InvestNow News – 26th March – Harbour Asset Management – Still a large gap in New Zealand output

Article written by Hamish Pepper, Harbour Asset Management – 19th March 2021

- The New Zealand economy shrank at the end of last year as the construction sector struggled to find the resources to continue to expand, while retail trade and accommodation activity dropped due to a lack of tourists.

- New Zealand is in a better position than many other economies, but there is still a gap between our potential output and where we are currently tracking, which is acting as a disinflationary force.

- It seems unlikely that the RBNZ will hike rate hikes in the next year; they have many other actions they could take before contemplating interest rate hikes.

- Longer-dated bond yields could be led higher by offshore developments as global growth beats expectations.

Initial estimates of GDP for the December quarter fell 1.0% q/q versus market expectations of a 0.2% q/q increase and an RBNZ forecast of 0.0% q/q. This meant that, officially, the level of GDP was 0.9% smaller than a year ago. Our initial take is that it must be very tough to accurately measure economic activity following such a large shock, and we should expect some risk of revisions to these estimates. This may be why the financial market reaction was relatively subdued.

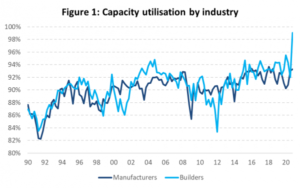

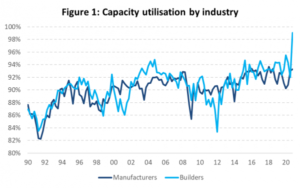

Surprisingly, given the anecdotal evidence, the construction sector was the largest contributor to the decline in activity. In the opinion of most commentators, this weakness is unlikely to persist. Construction activity fell 9% after a record 52% expansion in Q3. Some pullback was inevitable given capacity utilisation in the building sector was reported to be almost 100% in the NZIER Q4 Quarterly Survey of Business Opinion (QSBO, see Figure 1). It seems obvious that a lack of resources meant builders simply could not expand output further. We think capacity constraints should ease as supply chains normalise after COVID-19-related disruption and additional labour is attracted to the industry. The outlook for the sector remains very positive in the context of ongoing rises in house prices supported by historically low mortgage rates.

Source: NZIER

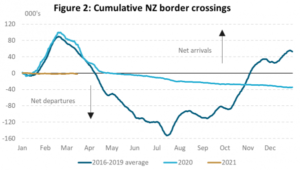

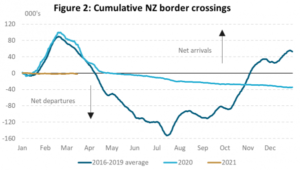

The more interesting aspect of the report was the 5% drop in retail trade and accommodation activity, which seems to relate to missing international tourists. We estimate that an additional 90,000 people would normally have been in New Zealand at the end of last year and that a further 90,000 visitors would usually arrive in the following months, peaking in the middle of February (see Figure 2). The ongoing absence of international tourists may continue to weigh on activity this quarter. Recent weakness in service sector business surveys, alongside lower electricity grid demand and traffic volumes, is consistent with this view. However, people registering as beneficiaries are falling, suggesting the drop in international tourists is not translating into job losses. All these data points are providing mixed signals for policy makers. One certainty, that we are anchoring our views on, is the recent confirmation of 8.5 million additional doses of the Pfizer-BioNTech COVID-19 vaccine to be delivered in the second half of 2021. This has reduced the likelihood that international tourists will be completely absent again next summer, and it seems likely that a deal may soon be on the table to open a trans-Tasman bubble.

Source: NZ Customs Service

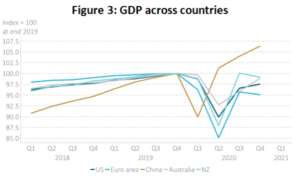

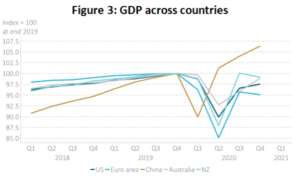

New Zealand remains a global outperformer, but there is still a gap between our potential activity level and where we are travelling right now, which is acting as a disinflationary force. Our economy is still about 1% smaller than it was at the end of 2019. This is a great outcome relative to the Euro area and US economies that are about 5% and 2.5% smaller, respectively (see Figure 3). There are currently 25,000 additional unemployed people in New Zealand than there were pre-COVID-19; in the US there are 10 million. Core inflation around the world has risen but remains below the midpoint of nearly every Central Bank’s target. Goods supply chain disruption, higher commodity prices and base effects related to low Q2 2020 prices may push annual inflation higher in the middle of this year, however all central banks assume this will be transitory. The case in New Zealand is no different and the Reserve Bank of New Zealand (RBNZ) seems a very long way off from increasing interest rates. We expect ongoing housing market strength may support economic activity via residential investment and consumption through the course of this year. The goods export sector may continue to benefit from increased global demand and higher commodity prices.

Source: BEA, Eurostat, NBS, ABS, Stats NZ, Macrobond

Ongoing economic uncertainty supports a patient approach from the RBNZ and challenges market expectations of near-term rate hikes. Interest rate markets reduced the implied chance of a 0.25% rate hike in the February 2022 Monetary Policy Statement (MPS) meeting from 70% to 55% following the GDP data. In our view, the prospect of a rate hike in the next 12 months remains very low while so many other actions are possible. For instance, the RBNZ is unlikely to hike the OCR until

- it ceases Quantitative Easing (QE) bond purchases, which are still happening at a pace of $630mn/week within a programme that does not expire until the middle of next year

- it successfully achieves its dual mandate of 2% inflation and maximum sustainable employment for several quarters, and

- economic uncertainty, largely related to the rollout of COVID-19 vaccinations here and abroad, has reduced sufficiently. The RBNZ remains very risk averse to continued disappointment on GDP growth and its impact on employment, while it seems unconcerned about inflation risks.

Longer-dated yields will be led by offshore developments where we continue to think the skew is towards higher interest rates. New Zealand longer-dated yields are highly sensitive to US Treasury yields. Temporary factors may push annual rates of headline US inflation to as high as 3% in the middle of this year. A surge in economic activity could add to this inflation pressure via a cocktail of a vaccine-led reopening of the US economy, pent up consumer demand and large amounts of fiscal and monetary stimulus. The US economy may expand 6-8% in 2021, implying it could be 4-6% larger than it was pre-COVID by year end, yet 10-year US Treasury yields are 40bp below their 10-year average and 10-year real interest rates are still negative.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.

InvestNow News – 26th March – Harbour Asset Management – Still a large gap in New Zealand output

Article written by Hamish Pepper, Harbour Asset Management – 19th March 2021

- The New Zealand economy shrank at the end of last year as the construction sector struggled to find the resources to continue to expand, while retail trade and accommodation activity dropped due to a lack of tourists.

- New Zealand is in a better position than many other economies, but there is still a gap between our potential output and where we are currently tracking, which is acting as a disinflationary force.

- It seems unlikely that the RBNZ will hike rate hikes in the next year; they have many other actions they could take before contemplating interest rate hikes.

- Longer-dated bond yields could be led higher by offshore developments as global growth beats expectations.

Initial estimates of GDP for the December quarter fell 1.0% q/q versus market expectations of a 0.2% q/q increase and an RBNZ forecast of 0.0% q/q. This meant that, officially, the level of GDP was 0.9% smaller than a year ago. Our initial take is that it must be very tough to accurately measure economic activity following such a large shock, and we should expect some risk of revisions to these estimates. This may be why the financial market reaction was relatively subdued.

Surprisingly, given the anecdotal evidence, the construction sector was the largest contributor to the decline in activity. In the opinion of most commentators, this weakness is unlikely to persist. Construction activity fell 9% after a record 52% expansion in Q3. Some pullback was inevitable given capacity utilisation in the building sector was reported to be almost 100% in the NZIER Q4 Quarterly Survey of Business Opinion (QSBO, see Figure 1). It seems obvious that a lack of resources meant builders simply could not expand output further. We think capacity constraints should ease as supply chains normalise after COVID-19-related disruption and additional labour is attracted to the industry. The outlook for the sector remains very positive in the context of ongoing rises in house prices supported by historically low mortgage rates.

Source: NZIER

The more interesting aspect of the report was the 5% drop in retail trade and accommodation activity, which seems to relate to missing international tourists. We estimate that an additional 90,000 people would normally have been in New Zealand at the end of last year and that a further 90,000 visitors would usually arrive in the following months, peaking in the middle of February (see Figure 2). The ongoing absence of international tourists may continue to weigh on activity this quarter. Recent weakness in service sector business surveys, alongside lower electricity grid demand and traffic volumes, is consistent with this view. However, people registering as beneficiaries are falling, suggesting the drop in international tourists is not translating into job losses. All these data points are providing mixed signals for policy makers. One certainty, that we are anchoring our views on, is the recent confirmation of 8.5 million additional doses of the Pfizer-BioNTech COVID-19 vaccine to be delivered in the second half of 2021. This has reduced the likelihood that international tourists will be completely absent again next summer, and it seems likely that a deal may soon be on the table to open a trans-Tasman bubble.

Source: NZ Customs Service

New Zealand remains a global outperformer, but there is still a gap between our potential activity level and where we are travelling right now, which is acting as a disinflationary force. Our economy is still about 1% smaller than it was at the end of 2019. This is a great outcome relative to the Euro area and US economies that are about 5% and 2.5% smaller, respectively (see Figure 3). There are currently 25,000 additional unemployed people in New Zealand than there were pre-COVID-19; in the US there are 10 million. Core inflation around the world has risen but remains below the midpoint of nearly every Central Bank’s target. Goods supply chain disruption, higher commodity prices and base effects related to low Q2 2020 prices may push annual inflation higher in the middle of this year, however all central banks assume this will be transitory. The case in New Zealand is no different and the Reserve Bank of New Zealand (RBNZ) seems a very long way off from increasing interest rates. We expect ongoing housing market strength may support economic activity via residential investment and consumption through the course of this year. The goods export sector may continue to benefit from increased global demand and higher commodity prices.

Source: BEA, Eurostat, NBS, ABS, Stats NZ, Macrobond

Ongoing economic uncertainty supports a patient approach from the RBNZ and challenges market expectations of near-term rate hikes. Interest rate markets reduced the implied chance of a 0.25% rate hike in the February 2022 Monetary Policy Statement (MPS) meeting from 70% to 55% following the GDP data. In our view, the prospect of a rate hike in the next 12 months remains very low while so many other actions are possible. For instance, the RBNZ is unlikely to hike the OCR until

- it ceases Quantitative Easing (QE) bond purchases, which are still happening at a pace of $630mn/week within a programme that does not expire until the middle of next year

- it successfully achieves its dual mandate of 2% inflation and maximum sustainable employment for several quarters, and

- economic uncertainty, largely related to the rollout of COVID-19 vaccinations here and abroad, has reduced sufficiently. The RBNZ remains very risk averse to continued disappointment on GDP growth and its impact on employment, while it seems unconcerned about inflation risks.

Longer-dated yields will be led by offshore developments where we continue to think the skew is towards higher interest rates. New Zealand longer-dated yields are highly sensitive to US Treasury yields. Temporary factors may push annual rates of headline US inflation to as high as 3% in the middle of this year. A surge in economic activity could add to this inflation pressure via a cocktail of a vaccine-led reopening of the US economy, pent up consumer demand and large amounts of fiscal and monetary stimulus. The US economy may expand 6-8% in 2021, implying it could be 4-6% larger than it was pre-COVID by year end, yet 10-year US Treasury yields are 40bp below their 10-year average and 10-year real interest rates are still negative.

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.