InvestNow Market Wrap-Up: July 2023

Written by Jason Choy, InvestNow Senior Portfolio Manager

Welcome to the July edition of the InvestNow Market Wrap-Up.

Financial markets can often be unnecessarily noisy and complicated – with so many headlines clamouring for our attention, it’s hard to keep up with what’s actually relevant to each of our investing journeys.

Well, InvestNow’s here to help! Each month we’ll distill everything you need to know in the wide world of investments into digestible bites curated for the Kiwi investor. At InvestNow, we think an important guiding principle of being a successful investor is to stay informed, but avoid the noise. So, make sure you keep abreast of what is happening in markets, but resist the urge to change your long-term strategy in response to market volatility and noise.

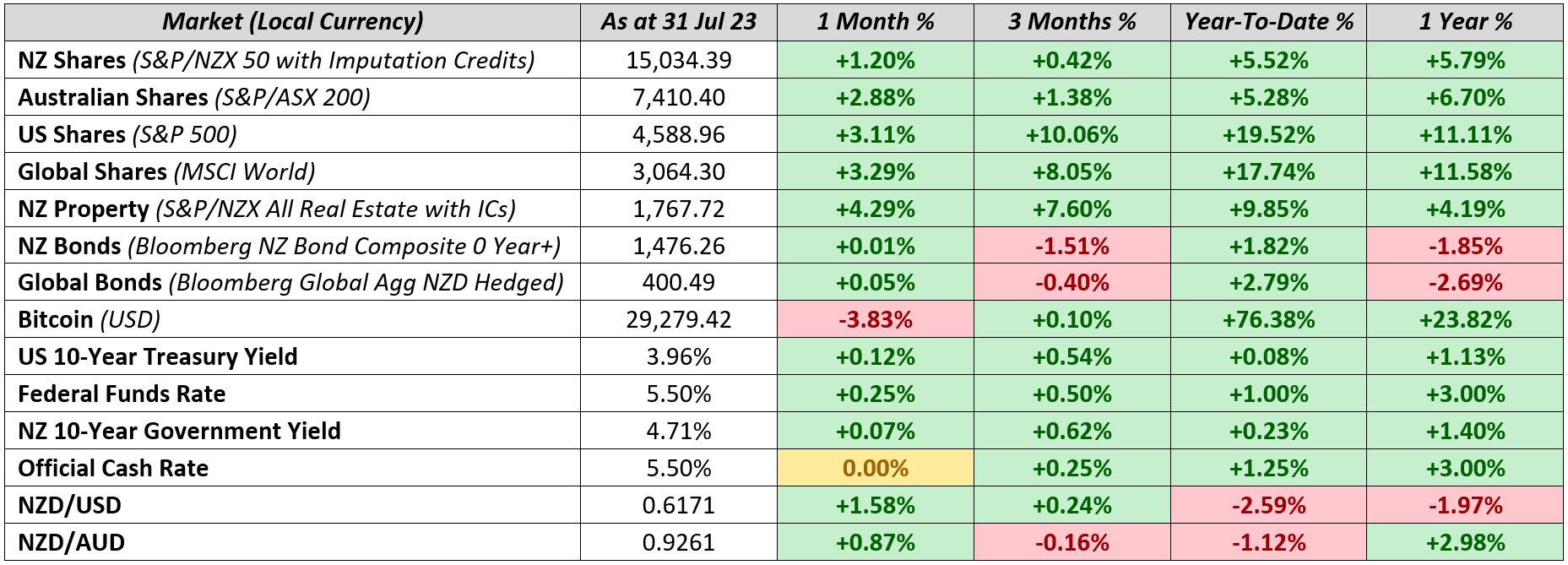

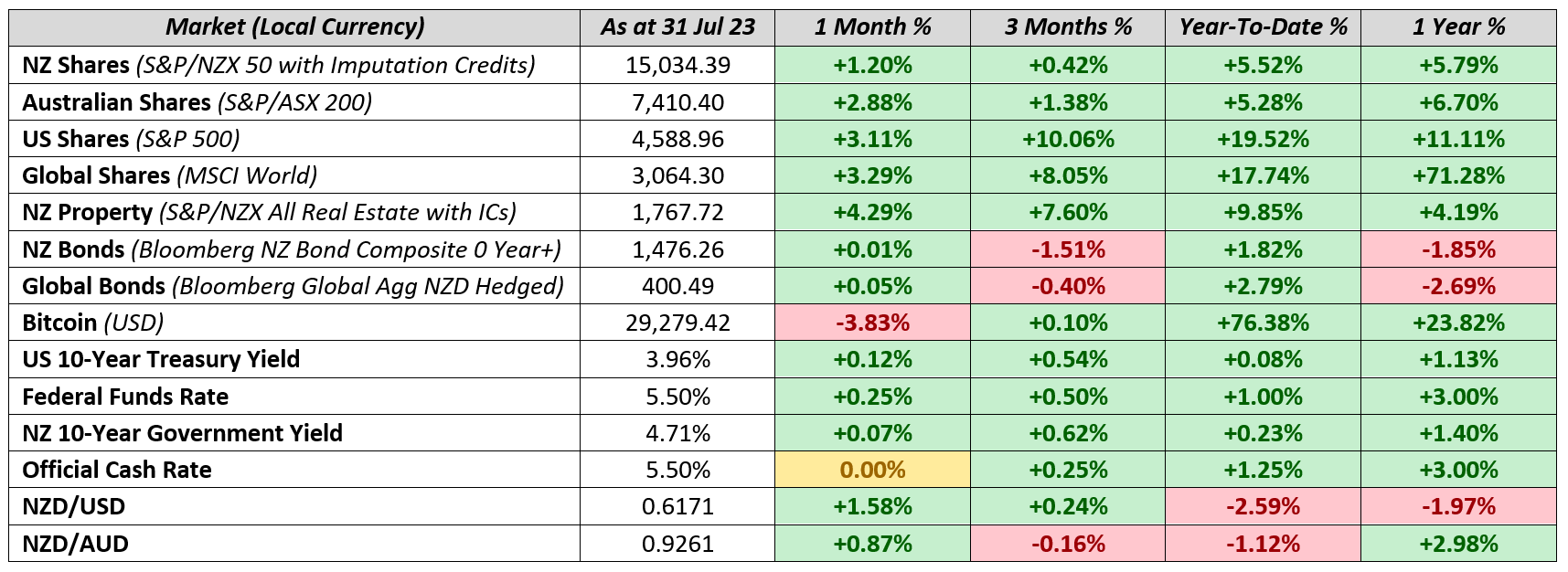

Market Dashboard

Global Markets Summary: July 2023

Another strong month for global share markets: Equity markets rallied once again in July as investors embraced easing inflation figures, a reduction in peak interest rate concerns, and robust economic activity worldwide. Developed markets delivered a solid 3.3% over the month as measured by the MSCI World Index, but it was emerging markets that stole the show, with the MSCI Emerging Markets Index up 6.3% in July alone, bringing its year-to-date return to 11%.

A soft landing in US markets? The US Federal Reserve raised interest rates by another 0.25% in July to match New Zealand’s rate at 5.50% (a 22-year high for the US). Markets expect this latest interest rate hike to be the Fed’s last this cycle, following the latest US Consumer Price Index (CPI) reading coming in at 3% year-on-year (from 4% previously). With inflation just 1% above the Fed’s target, and resilient Q2 GDP growth of 2.4% (versus forecasts of 1.8%), there is increasing optimism that the Fed has orchestrated a so-called ‘soft landing’ for the economy, where inflation cools without triggering a recession. Overall, this saw the S&P 500 Index rise a healthy 3.1% in July, taking the year-to-date returns to around 20%.

A similar central bank narrative in other global markets: The European Central Bank (ECB) increased rates by 0.25% to 3.75% in line with market expectations, with ECB president Christine Lagarde giving a decisive maybe to the possibility of a pause in September following Eurozone inflation easing to an estimated 5.3%. Meanwhile, the UK saw its first inflation surprise in a year, softening more than expected to 7.9%, leading to positive gains in the region. Over in Asian markets, despite starting the month hitting a 33-year high, Japanese equities underperformed developed markets as local inflation remains strong, while share prices in China were sharply higher after Beijing signalled economic support towards the real estate sector.

Global bond markets still seeking momentum: Global government bonds delivered negative returns overall in July, although yields at the shorter end of the curve (i.e. those that will mature sooner) trended lower due to clearer signs that interest rate hikes are easing. The bellwether US 10-Year Treasury Yield continued a gradual move upwards, increasing 12 bps to 3.96%, while the UK bucked the trend, with the UK 10-Year yield dropping to 4.31% as investors scaled back their rate expectations. Overall, this saw the Bloomberg Global Aggregate Bond Index (hedged to NZD) increase slightly by 0.05% over the month.

Key Updates for the Kiwi Investor

New Zealand share markets remain resilient in July: The S&P/NZX 50 advanced 1.2% over the month off the back of easing inflation that has retreated to 6% year-on-year. Despite the welcome drop from the previous quarter’s 6.7% inflation reading, prices are overall still increasing, with certain pockets of spending continuing to alarm everyday Kiwis – including a staggering 12.5% annual increase in food costs.

Local bond markets struggle to find direction: The Bloomberg NZ Bond Composite 0+ Year Index was effectively flat in July, returning 0.01% as the Reserve Bank of New Zealand (RBNZ) held the Official Cash Rate at 5.50% over the month – as expected by most economists. This saw the New Zealand 10-Year Government Bond yield increasing slightly by 7 bps to 4.71%, with the yield curve still remaining inverted.

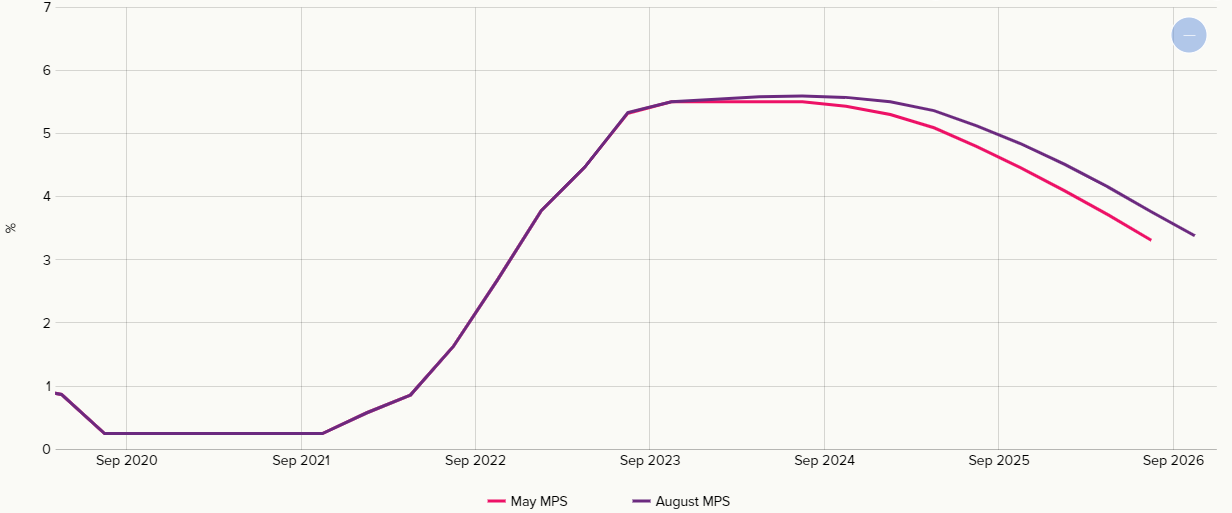

Has New Zealand reached peak interest rates? The RBNZ remains content that it has delivered sufficient policy tightening to keep the OCR at 5.50% going forward. However, tight monetary policy could still be in the process of delivering its peak impact, as despite no change in the OCR, 1- and 2-year mortgage rates have pushed 0.30% higher in the past month to levels around 7%. This is relevant for many Kiwis, with 50% of borrowers scheduled to refix at these higher rates in the next year, many will be gravitating towards the slightly lower rates offered by the longer (e.g. 3 to 5 year) tenors just to make ends meet.

But will interest rates come down soon? The flipside of Kiwis refixing at the slightly lower rates offered in the 3-to-5-year tenors means potentially paying higher interest rates for longer, should the OCR decrease soon. More household income tied up in hefty mortgage payments could mean a sustained period of below-trend economic growth as households tighten up their belt buckles and reduce spending elsewhere. A material reduction in economic activity in a short timeframe could lead the RBNZ to cut interest rates sooner than the current first half of 2025 timeline forecasted, in order to spur growth.

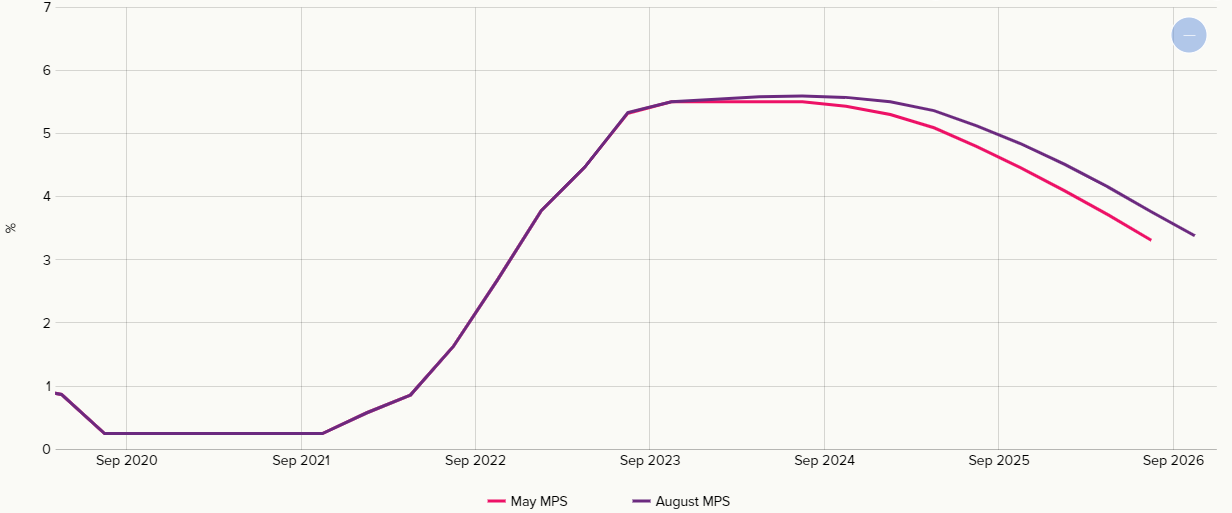

Reserve Bank of New Zealand’s Latest OCR Projections

Some fund managers foresee the potential for interest rate cuts as early as the first half of 2024, however, note that nobody has a 100% accurate crystal ball into the future, and these projections are also contingent on economic conditions remaining in trend, which is never guaranteed. Nevertheless, it may be worth Kiwis being a little more wary of refixing themselves into 3+ years of today’s higher mortgage rates if OCR cuts do materialise sooner rather than later.

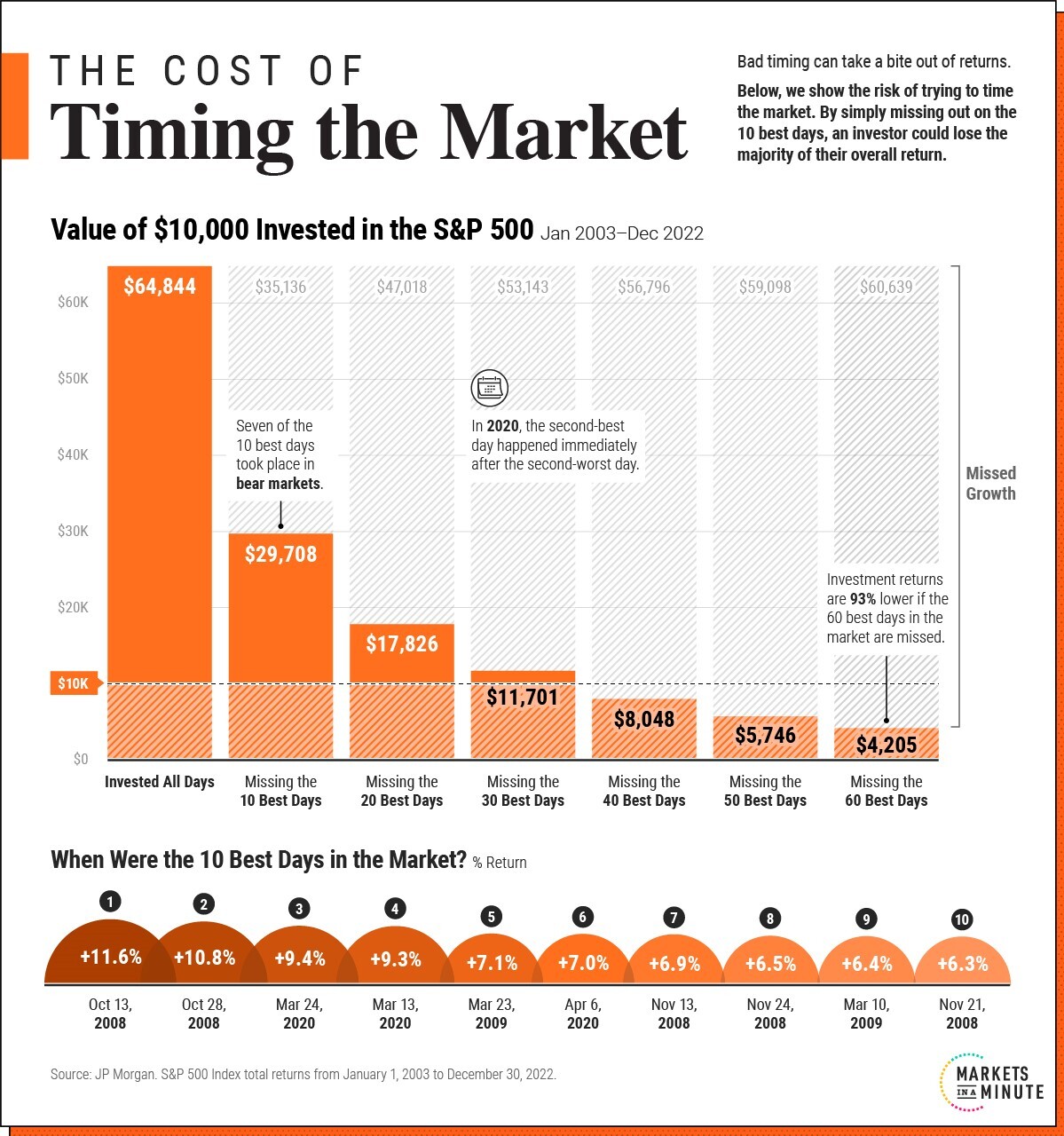

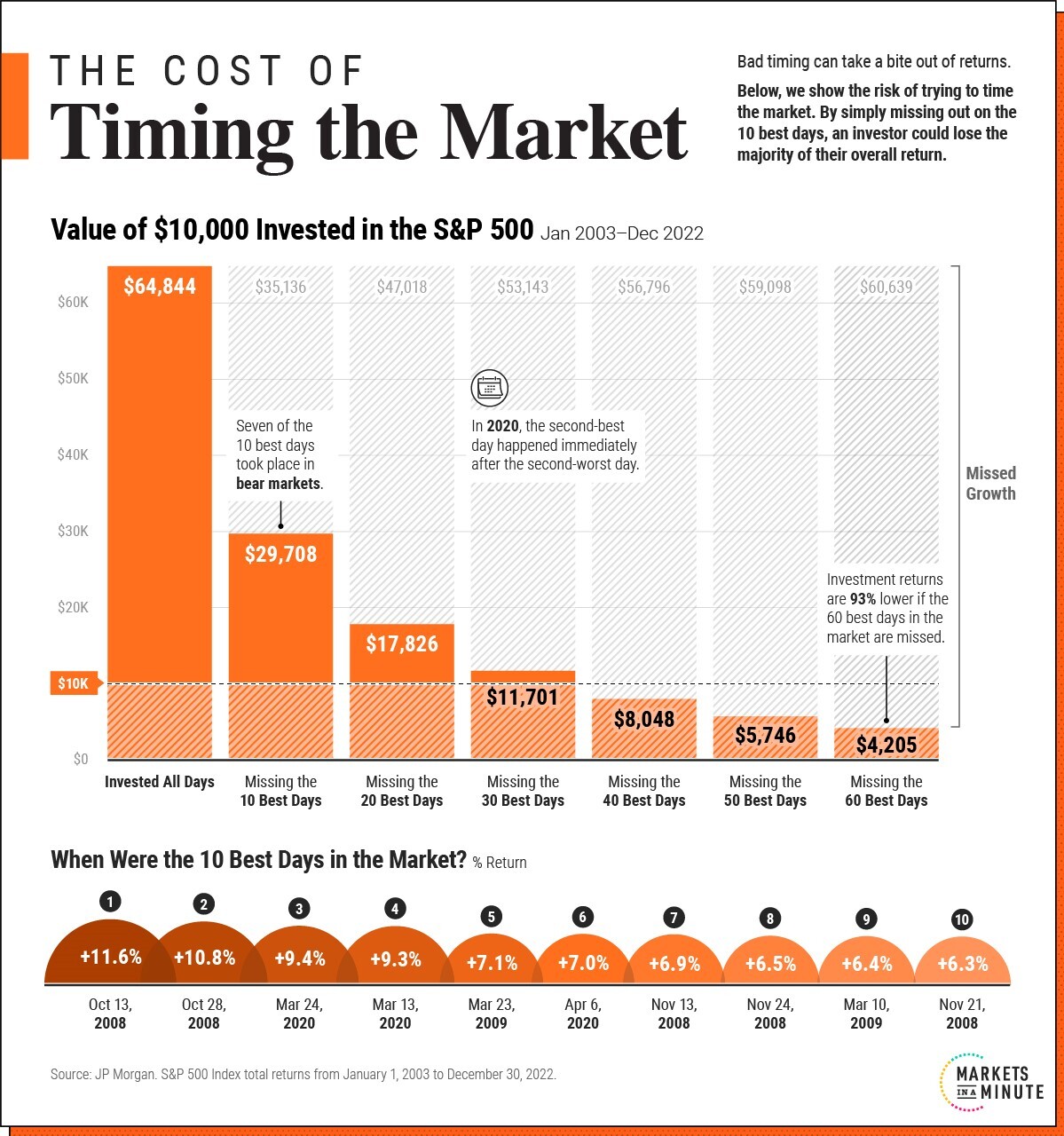

Chart of the Month

Our Chart of the Month is from Visual Capitalist with data from JP Morgan, which outlines the portfolio returns of $10,000 fully invested in the S&P 500 over the last 20 years, versus the drastic portfolio impacts of trying to time the market and not being invested for just a handful of days.

A buy-and-hold investor achieves a 9.8% annual return for 20 years, or more than 6x their investment of $10,000 by simply remaining invested. While an investor that tries to time the market and misses out on just the 10 best trading days in the 20– year period would more than halve their returns, generating a 5.6% annual return or only 3x their money.

Missing out on more than the best 30 days would result in a negatively performing portfolio, with missing out on just the 60 best trading days resulting in a -4.2% annual return, or a portfolio that is 93% worse off than being fully invested.

This illustrates the difficulties and potential disastrous consequences of attempting to time the market: during periods of market volatility, a natural emotion of many investors is to ‘take control’ by selling out of the market and getting back into the market later on. This action of ‘timing’ the market is extremely risky as it can often result in missing out on some of the best days of performance.

Particularly given some of the best days can often happen in some of the worst markets, for example:

- The 10 best days occurred during highly distressed markets (e.g. Global Financial Crisis and Covid)

- 7 of the 10 best days occurred within two weeks of the 10 worst days

- 6 of the 7 best days occurred after the worst days

- The second worst day of 2020, was immediately followed by the year’s second best day

Kiwis that remain invested throughout however stand to gain the most over the long-run! Taking a buy-and-hold approach and investing over the long-term irrespective of market conditions will result in greater portfolio values for most investors. Timing the market is incredibly difficult, and for many people results in losing out on meaningful return appreciation over the long-run.

What we’ve been reading

- Vanguard’s 2023 Index Chart

- Mint: Are Kiwis Recession Ready?

- Salt Fund Management’s Structural Themes 2023

- Franklin Templeton: Running of the Bulls (Have Markets Run Ahead of Expected Growth?)

- National’s KiwiSaver Splitting: Innovation or Complication?

- Fund Manager Diversification: Unlocking Better Risk-Adjusted Returns in KiwiSaver

- How to Hitch a Smoother Ride in Retirement: NZ Actuaries Deliver Revised Rules-of-thumb

- Generate 10-Year Results Top KiwiSaver Tables

- MoneyHub: Average KiwiSaver Balance By Age

InvestNow Market Wrap-Up: July 2023

Written by Jason Choy, InvestNow Senior Portfolio Manager

Welcome to the July edition of the InvestNow Market Wrap-Up.

Financial markets can often be unnecessarily noisy and complicated – with so many headlines clamouring for our attention, it’s hard to keep up with what’s actually relevant to each of our investing journeys.

Well, InvestNow’s here to help! Each month we’ll distill everything you need to know in the wide world of investments into digestible bites curated for the Kiwi investor. At InvestNow, we think an important guiding principle of being a successful investor is to stay informed, but avoid the noise. So, make sure you keep abreast of what is happening in markets, but resist the urge to change your long-term strategy in response to market volatility and noise.

Market Dashboard

Global Markets Summary: July 2023

Another strong month for global share markets: Equity markets rallied once again in July as investors embraced easing inflation figures, a reduction in peak interest rate concerns, and robust economic activity worldwide. Developed markets delivered a solid 3.3% over the month as measured by the MSCI World Index, but it was emerging markets that stole the show, with the MSCI Emerging Markets Index up 6.3% in July alone, bringing its year-to-date return to 11%.

A soft landing in US markets? The US Federal Reserve raised interest rates by another 0.25% in July to match New Zealand’s rate at 5.50% (a 22-year high for the US). Markets expect this latest interest rate hike to be the Fed’s last this cycle, following the latest US Consumer Price Index (CPI) reading coming in at 3% year-on-year (from 4% previously). With inflation just 1% above the Fed’s target, and resilient Q2 GDP growth of 2.4% (versus forecasts of 1.8%), there is increasing optimism that the Fed has orchestrated a so-called ‘soft landing’ for the economy, where inflation cools without triggering a recession. Overall, this saw the S&P 500 Index rise a healthy 3.1% in July, taking the year-to-date returns to around 20%.

A similar central bank narrative in other global markets: The European Central Bank (ECB) increased rates by 0.25% to 3.75% in line with market expectations, with ECB president Christine Lagarde giving a decisive maybe to the possibility of a pause in September following Eurozone inflation easing to an estimated 5.3%. Meanwhile, the UK saw its first inflation surprise in a year, softening more than expected to 7.9%, leading to positive gains in the region. Over in Asian markets, despite starting the month hitting a 33-year high, Japanese equities underperformed developed markets as local inflation remains strong, while share prices in China were sharply higher after Beijing signalled economic support towards the real estate sector.

Global bond markets still seeking momentum: Global government bonds delivered negative returns overall in July, although yields at the shorter end of the curve (i.e. those that will mature sooner) trended lower due to clearer signs that interest rate hikes are easing. The bellwether US 10-Year Treasury Yield continued a gradual move upwards, increasing 12 bps to 3.96%, while the UK bucked the trend, with the UK 10-Year yield dropping to 4.31% as investors scaled back their rate expectations. Overall, this saw the Bloomberg Global Aggregate Bond Index (hedged to NZD) increase slightly by 0.05% over the month.

Key Updates for the Kiwi Investor

New Zealand share markets remain resilient in July: The S&P/NZX 50 advanced 1.2% over the month off the back of easing inflation that has retreated to 6% year-on-year. Despite the welcome drop from the previous quarter’s 6.7% inflation reading, prices are overall still increasing, with certain pockets of spending continuing to alarm everyday Kiwis – including a staggering 12.5% annual increase in food costs.

Local bond markets struggle to find direction: The Bloomberg NZ Bond Composite 0+ Year Index was effectively flat in July, returning 0.01% as the Reserve Bank of New Zealand (RBNZ) held the Official Cash Rate at 5.50% over the month – as expected by most economists. This saw the New Zealand 10-Year Government Bond yield increasing slightly by 7 bps to 4.71%, with the yield curve still remaining inverted.

Has New Zealand reached peak interest rates? The RBNZ remains content that it has delivered sufficient policy tightening to keep the OCR at 5.50% going forward. However, tight monetary policy could still be in the process of delivering its peak impact, as despite no change in the OCR, 1- and 2-year mortgage rates have pushed 0.30% higher in the past month to levels around 7%. This is relevant for many Kiwis, with 50% of borrowers scheduled to refix at these higher rates in the next year, many will be gravitating towards the slightly lower rates offered by the longer (e.g. 3 to 5 year) tenors just to make ends meet.

But will interest rates come down soon? The flipside of Kiwis refixing at the slightly lower rates offered in the 3-to-5-year tenors means potentially paying higher interest rates for longer, should the OCR decrease soon. More household income tied up in hefty mortgage payments could mean a sustained period of below-trend economic growth as households tighten up their belt buckles and reduce spending elsewhere. A material reduction in economic activity in a short timeframe could lead the RBNZ to cut interest rates sooner than the current first half of 2025 timeline forecasted, in order to spur growth.

Reserve Bank of New Zealand’s Latest OCR Projections

Some fund managers foresee the potential for interest rate cuts as early as the first half of 2024, however, note that nobody has a 100% accurate crystal ball into the future, and these projections are also contingent on economic conditions remaining in trend, which is never guaranteed. Nevertheless, it may be worth Kiwis being a little more wary of refixing themselves into 3+ years of today’s higher mortgage rates if OCR cuts do materialise sooner rather than later.

Chart of the Month

Our Chart of the Month is from Visual Capitalist with data from JP Morgan, which outlines the portfolio returns of $10,000 fully invested in the S&P 500 over the last 20 years, versus the drastic portfolio impacts of trying to time the market and not being invested for just a handful of days.

A buy-and-hold investor achieves a 9.8% annual return for 20 years, or more than 6x their investment of $10,000 by simply remaining invested. While an investor that tries to time the market and misses out on just the 10 best trading days in the 20– year period would more than halve their returns, generating a 5.6% annual return or only 3x their money.

Missing out on more than the best 30 days would result in a negatively performing portfolio, with missing out on just the 60 best trading days resulting in a -4.2% annual return, or a portfolio that is 93% worse off than being fully invested.

This illustrates the difficulties and potential disastrous consequences of attempting to time the market: during periods of market volatility, a natural emotion of many investors is to ‘take control’ by selling out of the market and getting back into the market later on. This action of ‘timing’ the market is extremely risky as it can often result in missing out on some of the best days of performance.

Particularly given some of the best days can often happen in some of the worst markets, for example:

- The 10 best days occurred during highly distressed markets (e.g. Global Financial Crisis and Covid)

- 7 of the 10 best days occurred within two weeks of the 10 worst days

- 6 of the 7 best days occurred after the worst days

- The second worst day of 2020, was immediately followed by the year’s second best day

Kiwis that remain invested throughout however stand to gain the most over the long-run! Taking a buy-and-hold approach and investing over the long-term irrespective of market conditions will result in greater portfolio values for most investors. Timing the market is incredibly difficult, and for many people results in losing out on meaningful return appreciation over the long-run.

What we’ve been reading

- Vanguard’s 2023 Index Chart

- Mint: Are Kiwis Recession Ready?

- Salt Fund Management’s Structural Themes 2023

- Franklin Templeton: Running of the Bulls (Have Markets Run Ahead of Expected Growth?)

- National’s KiwiSaver Splitting: Innovation or Complication?

- Fund Manager Diversification: Unlocking Better Risk-Adjusted Returns in KiwiSaver

- How to Hitch a Smoother Ride in Retirement: NZ Actuaries Deliver Revised Rules-of-thumb

- Generate 10-Year Results Top KiwiSaver Tables

- MoneyHub: Average KiwiSaver Balance By Age