How to get your assets into gear for retirement

Investing success – It’s all about strategy.

With an aging population and the arguable sustainability of NZ super, saving for retirement is moving from a ‘nice-to-have’ to a ‘must-have’, which of course is a massive source of long-term anxiety and a big driving factor among Kiwi investors.

Whether you’re investing for retirement or for some other purpose, designing fit-for-purpose investment portfolios remains one of the most challenging tasks facing DIY investors.

Investors need structuring principles to guide product choices within their portfolios and influence their investment strategy; Because, as they say – fail to plan, plan to fail.

In fact, the portfolio construction task should invariably begin with setting investment goals and objectives, taking into account factors like your current financial resources, investment time-frame, and tolerance for risk. The ultimate purpose for any investment will determine the next steps, of which the first, and most important, is ‘asset allocation’.

Asset allocation – ‘Income’ & ‘growth’

At it’s most simple, asset allocation describes the split between two investment types – ‘growth’ and ‘income’. In short, ‘growth’ is a proxy for things like shares and property, while ‘income’ refers to fixed interest and cash-like investments.

Over the long-term, growth assets, like shares, historically deliver higher total returns than fixed income assets, like cash investments, but come with a higher risk of short-term losses.

The long-term return characteristics of the two investment types reflect the fundamental difference between them. Typically, ‘growth’ investments deliver investors the right to share in any price growth and dividends a company produces; and ‘income’ investments represent a promise to pay a set rate of interest to the investor.

While in practice the division between and within the different investment types is more complex, the ‘growth’/’income’ mix remains the core risk-return decision involved in asset allocation.

‘OK, so how do I find out what mix of ‘growth ‘and ‘income’ is right for me?’

Well, I’m glad you asked. This is key to even the most-seasoned investor, regardless of the purpose you are investing for. It’s also not a ‘set and forget’ task as you should regularly review your asset allocation, making sure it’s aligned to your current objectives and circumstances.

Your risk-tolerance and length of time you want to invest will largely tell you what kind of ‘growth’/’income’ mix is right for you. Generally speaking, the nearer an investor gets to retirement, when they need to access their investment capital, the higher they may want their weighting to be towards income investment types.

An easy way to determine your mix is by using the Sorted ‘Investor Kickstarter’ calculator. The calculator will categorise you as a certain ‘investor type’ which will then provide a percentage-based mix of asset classes appropriate for your ‘investor type’.

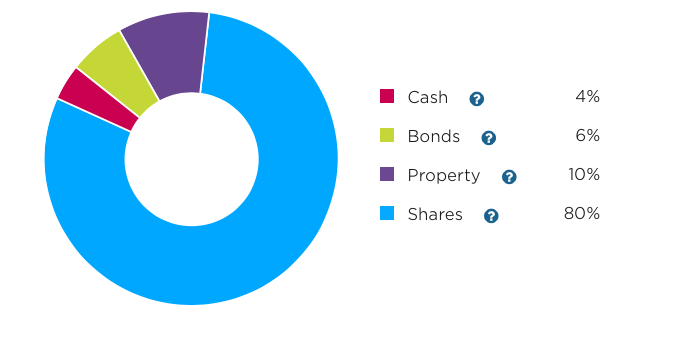

Example:

**Example is of an ‘Aggressive’ investor asset mix.

Below is a breakdown of the specific fund types that InvestNow offer to investors, linking them to the Sorted result categories:

- Cash (Income)

- Bonds (Income)

- Property (Income & Growth)

- Shares (Growth)

In addition, InvestNow also offers two other fund types that sit nicely in the middle-ground of ‘Income & Growth’ alongside Property. These fund types are:

Things to remember..

- Determine your asset allocation specific to your requirements.

- The older you get, the less risk you may want to expose yourself to – increase your weighting to ‘income’ investments.

- If you’re not sure where to start, use the Sorted calculator, our LikeMe tool to see how other InvestNow customers, like you, have constructed their portfolios. If after that, you’re still unsure, seek financial advice from a professional.