InvestNow News – 21st May – Harbour Asset Management – REINZ data shines a light

Article written by Simon Pannett, Harbour Asset Management – 14th May 2021

- The housing market holds firm in first read post significant policy changes

- Yesterday’s Real Estate Institute of New Zealand (REINZ) data is the most significant indicator of the housing market since the significant policy changes introduced on 31 March.

- This relatively strong data suggests that it takes both supply and time to cool a housing market.

There were a wide range of views regarding the likely impact of removing interest deductibility from residential property. Harbour’s own analysis suggested policy changes were likely to meaningfully slow the pace of gains, but not to tip the scales to outright falls. The truth is there was a significant degree of uncertainty to this analysis. There is little by way of historical comparisons, plus, it’s difficult to ascertain landlords’ pricing power and therefore the ability for rents to calibrate landlords’ yields.

We have had our ear out for anecdotes, and from these we glean a mixed picture. We hear of a dip in listings, less bidders at auctions but the hammer still falling, less inquiry for mortgages (even from first home buyers) and lower search activity. We are not hearing of panicked selling from investors but have heard of some large-scale investors rotating into commercial property.

Anecdotes are always fraught. They may not represent the broader market and can be influenced by bias. The media has already commented on average price data, we discount this methodology given it is skewed by compositional differences.

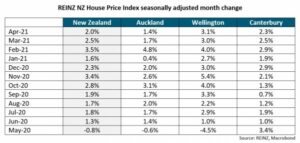

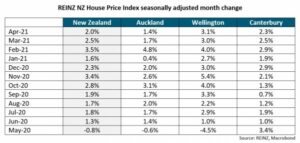

Therefore, yesterday’s REINZ data represents a welcome first high quality read on the market. Our seasonally adjusted series shows prices increased another 2.0% in April to be up 26.7% over the year. This is a small reduction on the prior pace of gains. While listings and sales fell modestly, there was little change in the time taken for sellers to find a bidder. This is a stronger-than-expected data print and, while only one observation, an important one for setting the tone in a market influenced by sentiment.

The housing market remains a key influence for New Zealand’s journey from recovery to economic expansion. Higher housing activity is a stalwart of recovery, as are the wealth effects from higher house prices through to consumption. On the other hand, significantly higher house prices are a risk that is giving the Reserve Bank of New Zealand pause. This time, we aren’t watching to allay concerns about the banks. In our view, if house price data continue to show modest gains, the conversation about normalising monetary policy will grow in volume and the onus will increasingly turn to the Government to help induce a stronger supply response.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.

InvestNow News – 21st May – Harbour Asset Management – REINZ data shines a light

Article written by Simon Pannett, Harbour Asset Management – 14th May 2021

- The housing market holds firm in first read post significant policy changes

- Yesterday’s Real Estate Institute of New Zealand (REINZ) data is the most significant indicator of the housing market since the significant policy changes introduced on 31 March.

- This relatively strong data suggests that it takes both supply and time to cool a housing market.

There were a wide range of views regarding the likely impact of removing interest deductibility from residential property. Harbour’s own analysis suggested policy changes were likely to meaningfully slow the pace of gains, but not to tip the scales to outright falls. The truth is there was a significant degree of uncertainty to this analysis. There is little by way of historical comparisons, plus, it’s difficult to ascertain landlords’ pricing power and therefore the ability for rents to calibrate landlords’ yields.

We have had our ear out for anecdotes, and from these we glean a mixed picture. We hear of a dip in listings, less bidders at auctions but the hammer still falling, less inquiry for mortgages (even from first home buyers) and lower search activity. We are not hearing of panicked selling from investors but have heard of some large-scale investors rotating into commercial property.

Anecdotes are always fraught. They may not represent the broader market and can be influenced by bias. The media has already commented on average price data, we discount this methodology given it is skewed by compositional differences.

Therefore, yesterday’s REINZ data represents a welcome first high quality read on the market. Our seasonally adjusted series shows prices increased another 2.0% in April to be up 26.7% over the year. This is a small reduction on the prior pace of gains. While listings and sales fell modestly, there was little change in the time taken for sellers to find a bidder. This is a stronger-than-expected data print and, while only one observation, an important one for setting the tone in a market influenced by sentiment.

The housing market remains a key influence for New Zealand’s journey from recovery to economic expansion. Higher housing activity is a stalwart of recovery, as are the wealth effects from higher house prices through to consumption. On the other hand, significantly higher house prices are a risk that is giving the Reserve Bank of New Zealand pause. This time, we aren’t watching to allay concerns about the banks. In our view, if house price data continue to show modest gains, the conversation about normalising monetary policy will grow in volume and the onus will increasingly turn to the Government to help induce a stronger supply response.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.