FMA retail investor platforms research findings – no real surprises …

Article written by InvestNow – 5th August 2021

The FMA published their research yesterday, looking at the adoption of platforms by Kiwis for investing. The objectives of the research was to understand:

- The type and profile of investors in retail platforms.

- Their risks and behaviour within these platforms.

- The motivations and influences that brought them to where they are.

It’s great to see the FMA spending time to get a better handle on platforms and the what, why and how for Kiwi investors.

I’m not sure there was anything new and/or unexpected in the results from the FMA’s research, particularly given the explosion in investing activity over the past 15 months (since COVID hit us in March ’20).

The reference to using social channels for information/education/advice makes sense, but as everyone reading this knows, it’s the norm i.e. social channels are the new “friends and families” that Kiwis have always had a preference for when it comes to getting advice.

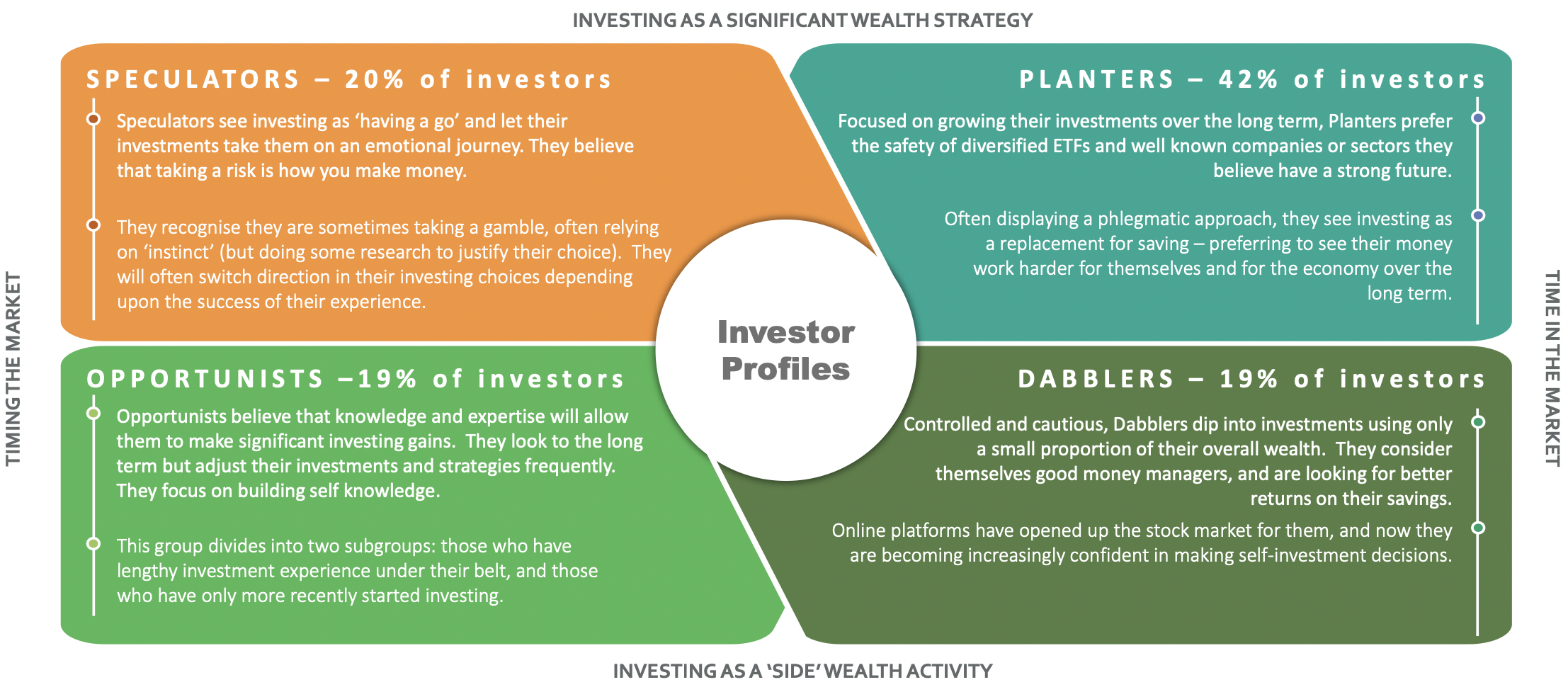

Our customers definitely behave like investors, as opposed to traders i.e. they take a long-term view, in times of volatility they sit, watch and then act (as opposed to displaying any knee-jerk behaviours). On that basis I’d categorise them as “Planters”.

I’m not sure that the label “Dabbler” marries up that well with the description in the FMA survey. The description reads like someone who makes cautious/considered decisions from a position of knowledge, looking for a favourable outcome, whereas the Cambridge English Dictionary defines a dabbler as “someone who takes a slight and not very serious interest in a subject, or tries a particular activity for a short period” 🙂

Mike Heath, GM InvestNow

FMA Retail investor platforms research findings – no real surprises …

Article written by InvestNow – 5th August 2021

The FMA published their research yesterday, looking at the adoption of platforms by Kiwis for investing. The objectives of the research was to understand:

- The type and profile of investors in retail platforms.

- Their risks and behaviour within these platforms.

- The motivations and influences that brought them to where they are.

It’s great to see the FMA spending time to get a better handle on platforms and the what, why and how for Kiwi investors.

I’m not sure there was anything new and/or unexpected in the results from the FMA’s research, particularly given the explosion in investing activity over the past 15 months (since COVID hit us in March ’20).

The reference to using social channels for information/education/advice makes sense, but as everyone reading this knows, it’s the norm i.e. social channels are the new “friends and families” that Kiwis have always had a preference for when it comes to getting advice.

Our customers definitely behave like investors, as opposed to traders i.e. they take a long-term view, in times of volatility they sit, watch and then act (as opposed to displaying any knee-jerk behaviours). On that basis I’d categorise them as “Planters”.

I’m not sure that the label “Dabbler” marries up that well with the description in the FMA survey. The description reads like someone who makes cautious/considered decisions from a position of knowledge, looking for a favourable outcome, whereas the Cambridge English Dictionary defines a dabbler as “someone who takes a slight and not very serious interest in a subject, or tries a particular activity for a short period” 🙂

Mike Heath, GM InvestNow