Getting to know the new Foundation Series Funds

Original Article written by InvestNow – 1st December 2022, updated 16th January 2026

We’re pleased to welcome the Foundation Series US 500 Fund and the Foundation Series Total World Fund onto InvestNow. These two new funds offer some of the most cost-effective ways to access global shares for long-term investors in NZ.

7 great reasons to consider the new Foundation Series US 500 and Total World Funds:

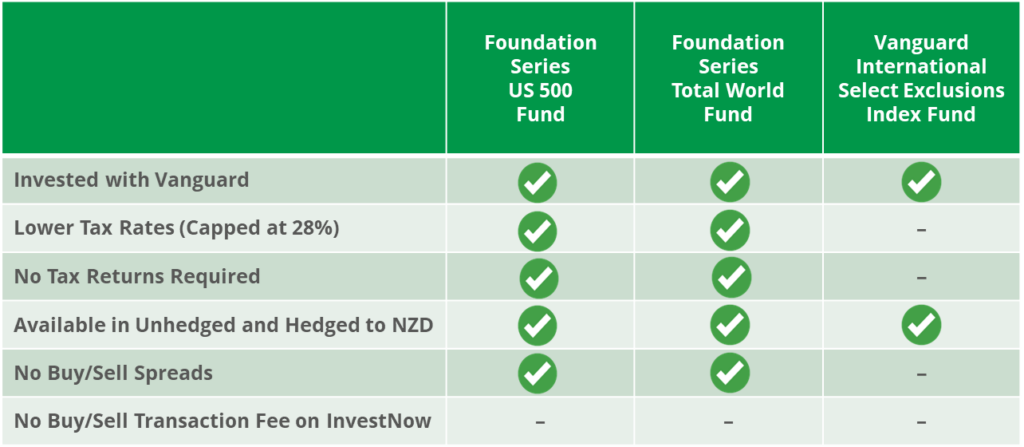

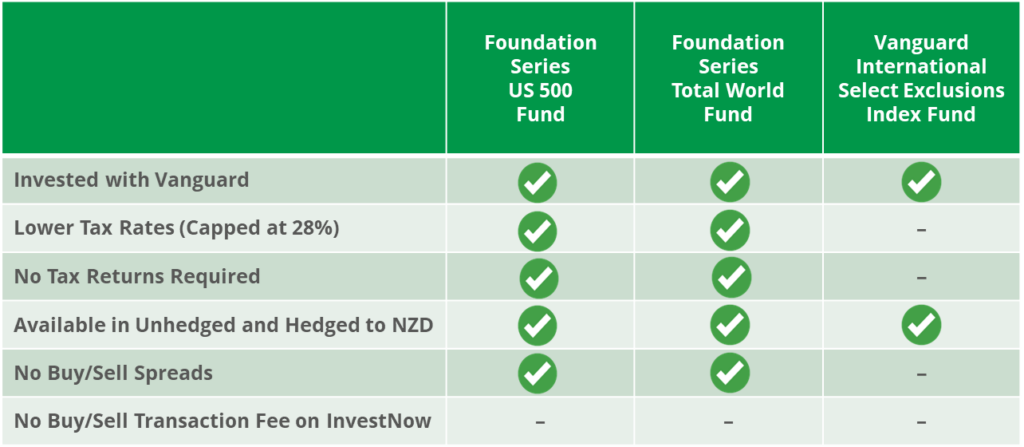

- Exposure to two of the world’s most popular ETFs – the Vanguard S&P 500 ETF (VOO) and the Vanguard Total World Stock ETF (VT), all within tax efficient New Zealand Portfolio Investment Entity (PIE) fund structures.

- Management fees of just 0.03% and 0.06% per annum respectively. In contrast, the management fee for the Vanguard International Shares Select Exclusions Index Fund is more than triple at 0.20% per annum.

- The funds are subject to 0.50% Buy/Sell Transaction Fees for all investments (Buy Transaction Fee) and redemptions (Sell Transaction Fee), but only on the amount transacted, which in conjunction with the low ongoing management fees can help optimise costs for long-term investors.

- Investor returns can be increased by up to 0.55% per annum as a result of the PIE tax benefits. As multi-rate PIE funds, tax is charged at a maximum rate of 28%. In comparison, where Kiwis invest in the Vanguard Australian unit trust (AUT) funds on InvestNow, they will be taxed at their marginal tax rate, which can be as high as 39%.

- PIE tax is a final tax, so no more administration hassles! There’s no need to prepare and file a tax return every year, which is the case when investing in the Vanguard Australian unit trust funds available on InvestNow.

- No additional foreign exchange costs. The funds are priced in NZ dollars and all transaction costs are covered by the funds’ 0.50% Buy/Sell Transaction Fees.

- Tax slippage is minimal as there is no additional non-resident withholding tax deducted on any of the underlying company dividends earned by the Foundation Series US 500 Fund and on 60% of the company dividends received by the Foundation Series Total World Fund. In contrast, for the Vanguard International Shares Select Exclusions Index Fund, non-resident withholding tax is fully deducted at 15% on all the company dividends received, resulting in tax slippage that reduces returns by around 0.30% per annum (assuming a 2% annual dividend yield on the 15% non-resident withholding tax on dividends that are all lost due to the AUT structure)

For more information on the impact of tax on investment returns, here is an excellent article that delves deeper into the benefits of utilising tax-efficient solutions such as the new offerings from the Foundation Series Funds for your global shares exposure and how this could result in better financial outcomes for investors.

Optimise your long-term investment portfolio costs and invest in Vanguard’s expertise through the new Foundation Series US 500 Fund and Foundation Series Total World Fund.

The issuer and manager of the Foundation Series Funds is FundRock NZ Limited.

You can download and view the PDS for both of these funds here.

The Foundation Series US 500 Fund and the Foundation Series Total World Fund are available today to all investors via the InvestNow platform. Login or create an account to invest.

Disclaimer: InvestNow is not a financial advisor and therefore we do not offer or provide personalised advice or recommendations. All investing involves risk. We encourage you to read the Product Disclosure Statement (PDS) of any prospective funds and consider seeking financial advice from a licenced provider, before making any investment decisions in any of the products offered on the InvestNow platform. Furthermore, any material relating to tax has been prepared for informational purposes only and is not formal tax advice, nor has it taken into account your individual tax circumstances.

Getting to know the new Foundation Series Funds

Article written by InvestNow – 1st December 2022

We’re pleased to welcome the Foundation Series US 500 Fund and the Foundation Series Total World Fund onto InvestNow. These two new global shares funds feature some of the lowest management fees of any PIE fund in NZ.

7 great reasons to consider the new Foundation Series US 500 and Total World Funds:

- Incredibly low on-going management fees of just 0.03% and 0.07% per annum respectively. In contrast, the management fee for the Vanguard International Shares Select Exclusions Index Fund is more than double at 0.20% per annum.

- Exposure to two of the world’s most popular ETFs - the Vanguard 500 Index Fund ETF (VOO) and the Vanguard Total World Stock ETF (VT), all within tax efficient New Zealand Portfolio Investment Entity (PIE) fund structures.

- Investors pay one-off transaction fees for each buy order (entry fee) and each sell order (exit fee), allowing these two funds to offer super-low ongoing management fees, which is ideal for long-term investors.

- Investor returns can be increased by up to 0.55% per annum as a result of the PIE tax benefits. As multi-rate PIE funds, tax is charged at a maximum rate of 28%. In comparison, where Kiwis invest in the Vanguard Australian unit trust funds on InvestNow, they will be taxed at their marginal tax rate, which can be as high as 39%.

- PIE tax is a final tax, so no more administration hassles! There’s no need to prepare and file a tax return every year, which is the case when investing in the Vanguard Australian unit trusts available on InvestNow.

- No additional foreign exchange costs. The funds are priced in NZ dollars and all transaction costs are covered by the funds’ entry/exit fees.

- Tax slippage is minimised as there is no additional non-resident withholding tax deducted on any of the underlying company dividends earned by the Foundation Series US 500 Fund and on 60% of the company dividends received by the Foundation Series Total World Fund. In contrast, for the Vanguard International Shares Select Exclusions Index Fund, non-resident withholding tax is fully deducted at 15% on all the company dividends received, resulting in tax slippage that reduces returns by around 0.30% per annum.

For more information on the impact of tax on investment returns, here is an excellent article that delves deeper into the benefits of utilising tax-efficient solutions such as the new Foundation Series Funds for your global shares exposure and how this could result in better financial outcomes for investors.

Pay lower management fees and less tax today by investing in Vanguard’s expertise through the new Foundation Series US 500 Fund and Foundation Series Total World Fund.

The issuer and manager of the Foundation Series Funds is Implemented Investment Solutions Limited.

You can download and view the PDS for both of these funds here.

The Foundation Series US 500 Fund and the Foundation Series Total World Fund are available today to all investors via the InvestNow platform. Login or create an account to invest.

Disclaimer: InvestNow is not a financial advisor and therefore we do not offer or provide personalised advice or recommendations. All investing involves risk. We encourage you to read the Product Disclosure Statement (PDS) of any prospective funds and consider seeking financial advice from a licenced provider, before making any investment decisions in any of the products offered on the InvestNow platform. Furthermore, any material relating to tax has been prepared for informational purposes only and is not formal tax advice, nor has it taken into account your individual tax circumstances.

Hedged in NZ dollars?

Hi

Firstly, apologies for my tardiness in responding to your questions. There is no current hedging in these two new Foundation Series funds.

Regards, Mike Heath

GM InvestNow

Are dividends automatically reinvested at the cost of 0.5% for US500 and Total World funds?

Thanks Jay, great question.

Any distributions/dividends generated by the underlying ETFs are automatically reinvested for InvestNow customers and do not incur any transaction fee.

Does that answer your question?

Regards Mike Heath

GM InvestNow

Awesome, thank you! Another question, I can’t see anything about the distribution frequency for the foundation funds. Does that mean the dividends received from these funds are never seen and are just reflected in the holdings?

Thanks Jay. Yes that’s correct, the dividends/distribution are automatically reinvested into your holdings.

Regards, Mike Heath

GM InvestNow

Could you please clarify, if I invest in TWF for 5 years and sell after that period, do I have to pay a 28% tax on my gains?

Hi Harry. Firstly, apologies for being so tardy in responding to your question (a technical issue resulted in us not being alerted to comments having been posted by customers on our website).

PIE tax is not directly related to the change in value of the fund, nor the distributions paid by the fund. PIE funds attributes its income/loss from its investments, expenses and tax credits across each day in the year. The net taxable income and tax credits are divided up among all of the units of the fund, and a share of the income and credits is attributed to everyone investing in the fund. PIE tax is then calculated based on each investors’ PIR.

When investing into foreign investments through a PIE fund (such as the Foundation Series Total World Fund), investors are deemed to have earned a taxable return of 5% each year, which is taxed at your PIR rate. If your PIR rate is 28%, then your tax obligations for the Total World Fund is 5% x 28% = 1.40% of the value of the fund each year.

This 1.40% PIE tax charge applies irrespective of whether the underlying Total World Fund returned more than 5% or less than 5% in any one year, you will only ever be deemed to have returned 5% in any one year. This 1.40% PIE tax charge is automatically deducted for you (reflected in the unit price of the fund) so when you eventually sell your Total World Fund holdings there is no additional tax you need to pay.

Regards, Tom Ayling, Head of Customer Services InvestNow

Am I right in thinking, in the unlikelihood of a five year bad run with say zero return, my fund would still lose [0.986^5=0.93] 7% to taxes? Even though I made zero gains?

Hi John,

Yes, that is right you get charged tax in PIE funds based off a 5% deemed rate of return irrespective of the actual return of the fund.

So even if you returned +20%, 0% or -10%, then the tax calculation is 5% taxable return x 28% PIR = 1.40% tax charged, compounded over 5 years is roughly 7% in tax charges.

Cheers

Jason Choy

Senior Portfolio Manager – InvestNow

Does the dividends count towards the 50k limit for FIF?

Hi Trish. Firstly, apologies for being so tardy in responding to your question (a technical issue resulted in us not being alerted to comments having been posted by customers on our website).

When you invest in the Foundation Series US 500 and Total World Funds, you do not have any FIF tax obligations as an individual investor. Both funds are a multi-rate PIE funds, with any tax obligation calculated using your Prescribed Investor Rate (PIR) and paid to the IRD on your behalf.

If you are investing in the Vanguard International Shares Select Exclusions Index Fund or Vanguard International Shares Select Exclusions Index Fund (NZD Hedged), if you elect to have your dividends reinvested, they will count towards your $50K threshold. If you have the dividends paid as cash, they will not count.

Regards, Tom Ayling, Head of Customer Services InvestNow

Kia ora, the PDS mentions

“Your investment in a Fund can be sold but there is no established market for trading these financial products.

This means that you may not be able to find a buyer for your investment.”

Can you provide a view on what that means in practice, considering likely and unlikely (incl. worst case) scenarios?

Hi Hendo

Can you please confirm which PDS you are referring to.

Thanks

Mike Heath

GENERAL MANAGER

InvestNow

Sorry, both the TWF and the S&P500

(in the summary section under “How can you get your money out?”)

Hendo

Every day our customers transact millions of dollars of buy and sell orders for the funds we offer, including the two you are referencing, with those orders then being sent to the respective managers for fulfilment. As it’s states in the PDS, the fund manager can decline to execute a sell order, if they felt it could be “impracticable or materially prejudicial”, however we have not seen this happen to date on InvestNow. The exception to this has been where a manager is facilitating an already communicated/disclosed closure of a fund (when this has been the case, the unit holders are communicated to directly in advance about such an event).

I trust this answers your question.

Regards

Mike Heath

GM, INVESTNOW

I have been invested in Foundation US500 for a year. I didn’t notice that there was dividend reinvest activities. While the Vanguard SP500 ETF has distributed dividend for multiple times in this period. I was wondering when will the Foundation US500 reinvest these dividend?

Hi Max, thanks for your question.

Please note that the Foundation Series US 500 Fund automatically reinvests all dividends back into the fund as soon as they are received. So you haven’t missed out on any dividends that the Vanguard S&P 500 ETF has distributed, as they have simply been reinvested into more units of the Foundation Series Fund for you. This means that economically you are not any better or worse off than had the dividends been distributed as cash, as the value of your fund holdings have simply increased by the value of the dividend.

Cheers

Jason Choy

Senior Portfolio Manager – InvestNow

How do we see the value of reinvested dividends?

Hi Michelle, the value of the reinvested dividends is reflected in unit price of the fund or the value of your holdings, which will increase when a dividend is paid. If you want to know the dividend that has been paid out, then you will want to look up the dividend payment schedule of the underlying ETF or index, such as: https://investor.vanguard.com/investment-products/etfs/profile/voo#distributions

Is the foundation us500 subject to fif?

Hi Zack, yes all foreign investment holdings (such as the Vanguard S&P 500 ETF) are subject to FIF tax, whether these foreign investments are held directly by an individual investor or if a fund held them.

A key difference however between a Kiwi investing directly into the Vanguard S&P 500 ETF is that the individual investor would need to calculate their FIF tax obligations themselves and pay FIF tax at their marginal income tax rate of up to 39%. Meanwhile, if the investor were to invest into the Foundation Series US 500 Fund (which invests into the same Vanguard S&P 500 ETF), the Foundation Series Fund itself would calculate investor’s FIF tax obligation on their behalf, as well as pay any FIF tax owing automatically, at a capped tax rate of just 28%.

I am interested in increasing my InvestNow holdings but would like you to clarify a couple of issues.

1) Are all of your investment products PIE Funds?

2)With regard to FIF, because my current holdings have to in a company, I have no option but to calculate my FIF by using the FDR method. However, my husband has his investments in his own name and therefore has the option to use whichever method is more favourable. Therefore the question is whether, assuming these new investments can be held in my own name, would that give me the same choice of FIF method that my husband enjoys?

3) Are any of your investment products actually exempt from the FIF regime?

Hi Mila

In answer to your questions …

1) Are all of your investment products PIE Funds?

All of the Foundation Series Funds investment options are structured as PIE Funds. The vast majority of the other investment options on the InvestNow Platform are also structured as PIE Funds, with the exception of a handful of Australian Unit Trusts (AUT). You can see which funds are structured as AUTs here by filtering by ‘Fund Type’: InvestNow | Managed Funds | Range of Managed Funds.

2) With regard to FIF, because my current holdings have to in a company, I have no option but to calculate my FIF by using the FDR method. However, my husband has his investments in his own name and therefore has the option to use whichever method is more favourable. Therefore the question is whether, assuming these new investments can be held in my own name, would that give me the same choice of FIF method that my husband enjoys?

If you were to invest into the Foundation Series Funds (or any other international shares PIE Fund) then tax on international shares must be calculated using the FDR method. There is no choice on the international shares taxation method when investing via PIE Funds. If you were to invest in your own name into non-PIE options, then you can choose your FIF taxation method. However, you’d also need to calculate your own FIF tax obligations and file your own tax returns, and pay this at your marginal tax rate of up to 39%, versus the capped 28% tax rate of PIE Funds, which also handle all tax obligations on your behalf.

3) Are any of your investment products actually exempt from the FIF regime?

Funds that invest into local assets only not be subject to the FIF regime, as the FIF regime applies to international assets only.

Regards

Jason Choy

SENIOR PORRTFOLIO MANAGER, INVESTNOW

1. Am I able to buy a combination of funds from different Foundation Units e.g. Core Equity #1 both US 500 and WTF but also Core Equity and Core Equity Funds #2 but just US Dividend

Equity Fund?

And still get the benefit of the PIR for each fund?

2. Would I be charged the standard 0.5% fee. for each fund? Each time if I purchased them regularly.

3. Is there any real difference cost/fee wise between regular contribution or doing one off random payment other than the later minimum of $250NZD per fund?

4. If after 10-20 years rather than re-investing and I decide to change to have the dividends paid out to me rather than re-invested. Would I be charged the 0.5% fee each time the distributions are paid out?

Good morning

Please find answers to your questions below:

1. Am I able to buy a combination of funds from different Foundation Units e.g. Core Equity #1 both US 500 and WTF but also Core Equity and Core Equity Funds #2 but just US Dividend

Equity Fund?

[MIKE] When you invest, you are investing in individual funds each time, so the answer is yes – you raise individual orders/amounts for each fund you wish to add to your portfolio.

And still get the benefit of the PIR for each fund?

[MIKE] The PIR (Prescribed Investor Rate) is your personal PIE tax rate, and is not an attribute/feature of a fund. It applies to all PIE funds you invest and is applied when those funds generate taxable income for you e.g. a distribution/dividend.

2. Would I be charged the standard 0.5% fee. for each fund? Each time if I purchased them regularly.

[MIKE]. The 0.50% transaction fee applies each time you buy or sell any units in the funds where this fee applies ie those in the Foundation Series Scheme that only invest in equities. For example the Foundation Series Total World Fund, Foundation Series Nasdaq 100 Fund.

3. Is there any real difference cost/fee wise between regular contribution or doing one off random payment other than the later minimum of $250NZD per fund?

[MIKE]. All costs/fees are the same, irrespective of whether you are buying a fund as a one-off investment or as part of your Regular Investment Plan.

4. If after 10-20 years rather than re-investing and I decide to change to have the dividends paid out to me rather than re-invested. Would I be charged the 0.5% fee each time the distributions are paid out?

[MIKE]. The transaction fee only applies when you buy or sell units, for those funds that have such a fee. The other “cost” to consider would be any tax you have to pay on any such distributions. If the distribution is from a PIE fund, we handle the tax payment at the time the distribution is made ie you receive the net of tax amount.

I trust the above answers your questions. Feel free to contact our team on 0800499466 with regards to these or any other questions.

Regards

Mike Heath

GENERAL MANAGER

InvestNow