Foundation Series Funds: PIE Funds powered by Vanguard

With a New Zealand twist to benefit Kiwi investors

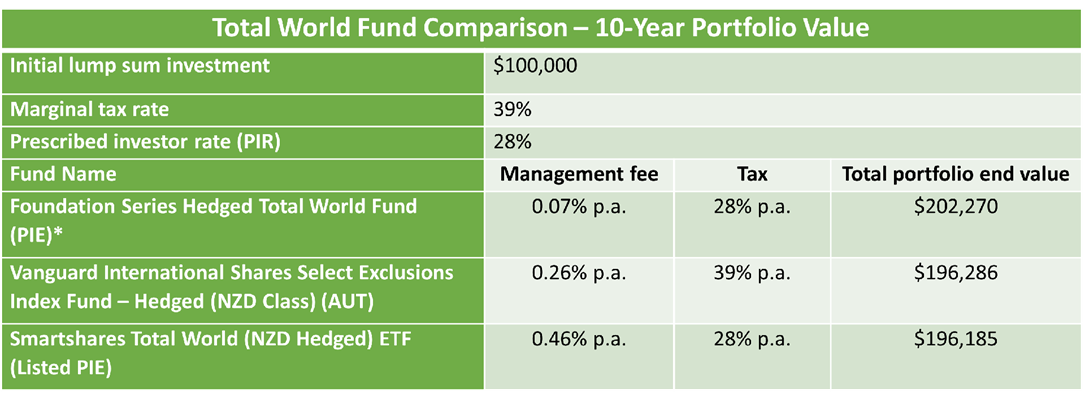

The Foundation Series Funds (Foundation Series) is the InvestNow house-brand of Portfolio Investment Entity (PIE) managed funds, that are tailored to meet the needs of New Zealand investors.

Within Foundation Series, we’ve built a select range of funds tailored to InvestNow customers that love global share funds managed by Vanguard… but with a few extra benefits for the New Zealand investor.

These funds invest directly into Vanguard Exchange Traded Funds (ETFs), which are passively managed and aim to replicate the performance of international share market indices.

Foundation Series Funds: PIE Funds powered by Vanguard

Available in our managed fund range & the InvestNow KiwiSaver Scheme

Reasons to choose the Foundation Series range of Vanguard-powered funds

Join InvestNow, or login to invest in the Foundation Series Funds

Available in InvestNow managed funds & the InvestNow KiwiSaver Scheme

If you have an existing InvestNow managed funds account, login here. If you have an existing InvestNow KiwiSaver Scheme account, login here.