InvestNow News – 11th June – Franklin Templeton – THE PUSH AND PULL TOWARD EMERGING MARKETS

Article written by Alberto J. Boquin, CFA, Franklin Templeton – 1st March 2021

In a previous post, my colleague Carol Lye highlighted two key tailwinds supportive of emerging markets (EM) in 2021: an easy U.S. Federal Reserve (Fed) and robust Chinese growth. Add to that buoyant commodity prices, rapid vaccination rates in the developed world, and a global—almost frenzied—search for yield. All these factors are obvious to anyone who reads the financial news. And yet, local-currency EM fixed income has struggled in 2021. What is holding it back? We would argue that there are two pieces still missing from the puzzle. One is that investment-grade EM sovereigns do not offer enough yield yet. The second is that speculative-grade EM have looming fiscal concerns. There are signs that both factors may be changing for the better.

AMONG INVESTMENT GRADE, CHILE AND POLAND STAND OUT

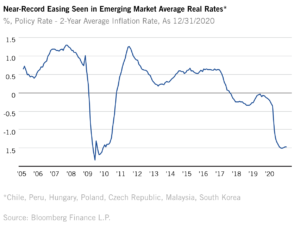

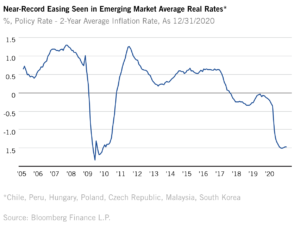

Let us start with investment-grade EM. In the midst of the unprecedented COVID-19 shock, many EM central banks quickly shifted to extraordinarily easy monetary policy. On some measures, monetary policy is even easier than it was following the global financial crisis (GFC) of 2008 (see Chart 1). So far, this recovery has been much faster and with less structural overhangs than the one following the GFC. However, policy rates that made sense in the summer of 2020 may no longer make sense as the world starts getting vaccinated and emerges from a year-long quarantine. While it is true that higher-quality EMs never offered particularly high real rates for foreign investors, the flows of capital go both ways. There is widespread evidence of local EM investors “dollarizing” their savings and prepaying U.S. dollar liabilities amid low domestic rates. For the moment, central banks worldwide have reaffirmed their intent to remain lower for longer, but money markets have started to price in rate normalization in many of these countries. Better rates of return domestically should encourage locals to remain in their home currencies. Thus, a key factor this year will be how central banks react in the face of changing growth and inflation outlooks. Chile and Poland stand out as two countries with central banks that may turn hawkish later this year, which would in turn support their respective currencies.

SPECULATIVE GRADE POISED TO SURPRISE POSITIVELY

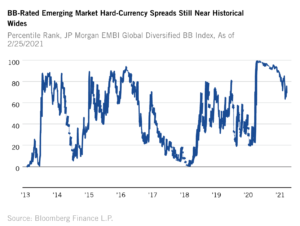

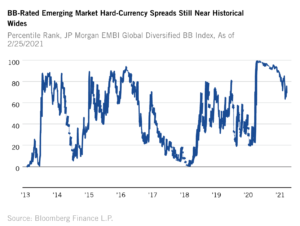

For speculative-grade EM sovereign bonds, the worries are more structural in nature. Debt loads were already high heading into the COVID-19 pandemic. Fiscal stimulus to counteract the shock of quarantine exacerbated the problem. The politics of fiscal consolidation are challenging amid still high unemployment rates. Market concerns are most apparent in BB-rated EMBI hard-currency spreads, which remain near historical wides, reflecting a great deal of pessimism.

The upside of having low expectations is that it does not require much to surprise positively. For this exercise, we will focus on the larger countries. Within this group, there are some positive trends that could work in their favor this year. Brazil has been in recession since 2016 but is likely to post positive gross domestic product (GDP) growth in 2021. South Africa just announced a reduction in planned debt issuance due to upside surprises in tax revenues from the mining sector. The traditionally dovish Turkish central bank has been tightening policy since July of last year. Tough challenges still lie ahead for BB-rated countries, but better global growth and some well-intentioned policy decisions present upside to what remain very skeptical valuations.

THE PUSH AND PULL TOWARD EMERGING MARKETS

To summarize, there are plenty of global “push” factors to encourage investors to move out of the U.S. dollar, not the least of which are an eroding trade balance for the U.S. and the Fed’s shift to average-inflation targeting. We also see signs of increasing global “pull” factors to coax investors into EM. In our view, 2021 will be about timing that inflection point at which skeptical valuations meet a confirmation of improving fundamentals.

DEFINITIONS

“AAA” and “AA” (high credit quality) and “A” and “BBB” (medium credit quality) are considered investment grade. Credit ratings for bonds below these designations (“BB,” “B,” “CCC,” etc.) are considered low credit quality, and are commonly referred to as “speculative” or “junk bonds.”

A sovereign credit rating is an independent assessment of the creditworthiness of a country or sovereign entity.

In Average inflation targeting (AIT), instead of aiming to return inflation over the medium term to the target rate of 2 percent, the Fed would aim to return the average of inflation over some period to the target rate.

The JPMorgan Emerging Markets Bond Index (EMBI) Global Below-Investment Grade (IG) is the below investment grade component of the JPMorgan Emerging Markets Bond Index (EMBI) Global which tracks total returns for U.S. dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds, and local market instruments. Below-investment grade refers to a credit quality rating of BB or below. Indexes are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

A real interest rate is an interest rate that has been adjusted to remove the effects of inflation to reflect the real cost of funds to the borrower and the real yield to the lender or to an investor.

WHAT ARE THE RISKS?

Past performance is no guarantee of future results. Please note that an investor cannot invest directly in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges.

Equity securities are subject to price fluctuation and possible loss of principal. Fixed-income securities involve interest rate, credit, inflation and reinvestment risks; and possible loss of principal. As interest rates rise, the value of fixed income securities falls. International investments are subject to special risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Commodities and currencies contain heightened risk that include market, political, regulatory, and natural conditions and may not be suitable for all investors.

U.S. Treasuries are direct debt obligations issued and backed by the “full faith and credit” of the U.S. government. The U.S. government guarantees the principal and interest payments on U.S. Treasuries when the securities are held to maturity. Unlike U.S. Treasuries, debt securities issued by the federal agencies and instrumentalities and related investments may or may not be backed by the full faith and credit of the U.S. government. Even when the U.S. government guarantees principal and interest payments on securities, this guarantee does not apply to losses resulting from declines in the market value of these securities.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

You need Adobe Acrobat Reader to view and print PDF documents. Download a free version from Adobe’s website.

Franklin Templeton Distributors, Inc.

InvestNow News – 11th June – Franklin Templeton – THE PUSH AND PULL TOWARD EMERGING MARKETS

Article written by Alberto J. Boquin, CFA, Franklin Templeton – 1st March 2021

In a previous post, my colleague Carol Lye highlighted two key tailwinds supportive of emerging markets (EM) in 2021: an easy U.S. Federal Reserve (Fed) and robust Chinese growth. Add to that buoyant commodity prices, rapid vaccination rates in the developed world, and a global—almost frenzied—search for yield. All these factors are obvious to anyone who reads the financial news. And yet, local-currency EM fixed income has struggled in 2021. What is holding it back? We would argue that there are two pieces still missing from the puzzle. One is that investment-grade EM sovereigns do not offer enough yield yet. The second is that speculative-grade EM have looming fiscal concerns. There are signs that both factors may be changing for the better.

AMONG INVESTMENT GRADE, CHILE AND POLAND STAND OUT

Let us start with investment-grade EM. In the midst of the unprecedented COVID-19 shock, many EM central banks quickly shifted to extraordinarily easy monetary policy. On some measures, monetary policy is even easier than it was following the global financial crisis (GFC) of 2008 (see Chart 1). So far, this recovery has been much faster and with less structural overhangs than the one following the GFC. However, policy rates that made sense in the summer of 2020 may no longer make sense as the world starts getting vaccinated and emerges from a year-long quarantine. While it is true that higher-quality EMs never offered particularly high real rates for foreign investors, the flows of capital go both ways. There is widespread evidence of local EM investors “dollarizing” their savings and prepaying U.S. dollar liabilities amid low domestic rates. For the moment, central banks worldwide have reaffirmed their intent to remain lower for longer, but money markets have started to price in rate normalization in many of these countries. Better rates of return domestically should encourage locals to remain in their home currencies. Thus, a key factor this year will be how central banks react in the face of changing growth and inflation outlooks. Chile and Poland stand out as two countries with central banks that may turn hawkish later this year, which would in turn support their respective currencies.

SPECULATIVE GRADE POISED TO SURPRISE POSITIVELY

For speculative-grade EM sovereign bonds, the worries are more structural in nature. Debt loads were already high heading into the COVID-19 pandemic. Fiscal stimulus to counteract the shock of quarantine exacerbated the problem. The politics of fiscal consolidation are challenging amid still high unemployment rates. Market concerns are most apparent in BB-rated EMBI hard-currency spreads, which remain near historical wides, reflecting a great deal of pessimism.

The upside of having low expectations is that it does not require much to surprise positively. For this exercise, we will focus on the larger countries. Within this group, there are some positive trends that could work in their favor this year. Brazil has been in recession since 2016 but is likely to post positive gross domestic product (GDP) growth in 2021. South Africa just announced a reduction in planned debt issuance due to upside surprises in tax revenues from the mining sector. The traditionally dovish Turkish central bank has been tightening policy since July of last year. Tough challenges still lie ahead for BB-rated countries, but better global growth and some well-intentioned policy decisions present upside to what remain very skeptical valuations.

THE PUSH AND PULL TOWARD EMERGING MARKETS

To summarize, there are plenty of global “push” factors to encourage investors to move out of the U.S. dollar, not the least of which are an eroding trade balance for the U.S. and the Fed’s shift to average-inflation targeting. We also see signs of increasing global “pull” factors to coax investors into EM. In our view, 2021 will be about timing that inflection point at which skeptical valuations meet a confirmation of improving fundamentals.

DEFINITIONS

“AAA” and “AA” (high credit quality) and “A” and “BBB” (medium credit quality) are considered investment grade. Credit ratings for bonds below these designations (“BB,” “B,” “CCC,” etc.) are considered low credit quality, and are commonly referred to as “speculative” or “junk bonds.”

A sovereign credit rating is an independent assessment of the creditworthiness of a country or sovereign entity.

In Average inflation targeting (AIT), instead of aiming to return inflation over the medium term to the target rate of 2 percent, the Fed would aim to return the average of inflation over some period to the target rate.

The JPMorgan Emerging Markets Bond Index (EMBI) Global Below-Investment Grade (IG) is the below investment grade component of the JPMorgan Emerging Markets Bond Index (EMBI) Global which tracks total returns for U.S. dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds, and local market instruments. Below-investment grade refers to a credit quality rating of BB or below. Indexes are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

A real interest rate is an interest rate that has been adjusted to remove the effects of inflation to reflect the real cost of funds to the borrower and the real yield to the lender or to an investor.

WHAT ARE THE RISKS?

Past performance is no guarantee of future results. Please note that an investor cannot invest directly in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges.

Equity securities are subject to price fluctuation and possible loss of principal. Fixed-income securities involve interest rate, credit, inflation and reinvestment risks; and possible loss of principal. As interest rates rise, the value of fixed income securities falls. International investments are subject to special risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Commodities and currencies contain heightened risk that include market, political, regulatory, and natural conditions and may not be suitable for all investors.

U.S. Treasuries are direct debt obligations issued and backed by the “full faith and credit” of the U.S. government. The U.S. government guarantees the principal and interest payments on U.S. Treasuries when the securities are held to maturity. Unlike U.S. Treasuries, debt securities issued by the federal agencies and instrumentalities and related investments may or may not be backed by the full faith and credit of the U.S. government. Even when the U.S. government guarantees principal and interest payments on securities, this guarantee does not apply to losses resulting from declines in the market value of these securities.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

You need Adobe Acrobat Reader to view and print PDF documents. Download a free version from Adobe’s website.

Franklin Templeton Distributors, Inc.