world were accelerating reopening plans.

Central banks, while pulling back on quantitative easing plans, remained accommodative with any comments around interest rate increases somewhat non-committal in terms of timelines. Global bond yields moderated, with the US 10-year yield falling back to 1.47% despite annualised inflation rates rising well above the central bank’s target, to levels not seen in over a decade.

The Kiwi market itself put in a positive performance during the quarter, albeit a modest one (+1%). The Trans-Tasman travel bubble provided some slight positivity for the tourism sector, which remained under pressure. This occurred at a time when we were all blissfully living without Covid, as was the NZ economy, which expanded 1.6% in the three months to March. This result was more than triple the market’s expectations and followed a lockdown-induced contraction of 1% in the previous three months. The seeds were however being sown for a lifting of rates by the RBNZ.

In the third quarter, roles were reversed somewhat as the NZX was one of the stronger performing markets globally, rising 4.9%. This compared favourably with gains of less than 0.5% for many global indices, including the S&P500 in the US, and the ASX200 across the Tasman.

The corporate earnings season was a strong one in the US, however concerns over inflation and the overall growth outlook carried more sway. The commencement of QE tapering by the Fed was also something that did not go unnoticed, along with consensus projections for a quicker pace of rate hikes. The Fed it seemed was also starting to appreciate that inflation was a bit more enduring (but still claiming it was transitory), lifting 2021 forecasts to 4.2% above a previous estimate of 3.4%. Central banks generally became slightly more ‘hawkish.’

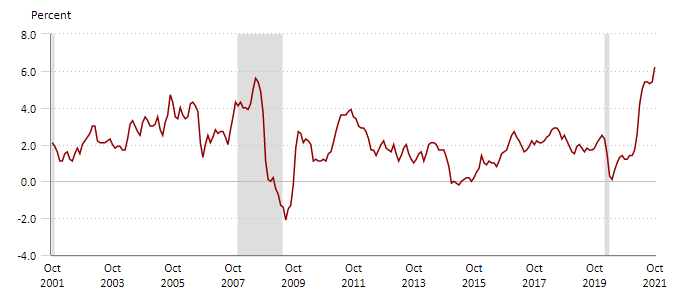

US Annual Consumer Price Index Change

Source: US Bureau of Labor Stats (shaded areas represent recessions)

Ironically, at the same time, some air started to go out of the inflationary trade. The price of iron ore in particular started to go into retreat mode, amidst concerns over China, the biggest consumer of the steel making ingredient. Fears over the country’s property market grew as property developer Evergrande warned it might not be able to pay its bills. While not going away, the Evergrande issue has, it seems, been successfully navigated to date, and while not being necessarily ‘too big to fail,’ authorities appear ready to engage in a ‘managed restructuring’ if need be. Concerns around China generally have also eased on early December’s robust manufacturing print and easing of production restrictions for the steel industry.

Elsewhere in Asia, Japan was in the limelight, and not just because the delayed 2020 Olympics went ahead (without crowds). Public opposition towards the government’s approach to the fifth Covid wave saw Prime Minister Suga resign with Mr Kishida becoming the country’s 100th Prime Minister.

The Kiwi market’s out-performance was however despite the arrival of the Delta variant in mid-August. Investors took renewed ‘stay-at-home’ orders in their stride on the view we had “been here before” with the economy likely to be resilient and bounce back strongly on the other side of the lockdowns.

Positive economic data supported sentiment. New Zealand June quarter GDP had the economy growing at a better than expected 2.8%, while the unemployment rate dropped to 4%. Ultra-low interest rates helped propel house prices further, making homeowners (and many consumers) feel wealthier. Closed borders (including the Trans-Tasman bubble) continued to boost savings through the quarter and spending generally.

Economic positivity was reflected across the corporate sector as companies started to report during August. Earnings growth was generally robust with strong pent-up demand and digitally driven growth, a pervading theme (along with supply chain challenges and price inflation). Even many of those companies impacted by border closures (e,g. Auckland Airport, and Vista, which is coincidentally is +35% at the end of November and one of the best performers on the NZX) expressed optimism about the light at the end of the tunnel as vaccination rates started to climb. Pandemic beneficiaries such as Mainfreight and Freightways were also continuing to leverage off robust levels of activity. The local market did well, despite a number of potential offshore headwinds to upset the applecart.

There was however a reversal of fortunes for the broader market as we headed into the final quarter, and as the RBNZ was one of the first central banks globally (beaten only by Norway) to break the mould in terms of rate tightening. At the end of November the NZX50 market was around 4% lower for the quarter, versus a 6% lift for the S&P500, and a flat performance in Australia.

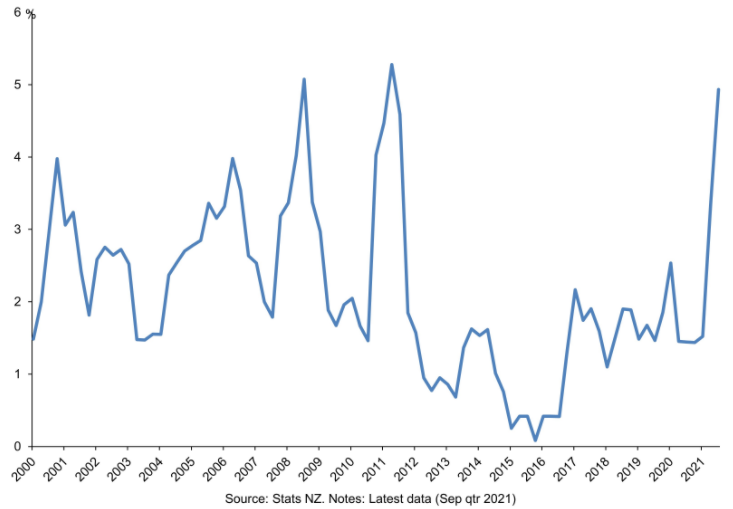

After a Delta-induced delay, the RBNZ lifted the Official Cash Rate for the first time in seven years in October. The central bank decided it was time to deliver its own ‘vaccine’ against inflationary pressures which have been mounting. The latter was confirmed by a ‘hot’ read on annual price inflation which hit 4.9% in the September quarter, the biggest jump since 2011.

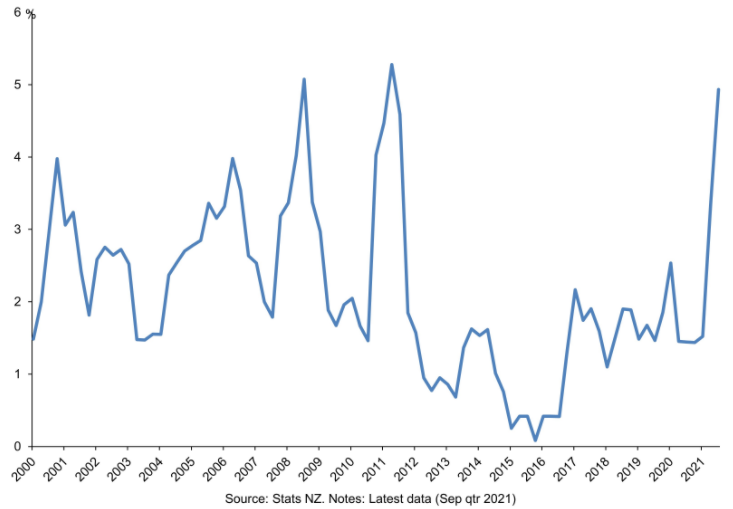

NZ Annual Consumer Price Index Change

The hawkish actions of our central bank have arguably contributed to the NZX trading lower through the first two months of the final quarter. Meanwhile the US indices were making regular record highs, driven by generally strong US corporate earnings reports.

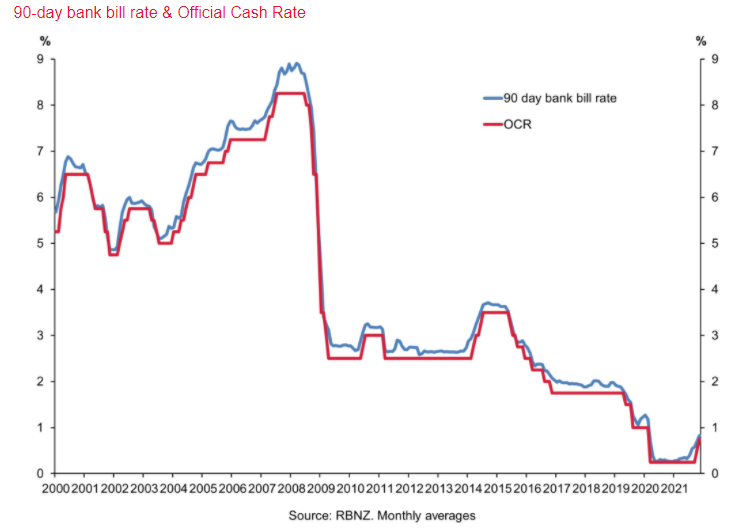

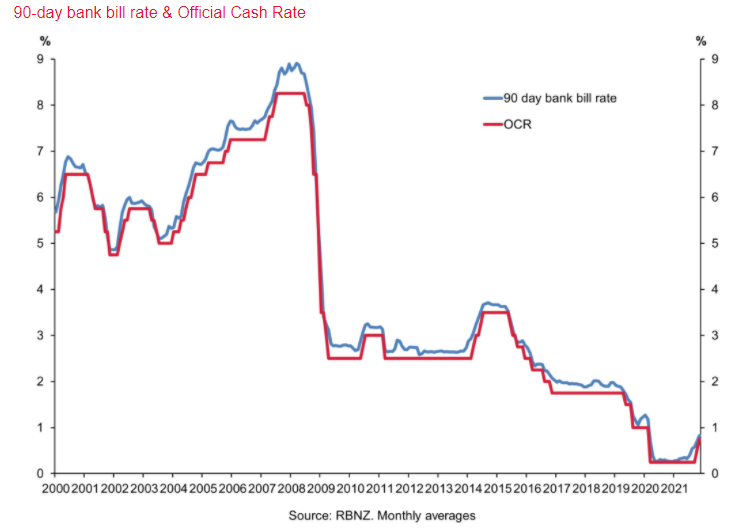

The RBNZ has of course gone again, with another rate rise in late November, but the 25bps lift in the cash rate to 0.75% was ‘better than feared’ and investors were comforted that a bigger 50bps move was not forthcoming. The central bank has it seems taken a view that the economy is in strong shape where inflation is running hot, offset by the impact of recent lockdowns and health uncertainties as they relate to Covid. Rampant house prices (+30% over the past year) are meanwhile being addressed by macro-prudential measures alongside recent lifts in lending rates.

In any event, the RBNZ has mapped out a plan for the OCR slowly but surely increasing, but in the meantime, the market has some ‘’breathing space’ until the next meeting which is not until 23rd February next year.

A greater sense of calm has however been short-lived, with Omicron arriving on the scene as a ‘variant of [extreme] interest.’ Scientists now are in a rush to determine just how infectious the new strain may be, and whether existing vaccines need to be modified. Opinions amongst big Pharma have varied, and will be something for investors to grapple with over the coming weeks before the true impact of the new variant is known. Sentiment towards reopeners versus pandemic beneficiaries may also ebb and flow as a result.

Markets are often inclined to assume the worst-case scenario, but it is clear that the jury is still out on the ramifications of the new strain. Either way this could determine whether the traditional ‘Santa rally’ for the markets arrives on time. Developments around Omicron are a sharp reminder that the virus is still in our midst, and have shaken out some investor complacency, but equally these developments could be seen as keeping the markets in check and from getting ahead of themselves.

The same could also be said of further clarity around central bank tightening plans.

Fed Chair Jerome Powell has delivered his own surprise in finally admitting in late November before a Congressional committee that inflationary pressures may not be ‘transitory” and it might be time to ‘retire” that word. While cognisant of the economic risks from Omicron, he is more focussed on another invisible enemy it seems.

While upbeat about the current strength of the US economy he has noted that inflationary pressures are high, and that it may be appropriate to consider “wrapping up the taper of our asset purchases” a few months sooner than anticipated.

The likely pace of rate increase is still modest, and the Fed will also be conscious of the adverse impacts of tightening too quickly, with the need to “strike a balance.” The pace of hikes could also change depending on the impact of Omicron, but clearly inflation is looking much more enduring to the Fed (as it potentially will be for other central banks, most of which to date have remained in the transitory inflation camp).

Investors will closely watch to see if other central banks also bring forward their tightening plans. A lift in global long-term bond rates can often cause the market to wobble but could equally see a tilt away from high priced growth names to companies with strong value propositions. This could augur well for the relative appeal of many of the constituents within the NZX50.

Overall, there has been a huge amount for investors to digest again this year, with a host of other pervading sub-plots including rampant levels of IPO (click here for our October special interest piece) and M&A activity (click here for our July special interest piece) covered in previous investor updates. The ‘electrification’ drive (Tesla joined the US$1 trillion market cap club in October!) has also been one of many other powerful themes this year.

What does 2022 have in store?

We will be providing a summary of some of the key themes we see driving markets, sectors, and stocks next year in January’s monthly report.

InvestNow News – 10th December – Devon – Navigating familiar themes

Article written by Greg Smith, Head of Retail, Devon – 2021

This month’s interest piece has been written by Devon’s Head of Retail, Greg Smith.

This month’s interest piece has been written by Devon’s Head of Retail, Greg Smith.

As we enter December and the final stanza of 2021, the year will be remembered as anything but dull. Markets have generally coped with a number of bolts from the blue, as economies have continued to rebound from the pandemic against the backdrop of the global reopening. Vaccine rollouts have provided cause for optimism, amidst a year still punctuated by lockdowns here and in various other parts of the globe.

Corporate earnings have been generally strong for not only pandemic beneficiaries but also companies that have been able to ‘pivot’ successfully within a Covid world. Governments have broadly remained supportive of their economies through significant stimulus programs, as have central banks, with only a handful (the RBNZ included) choosing to tighten monetary policy.

Bull markets climb “a wall of worry” as the saying goes, and there have been plenty of potential catalysts for investor angst. These have ranged from rising bond yields to concerns over a property-led downturn in China, pandemic-induced supply bottlenecks and surging inflation, which have all served to keep investors on their toes in 2021.

The arrival of a new variant in the form of Omicron is another challenge recently served up to investors during the year. Comments from the Federal Reserve about potential interest rate rises have also unsettled investors, but taking some perspective, central bank tightening plans have been on the market’s radar to varying degrees all year.

The US markets have led the way for long periods this year, notching up record highs with regular monotony. As things stand the Dow Jones Industrial Average has closed out November up 12.7% year to date, while the broader Nasdaq and S&500 indices have posted gains of 20.5% and 21.6% respectively. In contrast, the NZX50 is down around 2.8%, and struggled to get back to the pre-pandemic highs. Across the Tasman the ASX200 (which made a record high in August) has gained around 10% with a month to go in the year.

While there has been plenty for investors to digest again this year, a look back quarter by quarter reveals some recurrent themes.

Globally, the first quarter was generally strong for equity markets, with sentiment stoked by the roll-out of Covid-19 vaccines along with further news of US fiscal stimulus – President Biden confirmed a fiscal stimulus package of US$1.9 trillion, which was followed up with an additional promise of US$2 trillion in infrastructure spending.

The inflationary consequences of ‘open cheque books’ were however already on the radar of markets with bond yields on the rise (it was the second worst quarter since 1980 for US Treasuries as the 10-year yield jumped from 0.91% to 1.74%). Cyclicals exposed to the reflation trade, including financials, performed well in this environment. In general, the markets looked through lockdowns, and rising Covid infection rates, as vaccine rollouts progressed. Against this backdrop the corporate sector was in profit recovery mode.

The prospect of rising bond yields is again on the market’s radar, as it was earlier in the year – the chart below shows US 10-year Treasury yields over the past 12 months.

Source: Tradingeconomics

The stock markets of countries that were ‘behind the eight ball’ with respect to their vaccination rollouts didn’t fare as well. This included New Zealand, where after having been free of Covid for five months, the country moved up alert levels twice during the month of February. Australia also had its fair share of lockdowns (and Melbourne much more so as it transpired), but the banking sector performed strongly. This was supported by the ongoing view of ‘better-than-feared’ economic scenarios in Australia and New Zealand, with the prospect of further Covid provisioning being released.

The second quarter saw another strong performance from global equity markets as the acceleration of vaccine programs helped to drive the economic rebound which boosted investor sentiment. Growth stocks were back in favour as bond yields drifted generally.

The latter was interesting given inflationary data prints were coming in hotter. In the US the May core consumer price index jumped from 3% to 3.8% year-on-year – the biggest increase since June 1992. Central bank officials, including the Fed, stuck to the notion (and continued to do so until the end of November) that ‘reopening’ inflationary pressures were going to be a ‘transitory’ phenomenon, with the notion of interest rate rises pushed down the track. Progress on vaccination programs meanwhile was leading to a loosening of Covid-restrictions in many parts of the globe.

In June President Joe Biden secured a deal on an infrastructure package worth about US$1 trillion to upgrade roads, bridges and broadband networks over the next eight years. While short of the planned $2.3 trillion, it boosted the prospect of other countries rolling out such initiatives as part of a post-Covid reboot. This boosted optimism around sectors exposed to the ‘reflation’ trade, including commodities where pricing was already being supported by strong demand, and constrained supply. This was epitomised by iron ore with prices progressing towards (and surpassing in July) fresh records above US$200 a tonne. Oil prices climbed above US$70, as OPEC stuck to its guns on output curbs.

This helped drive a strong performance for ‘resource centric’ economies such as Australia, and propelling earnings and dividends to record levels for sector bellwethers such as BHP. The ASX200 (+8%) had a very strong quarter. Overall, economically sensitive sectors – including property, amidst generally strong property markets – were very much back in vogue, as most of the world were accelerating reopening plans.

Central banks, while pulling back on quantitative easing plans, remained accommodative with any comments around interest rate increases somewhat non-committal in terms of timelines. Global bond yields moderated, with the US 10-year yield falling back to 1.47% despite annualised inflation rates rising well above the central bank’s target, to levels not seen in over a decade.

The Kiwi market itself put in a positive performance during the quarter, albeit a modest one (+1%). The Trans-Tasman travel bubble provided some slight positivity for the tourism sector, which remained under pressure. This occurred at a time when we were all blissfully living without Covid, as was the NZ economy, which expanded 1.6% in the three months to March. This result was more than triple the market’s expectations and followed a lockdown-induced contraction of 1% in the previous three months. The seeds were however being sown for a lifting of rates by the RBNZ.

In the third quarter, roles were reversed somewhat as the NZX was one of the stronger performing markets globally, rising 4.9%. This compared favourably with gains of less than 0.5% for many global indices, including the S&P500 in the US, and the ASX200 across the Tasman.

The corporate earnings season was a strong one in the US, however concerns over inflation and the overall growth outlook carried more sway. The commencement of QE tapering by the Fed was also something that did not go unnoticed, along with consensus projections for a quicker pace of rate hikes. The Fed it seemed was also starting to appreciate that inflation was a bit more enduring (but still claiming it was transitory), lifting 2021 forecasts to 4.2% above a previous estimate of 3.4%. Central banks generally became slightly more ‘hawkish.’

US Annual Consumer Price Index Change

Source: US Bureau of Labor Stats (shaded areas represent recessions)

Ironically, at the same time, some air started to go out of the inflationary trade. The price of iron ore in particular started to go into retreat mode, amidst concerns over China, the biggest consumer of the steel making ingredient. Fears over the country’s property market grew as property developer Evergrande warned it might not be able to pay its bills. While not going away, the Evergrande issue has, it seems, been successfully navigated to date, and while not being necessarily ‘too big to fail,’ authorities appear ready to engage in a ‘managed restructuring’ if need be. Concerns around China generally have also eased on early December’s robust manufacturing print and easing of production restrictions for the steel industry.

Elsewhere in Asia, Japan was in the limelight, and not just because the delayed 2020 Olympics went ahead (without crowds). Public opposition towards the government’s approach to the fifth Covid wave saw Prime Minister Suga resign with Mr Kishida becoming the country’s 100th Prime Minister.

The Kiwi market’s out-performance was however despite the arrival of the Delta variant in mid-August. Investors took renewed ‘stay-at-home’ orders in their stride on the view we had “been here before” with the economy likely to be resilient and bounce back strongly on the other side of the lockdowns.

Positive economic data supported sentiment. New Zealand June quarter GDP had the economy growing at a better than expected 2.8%, while the unemployment rate dropped to 4%. Ultra-low interest rates helped propel house prices further, making homeowners (and many consumers) feel wealthier. Closed borders (including the Trans-Tasman bubble) continued to boost savings through the quarter and spending generally.

Economic positivity was reflected across the corporate sector as companies started to report during August. Earnings growth was generally robust with strong pent-up demand and digitally driven growth, a pervading theme (along with supply chain challenges and price inflation). Even many of those companies impacted by border closures (e,g. Auckland Airport, and Vista, which is coincidentally is +35% at the end of November and one of the best performers on the NZX) expressed optimism about the light at the end of the tunnel as vaccination rates started to climb. Pandemic beneficiaries such as Mainfreight and Freightways were also continuing to leverage off robust levels of activity. The local market did well, despite a number of potential offshore headwinds to upset the applecart.

There was however a reversal of fortunes for the broader market as we headed into the final quarter, and as the RBNZ was one of the first central banks globally (beaten only by Norway) to break the mould in terms of rate tightening. At the end of November the NZX50 market was around 4% lower for the quarter, versus a 6% lift for the S&P500, and a flat performance in Australia.

After a Delta-induced delay, the RBNZ lifted the Official Cash Rate for the first time in seven years in October. The central bank decided it was time to deliver its own ‘vaccine’ against inflationary pressures which have been mounting. The latter was confirmed by a ‘hot’ read on annual price inflation which hit 4.9% in the September quarter, the biggest jump since 2011.

NZ Annual Consumer Price Index Change

The hawkish actions of our central bank have arguably contributed to the NZX trading lower through the first two months of the final quarter. Meanwhile the US indices were making regular record highs, driven by generally strong US corporate earnings reports.

The RBNZ has of course gone again, with another rate rise in late November, but the 25bps lift in the cash rate to 0.75% was ‘better than feared’ and investors were comforted that a bigger 50bps move was not forthcoming. The central bank has it seems taken a view that the economy is in strong shape where inflation is running hot, offset by the impact of recent lockdowns and health uncertainties as they relate to Covid. Rampant house prices (+30% over the past year) are meanwhile being addressed by macro-prudential measures alongside recent lifts in lending rates.

In any event, the RBNZ has mapped out a plan for the OCR slowly but surely increasing, but in the meantime, the market has some ‘’breathing space’ until the next meeting which is not until 23rd February next year.

A greater sense of calm has however been short-lived, with Omicron arriving on the scene as a ‘variant of [extreme] interest.’ Scientists now are in a rush to determine just how infectious the new strain may be, and whether existing vaccines need to be modified. Opinions amongst big Pharma have varied, and will be something for investors to grapple with over the coming weeks before the true impact of the new variant is known. Sentiment towards reopeners versus pandemic beneficiaries may also ebb and flow as a result.

Markets are often inclined to assume the worst-case scenario, but it is clear that the jury is still out on the ramifications of the new strain. Either way this could determine whether the traditional ‘Santa rally’ for the markets arrives on time. Developments around Omicron are a sharp reminder that the virus is still in our midst, and have shaken out some investor complacency, but equally these developments could be seen as keeping the markets in check and from getting ahead of themselves.

The same could also be said of further clarity around central bank tightening plans.

Fed Chair Jerome Powell has delivered his own surprise in finally admitting in late November before a Congressional committee that inflationary pressures may not be ‘transitory” and it might be time to ‘retire” that word. While cognisant of the economic risks from Omicron, he is more focussed on another invisible enemy it seems.

While upbeat about the current strength of the US economy he has noted that inflationary pressures are high, and that it may be appropriate to consider “wrapping up the taper of our asset purchases” a few months sooner than anticipated.

The likely pace of rate increase is still modest, and the Fed will also be conscious of the adverse impacts of tightening too quickly, with the need to “strike a balance.” The pace of hikes could also change depending on the impact of Omicron, but clearly inflation is looking much more enduring to the Fed (as it potentially will be for other central banks, most of which to date have remained in the transitory inflation camp).

Investors will closely watch to see if other central banks also bring forward their tightening plans. A lift in global long-term bond rates can often cause the market to wobble but could equally see a tilt away from high priced growth names to companies with strong value propositions. This could augur well for the relative appeal of many of the constituents within the NZX50.

Overall, there has been a huge amount for investors to digest again this year, with a host of other pervading sub-plots including rampant levels of IPO (click here for our October special interest piece) and M&A activity (click here for our July special interest piece) covered in previous investor updates. The ‘electrification’ drive (Tesla joined the US$1 trillion market cap club in October!) has also been one of many other powerful themes this year.

What does 2022 have in store?

We will be providing a summary of some of the key themes we see driving markets, sectors, and stocks next year in January’s monthly report.

Leave A Comment