Access to ETFs for New Zealand investors – When is 0.34% cheaper than 0.04%?

by Smartshares, April 2019

Passively managed Exchange Traded Funds (ETFs) are becoming more and more popular among Kiwi investors as a way of gaining cheap access to global shares. Passive ETFs offer low cost, liquidity and broad diversification. In addition, there is decades of evidence to show that passive funds deliver better after-fee returns than the vast majority of actively managed funds.

We are delighted to see the growth in investor interest in ETFs. However, based on feedback we receive from investors and financial advisers the total cost of buying, holding and selling ETFs is not widely understood, especially when comparing NZX listed ETFs with ETFs listed overseas.

One of the most well known ETFs globally is the Vanguard US500 Fund. This ETF has total assets of almost US$450 billion, and has an annual management fee of 0.04% p.a.

Smartshares offers an NZX listed US500 ETF, which invests directly into the Vanguard US500 ETF. Our annual fee is 0.34% p.a.

Investors naturally ask why they would invest in the Smartshares US500 fund when the Vanguard ETF has a much lower management fee. The answer is that the annual fee is only a small part of the total cost of owning an overseas ETF. Other considerations are:

- Ease of access

- Total cost of entry

- Total holding costs

- Tax

Let’s examine a New Zealand retail investor considering an investment of $10,000 into either the Smartshares US500 ETF listed on the NZX or Vanguard’s US500 ETF listed on the New York Stock Exchange.

This article was produced by Smartshares, April 2019

1. Ease of Access

Investing in Smartshares is simple compared with the process for buying Vanguard’s US500 ETF.

| Smartshares US500 ETF | Vanguard US500 ETF |

|---|---|

| Apply direct to Smartshares in NZD | Set up an account with an NZ sharebroker |

| Place an order for US500 ETF | |

| Change NZD to USD | |

| Purchase ETF | |

| ETF placed in broker custody |

2. Total Cost of Entry

| Cost of $10,000 investment | Smartshares | NZ Broker Online |

|---|---|---|

| Brokerage* | $30.00 | $103.00 |

| Currency Exchange** | $0.00 | $150.00 |

| Custody | $0.00 | $25.00 |

| Administration Fee | $0.00 | $60.00 |

| Total | $30.00 | $338.00 |

* Smartshares charges a one-off set up fee of $30 for investors coming direct. Minimum broker commission is US$69.50

** NZ broker Currency margin “up to 1.50%”

Investing directly into Smartshares is significantly cheaper than investing directly into Vanguard’s US500 ETF. Even going through an online broker, there are a number of additional costs which investors need to pay to invest in overseas shares, including broker commission, currency exchange spreads, custody fees and administration fees. In fact, through an NZ online broker it costs over 10 times more to invest directly in Vanguard’s US500 ETF than to invest in Smartshares US500 fund.

3. Total Cost of Ownership

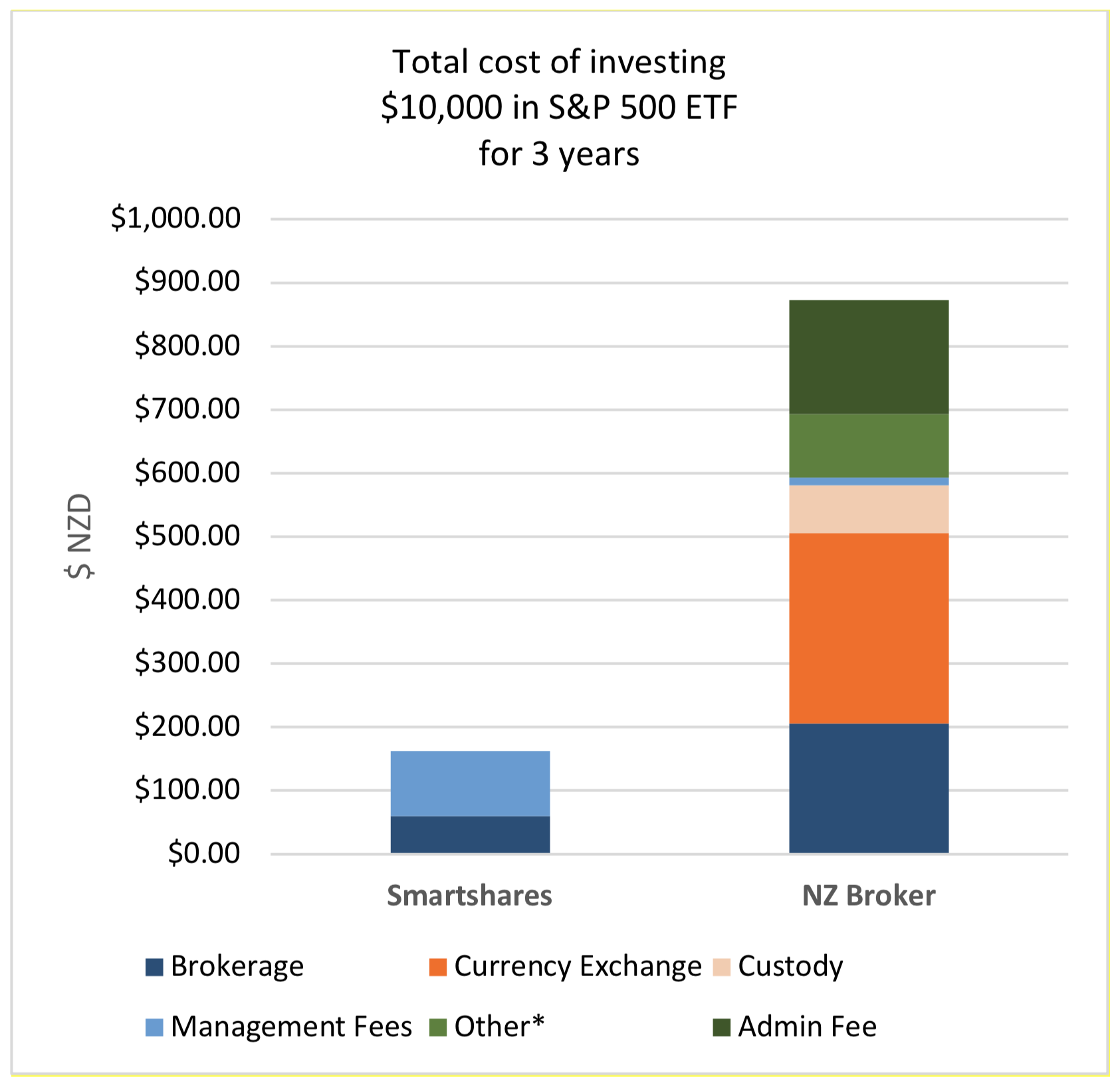

In the example below we have assumed an investor puts $10,000 each into the Smartshares US500 fund and the Vanguard US500 ETF, and sells after three years. For ease of comparison, we have assumed there is no capital growth over the three year period. Despite the additional transaction costs of buying Vanguard’s ETF via a broker, do Vanguard’s much lower annual management fees mean total ownership costs over a three year period are lower?

| S&P 500 - Costs over three years $10, 000 investment | Smartshares | NZ Broker Online |

|---|---|---|

| Brokerage | $60.00 | $206.00 |

| Currency Exchange | $0.00 | $300.00 |

| Custody | $0.00 | $75.00 |

| Admin Fee | $0.00 | $180.00 |

| Management Fees | $102.00 | $12.00 |

| Other* | $0.00 | $100.00 |

| Total | $162.00 | $873.00 |

* Custody release fee

The total cost of owning the Smartshares US500 fund over three years is significantly lower than for purchasing the Vanguard US500 ETF via an online broker. Despite Vanguard’s annual management fee being only $12.00 over 3 years, the transaction, forex, custody and administration costs swamp this. In total, it is around 5 times more expensive to invest directly into the Vanguard ETF than the Smartshares ETF.

4. Tax

Smartshares are listed PIE funds meaning they are taxed at 28%. In contrast investors on the top marginal tax rate are subject to 33% tax for FDR income on their FIF investments.

The disadvantage of using FIF funds is that investors need to do their own tax returns, which can be complex, and may require input from an accountant or tax expert.

Note that listed PIEs are taxed at 28%, so people on lower PIR rates need to take this into account. While people on lower PIR rates can offset this against other sources of income, it does mean they need to do a tax return.

5. Conclusion

When assessing whether to invest in Smartshares or directly into an overseas listed ETF, it is vital to look at the total costs of ownership in order to assess the most cost effective route. For most investors, it is significantly cheaper both to invest in and to hold the Smartshares EF than to invest directly in an overseas listed ETF.