Three companies which define why we should invest in India

Three companies which define why we should invest in India

Article by India Avenue Investment Management

Investing in India can be considered mysterious, dangerous, risky and volatile. Investors who prefer clarity and transparency through well managed and governanced companies, generally stick to developed markets like the US, UK, Japan and the ASX 200 for us Australians.

However, perhaps some of the best performed businesses are domiciled in developing economy share markets such as India, China and Brazil. With strong economic growth being driven by fundamentals such as a young and aspiring population, a rich resource base or a comparative advantage, these economies create an ecosystem for thriving companies selling simple goods and services like cars, financial services, consumer goods and information technology solutions. Additionally, the need for infrastructure and economic development creates significant opportunity for businesses involved in areas like road construction, telecom enablers, railway networks and port operators.

These companies are yet to become a Nestle, McDonalds, Coca-Cola, IBM, Facebook, Amazon, WalMart, Pfizer or Apple yet. Their profit base is still at a low point (the Western consumer dwarves the Eastern consumer at this stage), but they are powered by the potential for a significant rise in wealth relative to a developed market ecosystem.

Take for example the case of India. The Government has a stated goal (in its recent budget) of achieving an economic size of US$5trillion by 2024. This will take India to 4th largest economy in the world, behind the US, China and Japan. Importantly, it will mean its GDP per capita will rise from US$2,100 to over $3,500 i.e. a 67% increase in wealth over 5 years. Additionally, the Government of India has stated the need for US$1.5trillion of infrastructure over the next 5 years. More roads, rail, ports, airports and urban infrastructure, which will create substantial opportunity for companies within the ecosystem.

Whilst investors in developed markets are looking for a new technology, the next all curing drug or a medium that gathers significant customers with the intent of future data, in markets like India it can be simple businesses growing tremendously from old-school aspiration and development. We explore three such companies below.

Titan Company

Titan Company is a consumer goods company which generates most of its revenue through the procurement of gold, manufacture and design and retailing of jewelry (93% of revenue). The company, a JV between the Tata Group and State Government, is also involved in manufacture and retailing of fashion watches and eyewear.

As the economy of India is becoming formalised through Government reforms like GST and Demonetisation, there is a huge push towards organised retailing rather than one store operators or those which have traditionally operated in the non-tax paying sector of the economy. This created the opportunity for chains as the aggregation of retailing occurs. Titan now has 4% market share of jewelry and its business is thriving through brand recognition.

The stock has generated an annualised return of 34% over the last 10 years. That’s a return of $190,328 on a $10,000 investment over just 10 years. That’s from something simple like selling jewelry, driven by fundamentals such as Indian’s love of gold and a transition to organised retailing as wealth increases and the need for authenticity rises.

Bajaj Finance

Bajaj Finance is a non-banking financial services company. The company deals in consumer finance, SME and commercial lending and wealth management. The company has close to 300 consumer branches and 500 rural locations, with over 33,000 distribution points.

The company has emerged from providing two-wheeler and three-wheeler vehicle loans to durables financing and business and property loans. As credit growth has flourished in India, this company has thrived through strong brand recognition, distribution points and quality management.

The stock has generated an annualised return of 66% over the last 10 years. That’s a return of $1,628,300 on a $10,000 investment over just 10 years.

This is from a simplistic business benefitting from a shift in a savings culture towards a credit culture for purchases (coming from a low base of only 10% household debt to GDP!).

KEI Industries

KEI Industries is a manufacturer and distributor of cable and wires for the electronics industry. Currently the company has an order book of the size of A$1bn and is winning strong orders in the EPC category. The end users for the product in India are the railway, consumer durables, construction, power and automotive sectors, all of which are thriving from the significant development of infrastructure in the country.

The company is relatively small at a market capitalization of A$700m, however its history illustrates its emergence in a growing industry in India which generates double digit EBITDA margins in a market growing at between 15- 20% per annum. Over time, KEI Industries will not only be able to thrive in markets like India, but also through exports to other regions through its comparative advantage.

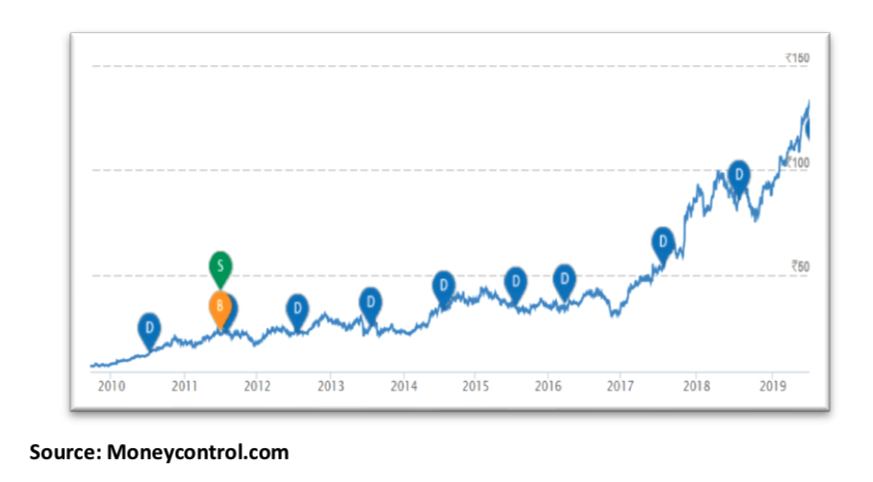

The stock has generated an annualised return of 33% over the last 10 years. That’s a return of $174,371 on a $10,000 investment over just 10 years.

This business is an ancillary business to manufacturing and infrastructure and illustrates India’s increasing capability for value-added manufacturing in the electronics industry.

India’s simple businesses, which we know are likely to thrive in an economy where GDP per Capita of US$2,100 rises substantially over the next decade, should generate significant profits. Investing in a portfolio of less discovered companies (i.e. perhaps finding the next Titan Company or Bajaj Finance) in such a market can create substantial gains for investors, if the appropriate primary research is undertaken to decipher the winners from the losers. That is critical!

The India Avenue Equity Fund owns all the companies mentioned in this article. Given their co-locations in Sydney, Australia and Mumbai, India as well as their partnerships with locally based stock and portfolio advisers, it places them in a strong position to identify these companies at an early stage. You can visit their website at www.indiaavenueinvest.com.

The views and opinions contained in this document are those of India Avenue Investment Management Australia Pty. Ltd. (IAIM) (ABN 38 604 095 954) & AFSL 478233. Equity Trustees Limited (Equity Trustees) (ABN 46 004 031 298) AFSL 240975, is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT), is the Responsible Entity of the India Avenue Equity Fund. This document has been prepared to provide you with general information only and does not take into account the investment objectives, financial situation or particular needs of any person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. IAIM does not express any view about the accuracy and completeness of information that is not prepared by IAIM and no liability is accepted for any errors it may contain. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the product disclosure statement before making a decision about whether to invest in this product. No part of this material may be copied, duplicated or redistributed without prior written permission of IAIM or Equity Trustees. The user will be held liable for any unauthorised reproduction or circulation of this document, which may give rise to legal proceedings. Information contained here is based on IAIM’s assumptions and can be changed without prior notice. It is not and may not be relied upon in any manner as legal, tax or investment advice or a recommendation or opinion in relation to an IAIM financial product or service, or any other financial product or service. Please consult your advisors, read the relevant offer document and consider whether the relevant financial product or service is appropriate for you before making any investment decision. Investment in securities involves risks and there is no assurance of returns or preservation of capital. Neither IAIM, Equity Trustees, nor any of its related parties, their directors, employees, agents or representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost capital, lost revenue or lost profits that may arise from or in connection with the use of this information.