Investing for retirement

Make your money work hard, with InvestNow.

Using the findings of the Massey University study, in addition to the current NZ Super entitlement, a two-person household would need a retirement nest egg of up to $252k for a simple ‘no-frills’ basic retirement, and up to $1.1m for a more comfortable ‘choices’ lifestyle (assuming you retire at age 65, earn no other income, live until age 90 and only draw on your lump sum savings when you need it).*

Will you have enough to do the things you love, when you retire? Use our calculator below to see how much money you’re estimated to have when you reach retirement.

*For more detailed information about retirement expenditure, read the full Massey University Study findings here. Total retirement expenditure calculations for the 25-year period are based on the current weekly expenditure figures published in the study and do not take into account the effects of inflation.

Retirement Fund Calculator

See your estimated retirement savings/investment value

Using the findings of the Massey University study, if you were to save a lump sum of approx. $252k by retirement at age 65, this coupled with the current NZ Super entitlement, will be able to provide a basic ‘no-frills’ retirement (assuming you retire at age 65, earn no other income, live until age 90 and only draw on your lump sum savings when you need it).

Tips to help you boost your retirement fund

The steps mentioned above provide general guidance, and it’s crucial to consider your individual circumstances, risk tolerance, and long-term financial goals when planning for retirement. A financial advisor or planner can provide personalised advice based on your situation and help you develop a comprehensive retirement strategy.

How InvestNow can help you invest for your retirement…

Access to 150+ Managed Fund investment options

With InvestNow, you can invest in 150+ Managed Funds (including ETFs and Index funds) from a range of expert New Zealand and global fund managers.

Lear more here.

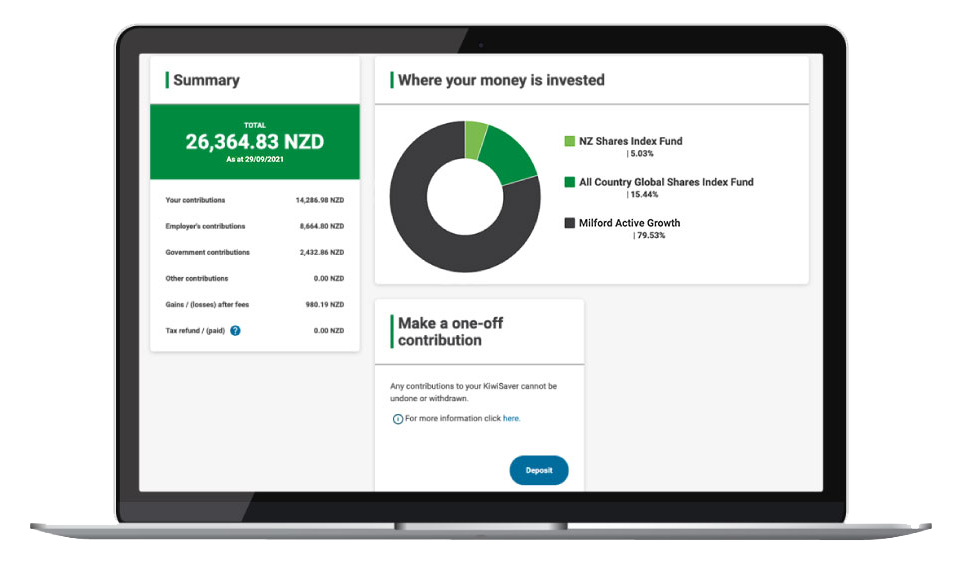

Access to 40+ KiwiSaver investment options

With InvestNow, you can invest your KiwiSaver portfolio in up to 40 different managed funds from multiple leading investment managers, through the InvestNow KiwiSaver Scheme.

Learn more here.

Access to Term Deposit options from 5 leading banks

With InvestNow, you can invest in flexible term deposits from 6 leading banks. No need to open any bank accounts – instant online access.

Learn more here.

Join InvestNow to invest, and make your money work hard for your retirement

Managed Fund, KiwiSaver & Term Deposit options through one online account.

If you have an existing InvestNow account, login here.