Responsible Investing: Explained

Article written by InvestNow

What is ‘Responsible Investing’?

From a Fund Manager perspective, Responsible Investing is essentially a values-based approach to selecting the underlying investments within a managed fund; And from an Investor perspective, Responsible Investing is identifying and selecting managed funds that employ a responsible investing strategy; or selecting companies/shares that meet a responsible investing standard.

Traditional investment – about returns and risk

Traditionally, investment strategies have been primarily focused on return and risk. Fund Managers would select underlying investments (companies) that offered the best returns for an acceptable level of risk, for their customers, with less interest in the nature of those investments and their real-world impact e.g. fossil fuels, tobacco etc.

This traditional approach to investing still exists, and is entirely relevant for some investors, however as society has evolved, consumers have driven demand for investment options that don’t hurt the world around them; And further to that, demand for investment options that have a positive impact.

The three broad levels of Responsible Investing:

- Avoiding

Investment that avoids harm by actively excluding unacceptable sectors and companies with low ethical standards, such as Tobacco, Fossil Fuels and weapons companies. - Higher standards

Investment that avoids harm by excluding unacceptable sectors and companies, as above. Sways towards companies that have higher ethical standards, for example, good governance practices. - Positive Impact

Investment that targets sectors/companies with social and/or environmental benefits.

The many technical terms that refer to Responsible Investing:

There are a lot of terms out there that refer to responsible investing in one shape or another. Below are the main five:

- Socially Responsible Investment

- ESG (Environmental, Societal, Governance) Investment

- Sustainable Themed Investment

- Impact Investment

- Philanthropy

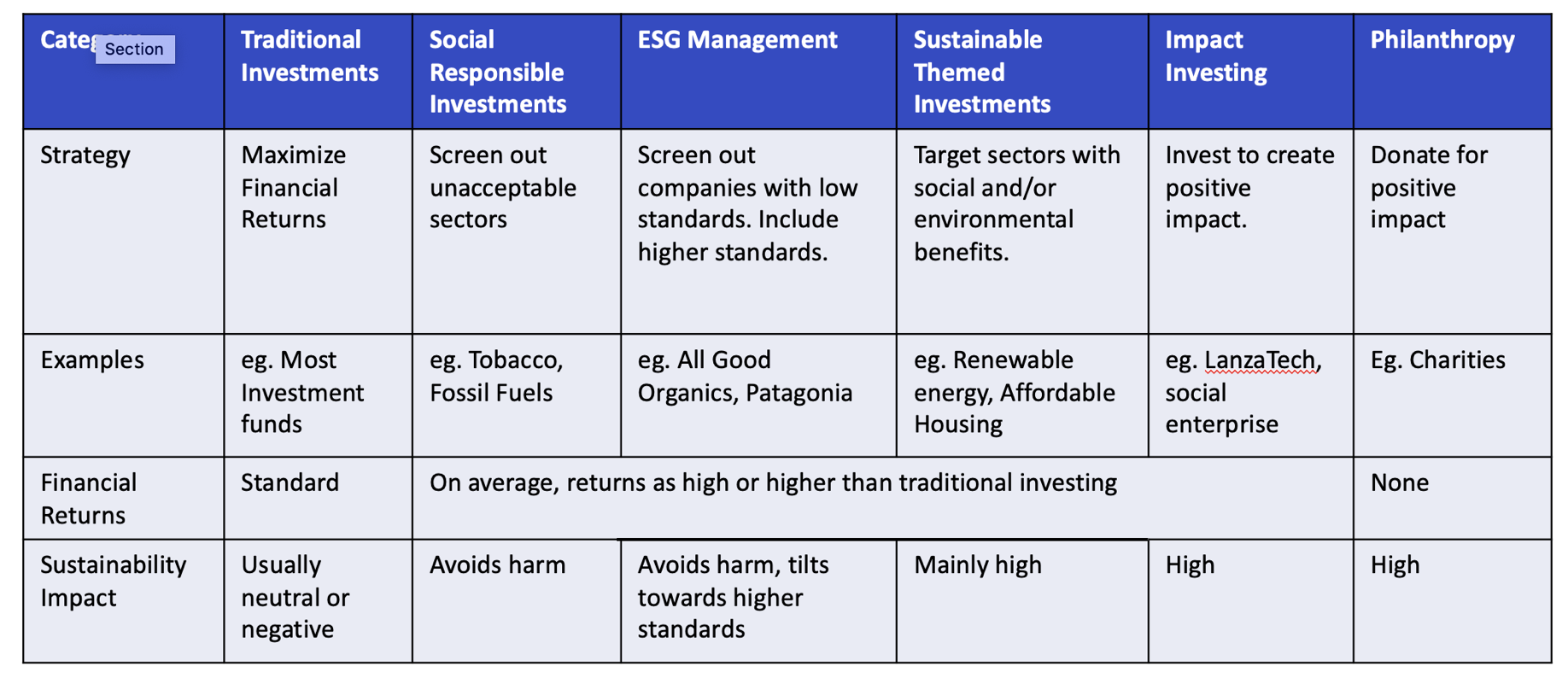

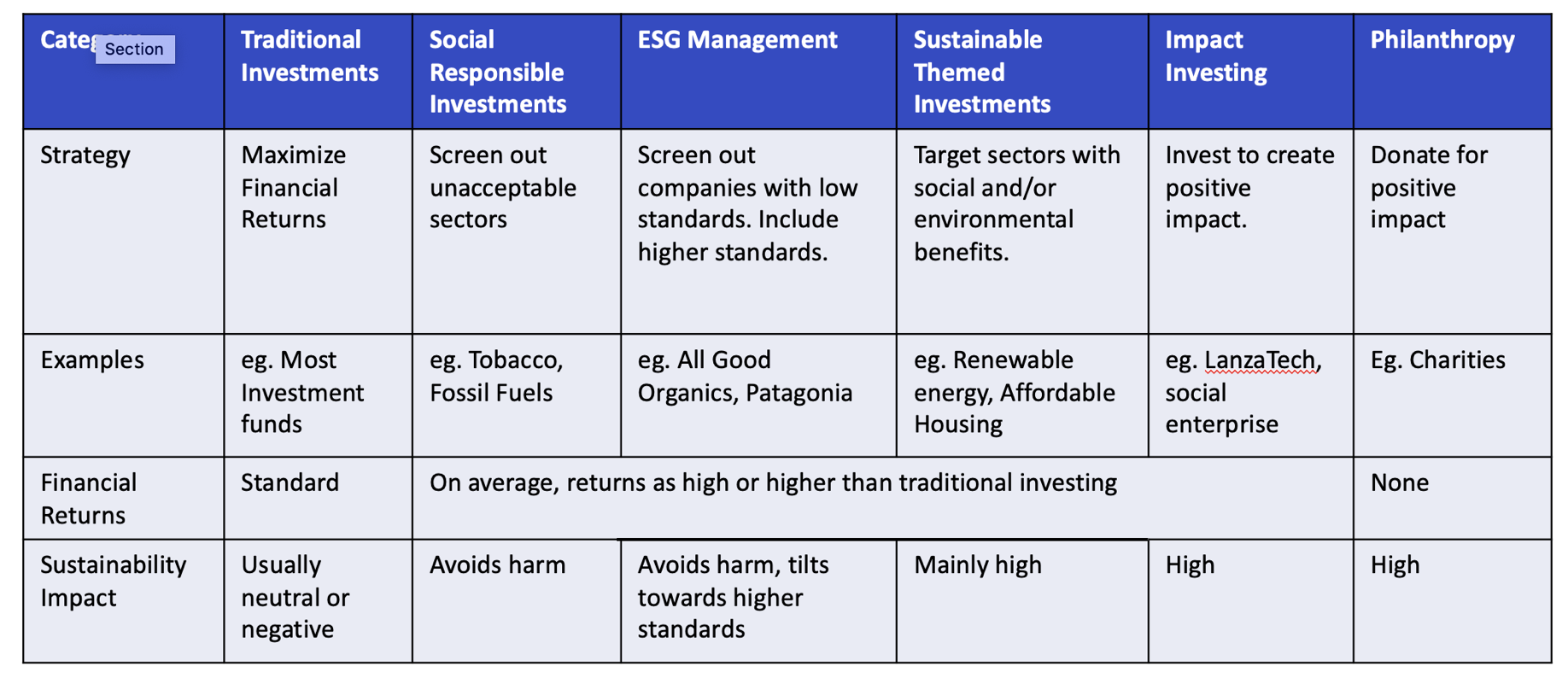

Each of these terms refers to a specific Responsible Investment Strategy. For more detail on what these Responsible Investment strategies are, see Mindful Money’s Responsible Investment Strategy chart below:

The pay-back of Responsible Investing

There’s growing evidence from credible subject experts, such as Morgan Stanley, showing that, responsible investments have returns that are at least as high, or higher, than traditional funds.

Specifically referring to sustainable investment – “The myth that sustainable investing requires a financial trade-off has been surprisingly sticky, despite research demonstrating that companies with strong social or environmental practices outperform their peers on a variety of measures.” Says Matthew Slovik, Head of Global Sustainable Finance and Morgan Stanley. “By looking at thousands of funds across multiple asset classes, we found that sustainable investments can help investors meet a variety of financial objectives for generating returns and managing risk.”

Morgan Stanley carried out an analysis of over 10,700 funds, using Morningstar data on exchange-traded and open-ended funds active in any given year from 2004-2018. The key findings, as referenced in this Morgan Stanley article, were:

- No financial trade-off in the returns of sustainable and traditional funds

- No statistically significant difference in total returns between ESG focused, traditional funds and ETFs

- Sustainable funds may offer lower market risk

-

The research also found that in periods of extreme market volatility, such as 2008, 2009, 2015 and 2018, sustainable funds downside deviation was notably smaller than traditional funds.

Identifying responsible investments:

In terms of Managed Funds, the best way to determine what level of Responsible Investing they fit into is to review the funds PDS (Product Disclosure Document). In this, you will be able to view any claims of Responsible Investment and the top 10 holdings of the fund. From there you’ll be able to carry out your own research of those top 10 holdings (a Google search can usually reveal anything nasty).

One thing to note is, there is no set standard that measures/fact checks claims of ‘Responsible Investing’. If you are explicitly searching for Responsible Investment options, this kind of due diligence is a very wise place to start, as you’ll need to determine what level of Responsible Investment your prospective investment fits into.

When in doubt, consult a financial advisor

And if after all of your own research, you’re still not sure, consult a financial advisor – let them know what you consider Responsible Investment and let them do the work.

Helpful resources for further research:

- Mindful Money – A New Zealand-based website providing information on Responsible Investment and Responsible Investment options.

- Sustainable Investing’s Competitive Advantages – Morgan Stanley article

Responsible Investing: Explained

Article written by InvestNow

What is ‘Responsible Investing’?

From a Fund Manager perspective, Responsible Investing is essentially a values-based approach to selecting the underlying investments within a managed fund; And from an Investor perspective, Responsible Investing is identifying and selecting managed funds that employ a responsible investing strategy; or selecting companies/shares that meet a responsible investing standard.

Traditional investment – about returns and risk

Traditionally, investment strategies have been primarily focused on return and risk. Fund Managers would select underlying investments (companies) that offered the best returns for an acceptable level of risk, for their customers, with less interest in the nature of those investments and their real-world impact e.g. fossil fuels, tobacco etc.

This traditional approach to investing still exists, and is entirely relevant for some investors, however as society has evolved, consumers have driven demand for investment options that don’t hurt the world around them; And further to that, demand for investment options that have a positive impact.

The three broad levels of Responsible Investing:

- Avoiding

Investment that avoids harm by actively excluding unacceptable sectors and companies with low ethical standards, such as Tobacco, Fossil Fuels and weapons companies. - Higher standards

Investment that avoids harm by excluding unacceptable sectors and companies, as above. Sways towards companies that have higher ethical standards, for example, good governance practices. - Positive Impact

Investment that targets sectors/companies with social and/or environmental benefits.

The many technical terms that refer to Responsible Investing:

There are a lot of terms out there that refer to responsible investing in one shape or another. Below are the main five:

- Socially Responsible Investment

- ESG (Environmental, Societal, Governance) Investment

- Sustainable Themed Investment

- Impact Investment

- Philanthropy

Each of these terms refers to a specific Responsible Investment Strategy. For more detail on what these Responsible Investment strategies are, see Mindful Money’s Responsible Investment Strategy chart below:

The pay-back of Responsible Investing

There’s growing evidence from credible subject experts, such as Morgan Stanley, showing that, responsible investments have returns that are at least as high, or higher, than traditional funds.

Specifically referring to sustainable investment – “The myth that sustainable investing requires a financial trade-off has been surprisingly sticky, despite research demonstrating that companies with strong social or environmental practices outperform their peers on a variety of measures.” Says Matthew Slovik, Head of Global Sustainable Finance and Morgan Stanley. “By looking at thousands of funds across multiple asset classes, we found that sustainable investments can help investors meet a variety of financial objectives for generating returns and managing risk.”

Morgan Stanley carried out an analysis of over 10,700 funds, using Morningstar data on exchange-traded and open-ended funds active in any given year from 2004-2018. The key findings, as referenced in this Morgan Stanley article, were:

- No financial trade-off in the returns of sustainable and traditional funds

- No statistically significant difference in total returns between ESG focused, traditional funds and ETFs

- Sustainable funds may offer lower market risk

The research also found that in periods of extreme market volatility, such as 2008, 2009, 2015 and 2018, sustainable funds downside deviation was notably smaller than traditional funds.

Identifying responsible investments:

In terms of Managed Funds, the best way to determine what level of Responsible Investing they fit into is to review the funds PDS (Product Disclosure Document). In this, you will be able to view any claims of Responsible Investment and the top 10 holdings of the fund. From there you’ll be able to carry out your own research of those top 10 holdings (a Google search can usually reveal anything nasty).

One thing to note is, there is no set standard that measures/fact checks claims of ‘Responsible Investing’. If you are explicitly searching for Responsible Investment options, this kind of due diligence is a very wise place to start, as you’ll need to determine what level of Responsible Investment your prospective investment fits into.

When in doubt, consult a financial advisor

And if after all of your own research, you’re still not sure, consult a financial advisor – let them know what you consider Responsible Investment and let them do the work.

Helpful resources for further research:

- Mindful Money – A New Zealand-based website providing information on Responsible Investment and Responsible Investment options.

- Sustainable Investing’s Competitive Advantages – Morgan Stanley article