Thoughts on short-term money storage options: Why managed cash PIE funds are a no-brainer for Anthony Edmonds

Article written by InvestNow – 22 November 2023

Investors need to think carefully about the best place to park their lazy money as interest rates rise well above neutral and drive up nominal returns for cash.

We asked InvestNow founder, Anthony Edmonds, to explain his journey to managed cash PIE funds, as his preferred solution to getting the best value from his lazy cash.

“Earlier this year I was pondering what do to with a little spare cash that was earmarked for spending some time over the next two years.

I don’t know the exact date when we’ll need the money but thought it prudent to ‘match my liability’ with a short-term investment while looking to make the most of the high rates currently on offer.

Historically, the go-to option in such a situation is to park the money in an interest-bearing on-call bank account, trading off lower rates (compared to term deposits) for instant access.

As at the end of October, the best on-call rate I could find on the www.interest.co.nz website stood at 4.7 per cent per annum – better than nothing, but still significantly below the official cash rate (OCR) of 5.5 per cent set by the Reserve Bank of NZ.

Offering something closer to the OCR, I spotted a bank with a 5.25 per cent per annum sticker rate of return for a so-called ‘notice saver account’, which lifted the bar in exchange for a 32-day withdrawal period.

The 32-day ‘liquidity’ trade-off was a bit of a turn-off. And the deal would also require me to suffer the painful admin process of opening an account with a bank I’m not a customer of. (Not to mention the question of whether the bank offering the highest short-term might need my money more than most!)

Finally, I toyed with pushing the liquidity boat out a bit further by investing in a three-month term deposit with my current bank, or possibly a portfolio of different term deposits selected from the six bank products available on InvestNow.

But given the fact I might need the cash at any time over the next couple of years, the prospect of incurring substantial break fees on bank term deposits, plus significant potential delays before I received my money, ruled this option out for me.

Term deposits also come with certain administrative hassles such as reinvesting cash as the investment matures as well as end-of-year tax-reporting duties.

Most importantly, however, all the bank-based solutions I considered came with a hefty 39 per cent tax rate: interest is typically taxed at investors’ marginal tax rate.

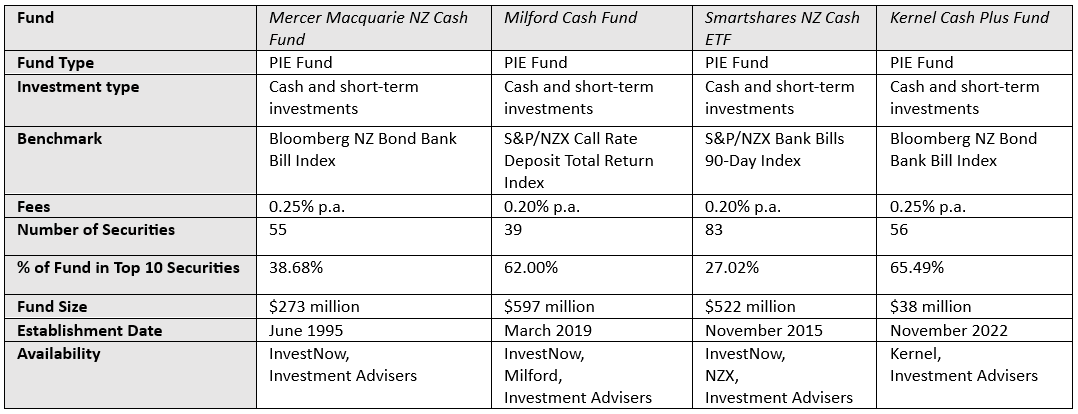

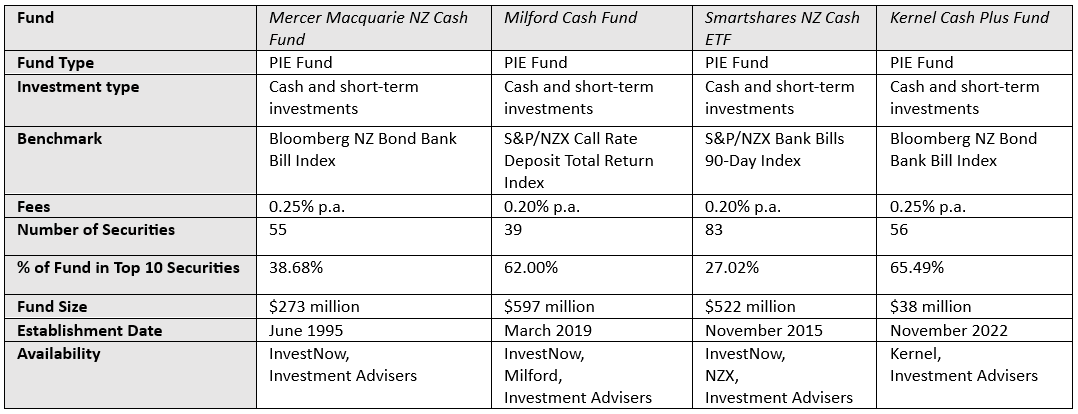

This is why I next explored the growing number of managed cash portfolio investment entity (PIE) funds now on offer in the NZ market, including the likes of the Mercer Macquarie NZ Cash Fund, Milford Cash Fund, Smartshares NZ Cash ETF, and Kernel Cash Plus Fund.

Each of these funds invests in a diversified portfolio of short-term fixed interest securities, typically with an average maturity of less than six months.

I weighed up the benefits and features of the managed cash PIE funds as below:

- PIE funds carry a maximum tax rate (PIR) of 28 per cent, meaning investors on the 33 and 39 per cent marginal rates gain a material benefit. In my case, for example, a pre-tax and after-fees return of 5.5 per cent per annum would equate to 3.36 per cent per annum after tax compared to 3.96 per cent per annum at the PIR rate of 28 per cent;

- there are no restraints locking my money in for a long period or break fees for drawing down from cash PIE funds on request – the money would be accessible within two or three days, which fits perfectly with my requirements;

- I would have fewer administrative hassles in a PIE fund as all the investment activities such as selecting and managing securities and reinvesting on maturity is carried out by the fund. Fund managers and platforms like InvestNow also pay the PIE tax on my behalf with no end-of-year IRD reporting responsibilities for me either; and,

- finally, I compared the managed cash PIE funds in the NZ market against various metrics – as per the table below – based on data sourced from the Sorted ‘Smart Investor’ website.

Of course, unlike term deposits, managed cash PIE fund returns are not fixed at a certain rate over a particular period of time, but fluctuate depending on a range of factors. In general, however, my analysis shows that cash PIE fund returns tend to stay in line with NZ wholesale money market indicators such as the OCR.

To understand the current potential returns available from the four managed cash PIE funds in my table, I looked at their respective ‘yield-to-maturity’ reports rather than historical performance figures (that reflect past interest rate environments).

Yield-to-maturity (also known as a ‘running yield’) measures the income available from the portfolio of fund assets if all securities are held until they mature.

Remembering the current OCR sits at 5.5 per cent, a couple of examples show managed cash PIE funds are staying on track of, or ahead of, the benchmark even after fees:

- the Mercer Macquarie Cash Fund reported a yield-to-maturity of 5.78 per cent, translating to 5.53 per cent after fees; and,

- the Kernel Cash Plus Fund had a running yield of 6.06 per cent after fees as at the end of September.

Thinking about the combination of PIE tax benefits, administration simplicity, competitive returns, and ease of access to my money compared to bank-based term deposit alternatives, the final decision for me was a no-brainer.

I selected two managed cash PIE funds (for diversification purposes) and then moved on to worrying about more important things in life.

Of course, different people will have different investment requirements and marginal tax rates, so what might work for me might not be right for others. People should read the disclosure material before investing in any financial product and seek independent financial advice if they need it.” – Anthony Edmonds, InvestNow Founder.

The information and opinions in this publication are based on sources that InvestNow believes are reliable and accurate. InvestNow makes no representations or warranties of any kind as to the accuracy or completeness of the information contained in this publication and disclaim liability for any loss, damage, cost or expense that may arise from any reliance on the information or any opinions, conclusions or recommendations contained in it, whether that loss or damage is caused by any fault or negligence on the part of InvestNow, or otherwise, except for any statutory liability which cannot be excluded. All opinions reflect InvestNow’s judgment on the date of this publication and are subject to change without notice. This disclaimer extends to any entity that may distribute this publication. The information in this publication is not intended to be financial advice for the purposes of the Financial Markets Conduct Act 2013, as amended by the Financial Services Legislation Amendment Act 2019. In particular, in preparing this document, InvestNow did not take into account the investment objectives, financial situation and particular needs of any particular person. Professional investment advice from an appropriately qualified adviser should be taken before making any investment.

Thoughts on short-term money storage options: Why managed cash PIE funds are a no-brainer for Anthony Edmonds

Article written by InvestNow – 22 November 2023

Investors need to think carefully about the best place to park their lazy money as interest rates rise well above neutral and drive up nominal returns for cash.

We asked InvestNow founder, Anthony Edmonds, to explain his journey to managed cash PIE funds, as his preferred solution to getting the best value from his lazy cash.

“Earlier this year I was pondering what do to with a little spare cash that was earmarked for spending some time over the next two years.

I don’t know the exact date when we’ll need the money but thought it prudent to ‘match my liability’ with a short-term investment while looking to make the most of the high rates currently on offer.

Historically, the go-to option in such a situation is to park the money in an interest-bearing on-call bank account, trading off lower rates (compared to term deposits) for instant access.

As at the end of October, the best on-call rate I could find on the www.interest.co.nz website stood at 4.7 per cent per annum – better than nothing, but still significantly below the official cash rate (OCR) of 5.5 per cent set by the Reserve Bank of NZ.

Offering something closer to the OCR, I spotted a bank with a 5.25 per cent per annum sticker rate of return for a so-called ‘notice saver account’, which lifted the bar in exchange for a 32-day withdrawal period.

The 32-day ‘liquidity’ trade-off was a bit of a turn-off. And the deal would also require me to suffer the painful admin process of opening an account with a bank I’m not a customer of. (Not to mention the question of whether the bank offering the highest short-term might need my money more than most!)

Finally, I toyed with pushing the liquidity boat out a bit further by investing in a three-month term deposit with my current bank, or possibly a portfolio of different term deposits selected from the six bank products available on InvestNow.

But given the fact I might need the cash at any time over the next couple of years, the prospect of incurring substantial break fees on bank term deposits, plus significant potential delays before I received my money, ruled this option out for me.

Term deposits also come with certain administrative hassles such as reinvesting cash as the investment matures as well as end-of-year tax-reporting duties.

Most importantly, however, all the bank-based solutions I considered came with a hefty 39 per cent tax rate: interest is typically taxed at investors’ marginal tax rate.

This is why I next explored the growing number of managed cash portfolio investment entity (PIE) funds now on offer in the NZ market, including the likes of the Mercer Macquarie NZ Cash Fund, Milford Cash Fund, Smartshares NZ Cash ETF, and Kernel Cash Plus Fund.

Each of these funds invests in a diversified portfolio of short-term fixed interest securities, typically with an average maturity of less than six months.

I weighed up the benefits and features of the managed cash PIE funds as below:

- PIE funds carry a maximum tax rate (PIR) of 28 per cent, meaning investors on the 33 and 39 per cent marginal rates gain a material benefit. In my case, for example, a pre-tax and after-fees return of 5.5 per cent per annum would equate to 3.36 per cent per annum after tax compared to 3.96 per cent per annum at the PIR rate of 28 per cent;

- there are no restraints locking my money in for a long period or break fees for drawing down from cash PIE funds on request – the money would be accessible within two or three days, which fits perfectly with my requirements;

- I would have fewer administrative hassles in a PIE fund as all the investment activities such as selecting and managing securities and reinvesting on maturity is carried out by the fund. Fund managers and platforms like InvestNow also pay the PIE tax on my behalf with no end-of-year IRD reporting responsibilities for me either; and,

- finally, I compared the managed cash PIE funds in the NZ market against various metrics – as per the table below – based on data sourced from the Sorted ‘Smart Investor’ website.

Of course, unlike term deposits, managed cash PIE fund returns are not fixed at a certain rate over a particular period of time, but fluctuate depending on a range of factors. In general, however, my analysis shows that cash PIE fund returns tend to stay in line with NZ wholesale money market indicators such as the OCR.

To understand the current potential returns available from the four managed cash PIE funds in my table, I looked at their respective ‘yield-to-maturity’ reports rather than historical performance figures (that reflect past interest rate environments).

Yield-to-maturity (also known as a ‘running yield’) measures the income available from the portfolio of fund assets if all securities are held until they mature.

Remembering the current OCR sits at 5.5 per cent, a couple of examples show managed cash PIE funds are staying on track of, or ahead of, the benchmark even after fees:

- the Mercer Macquarie Cash Fund reported a yield-to-maturity of 5.78 per cent, translating to 5.53 per cent after fees; and,

- the Kernel Cash Plus Fund had a running yield of 6.06 per cent after fees as at the end of September.

Thinking about the combination of PIE tax benefits, administration simplicity, competitive returns, and ease of access to my money compared to bank-based term deposit alternatives, the final decision for me was a no-brainer.

I selected two managed cash PIE funds (for diversification purposes) and then moved on to worrying about more important things in life.

Of course, different people will have different investment requirements and marginal tax rates, so what might work for me might not be right for others. People should read the disclosure material before investing in any financial product and seek independent financial advice if they need it.” – Anthony Edmonds, InvestNow Founder.