Frequently asked questions:

Whose KiwiSaver scheme am I joining?

The InvestNow KiwiSaver Scheme is managed by FundRock NZ Limited (FundRock). Both InvestNow and FundRock NZ are members of the Apex Group.

FundRock NZ, based in Wellington, is a specialist investment management company focused on meeting the specific needs and requirements of New Zealand investors and clients. Our objective is to provide our clients with access to world-class investment solutions and opportunities, while ensuring that these are easy to use and understand.

For more information visit https://www.fundrock.com/fundrock-new-zealand

Where can I see which funds are in my portfolio?

You will be able to see the funds you have selected for your KiwiSaver under the ‘Dashboard’ when you are logged in.

What is the Performance Chart?

By clicking on the ‘Performance’ title, we provide a simple bar chart which shows the returns for each asset you currently hold, since inception of your portfolio. This can be filtered by either percentage or dollar return.

What is swing pricing?

Swing pricing only applies to the InvestNow Milford Conservative Fund and InvestNow Milford Balanced Fund.

A swing price is applied to mitigate dilution in investment value due to transaction costs attributable to other investors buying or selling funds interests. On each valuation day the Underlying Milford Funds apply a swing factor adjustment to the price for investor applications and withdrawals. Subject to a threshold being met, the price is adjusted up or down based on the direction of the net investor flows. If net flows are positive, the price will swing up and if net flows are negative, the price will swing down.

The indicative swing factor adjustments for the Underlying Milford Funds are detailed in the InvestNow KiwiSaver Scheme Fees and Charges document.

What is a diversified fund?

A diversified fund invests in a range of asset classes, regions, and/or industry sectors. Each of these assets have different characteristics eg their values may not all rise or decline at the same time. Investing in a range reduces the potential risk that anyone sector/region/industry can have on the overall performance of the fund – spreading the risk.

Diversified funds can be built to align to specific risk profiles, for example, Conservative, Balanced or Growth.

What if I want to take a break from contributing to KiwiSaver?

If you want to take a break from contributing to KiwiSaver, you can apply for a savings suspension (previously known as a contributions holiday) by contacting the IRD.

If you’ve been in KiwiSaver for less than a year, you will need to provide them with evidence of financial hardship. Otherwise, you can apply for a savings suspension for up to a year without providing a reason, and there is no limit to how many times you can do this.

For more information, please refer to the IRD website.

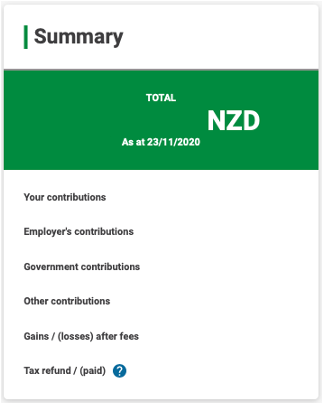

What does the KiwiSaver Summary provide?

The KiwiSaver Summary provides a high-level overview of your portfolio, including details such as:

Your contributions – Contributions you have made to KiwiSaver, from the time you first joined KiwiSaver (includes if you joined KiwiSaver before switching to InvestNow).

Employer’s contributions – Contributions your employer(s) have made to KiwiSaver, from the time you first joined KiwiSaver (includes if you joined KiwiSaver before switching to InvestNow).

Government contributions – Contributions the government have made to KiwiSaver, from the time you first joined KiwiSaver (includes if you joined KiwiSaver before switching to InvestNow).

Other contributions – Any other contributions your employer(s) have made to KiwiSaver, from the time you first joined KiwiSaver (includes if you joined KiwiSaver before switching to InvestNow).

Gains/(losses) after fees – any gains or losses, after management fees, you have made in your KiwiSaver portfolio since joining the InvestNow KiwiSaver Scheme.

Tax refund/(paid) – any taxes paid/refunded since joining the InvestNow KiwiSaver Scheme. Note that this excludes any Portfolio Investment Entity (PIE) tax that is accrued but not yet paid or refunded.

What are the fees for the InvestNow KiwiSaver Scheme?

InvestNow doesn’t charge any fees for you to invest in the InvestNow KiwiSaver Scheme. Fees that are charged vary by the underlying fund manager and can be found here. These fees are the estimated total fund charges (including GST) which are made up of:

- Management & administration charges, including Manager’s basic fee and other management and administration charge and;

- Performance fees

Fees have been estimated using the information provided by underlying fund managers and by reference to the underlying fund’s disclosure documents.

Is there a minimum or maximum number of funds I must have in my KiwiSaver portfolio?

The minimum number of funds is one and the maximum number of funds you can have in your InvestNow KiwiSaver Scheme portfolio is limited only by the number of funds we offer (currently 38).

How often can I change the funds in my KiwiSaver portfolio?

You can change your investment plan for your KiwiSaver at any point and there is no limit on how many times you can change. Please note that a buy/sell margin or swing price adjustment may apply when you buy/sell funds.

How long does it take my KiwiSaver funds to be transferred to InvestNow?

Once you have completed your account opening and your current KiwiSaver provider has received the switch notification, your funds should be transferred within 10 business days.

How do I switch my KiwiSaver to InvestNow?

You will first need to set up your KiwiSaver account with InvestNow. Please refer to our FAQ here. Once your account is open, we will organise the transfer of your KiwiSaver to the InvestNow KiwiSaver Scheme, which takes approximately 10 business days.

How do I make changes to my KiwiSaver portfolio?

You can change your allocation of funds under the ‘My Portfolio’ tab. This will show your current portfolio.

To change your portfolio, please follow these steps

- Click the ‘Change your portfolio’. Select the funds you would like to include in your portfolio, then click ‘Next’.

- Select the percentage you would like for each fund and click ‘Next’. Please note that this must add to 100%.

- You can then select either “Apply change to your current investment mix and future contributions”, which will rebalance your entire portfolio (selling and buying as necessary) to the new weightings, or “Apply change to future contributions only”, which will not affect your existing funds but will be applied to all future contributions.

- Download the PDS document and check the box marked ‘I have read, understood and accept the latest Investment statements or Product Disclosure Statement’.

- Click ‘Confirm’ and a successful notification will appear once the change has been completed.

You can change your investment plan for your KiwiSaver at any point and there is no limit on how many times you can change. Please note that a buy/sell spread, swing price adjustment and/or entry/exit fee may apply when funds are bought and sold as part of a rebalance.

How do I make a voluntary contribution?

You can view the Public Trust bank account details for making a voluntary contribution by clicking ‘Deposit’ under the ‘Make a One-Off Contribution’ heading when you are logged into your InvestNow KiwiSaver Scheme account.

From your internet banking, you can simply search for InvestNow KiwiSaver Scheme as the payee in the bill payment register and complete the details. You can then save this for future contributions, or set up an automatic payment.

Payment can also be made directly to Inland Revenue by selecting the Pay Tax option in internet banking (choose the KSS tax code).

How do I join the InvestNow KiwiSaver Scheme?

If you are an existing InvestNow customer, click here to log in to the InvestNow KiwiSaver Scheme portal using your existing InvestNow email and password to begin the online application process.

If you are completely new to InvestNow, begin the InvestNow KiwiSaver Scheme online application process by creating your online account here.

How do I apply for a withdrawal e.g. first home, hardship or serious illness?

If you are looking to make a withdrawal, please contact us via email at contact@investnow.co.nz or by phone via 0800 499 466.

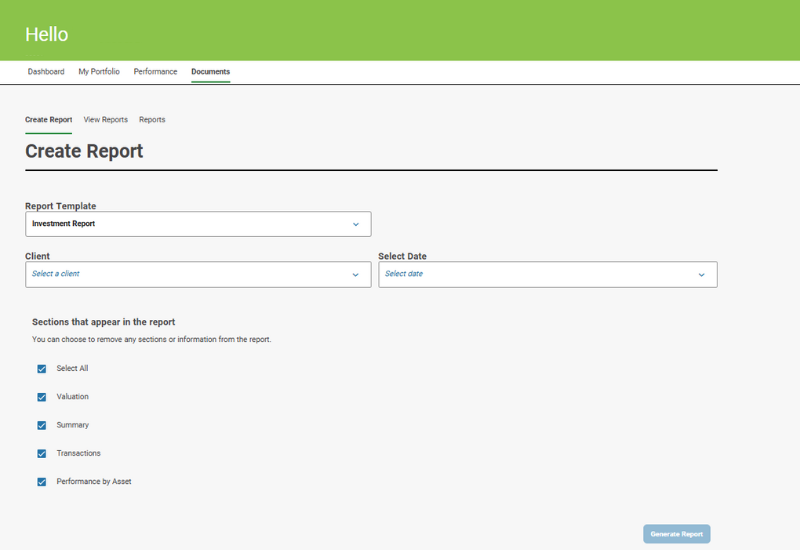

How can I produce reports with information about my InvestNow KiwiSaver Scheme portfolio?

InvestNow is an online service. You can download statements when you are logged into your InvestNow KiwiSaver Scheme account.

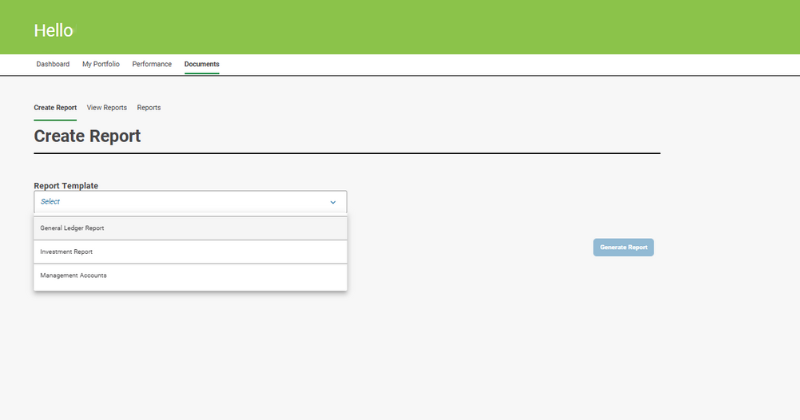

There are three types of reports:

- Investment Report – provides information about your portfolio returns, contributions, tax information, and more (PDF format)

- Management Accounts Report – provides more detailed information that may be of use to you and/or your accountant (Excel format)

- General Ledger Report – provides information about your portfolio returns, contributions, tax information, and more (Excel format)

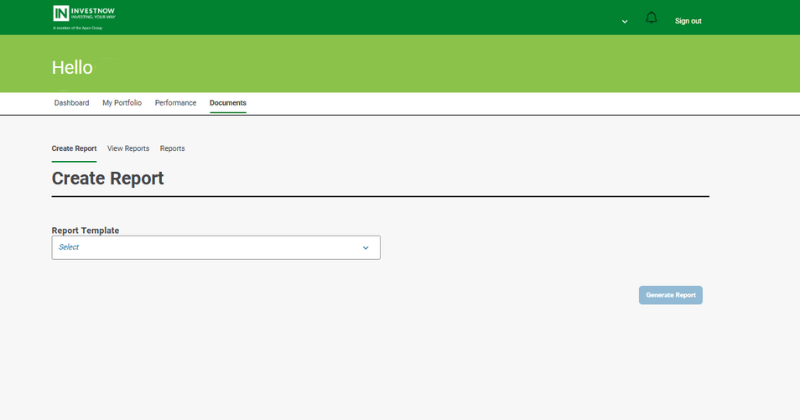

You can create any of the above reports by following these steps:

- Click the “Documents” tab

- Select the relevant report under “Report Template”

- Select a time period under “Select Date”

- Click “Generate Report”