InvestNow News – 4th February – Harbour Asset Management – Social Spotlight III: Modern Slavery

Article written by Jorge Waayman, Harbour Asset Management – 2nd February 2022

The Harbour Social Spotlight is a three-part series summarising our recent research project into ESG-related issues. (Part 1, Part 2)

- Modern slavery is a key social issue still occurring today and is a core aspect to be addressed as part of the United Nation’s Sustainable Development Goals

- In our final article following our research project on social aspects, we summarise our findings on modern slavery prevention practices across a sample of the New Zealand market

- We found that the majority of the respondents do not regularly monitor or evaluate their supply chain partners

- Approximately one third of the respondents do not currently have a response mechanism in place in case of a modern slavery incident

- Modern slavery incidents may lead to costs associated with victim support, legal proceedings as well as reputational damage

Introduction

Modern slavery is the exploitation of human capital for professional or personal gain. Some of the modern slavery incidents are more blatant like child labour, child marriage, human trafficking, etc. whereas some of them are more difficult to identify such as bonded labour, descent-based slavery and labour under coercion (threat of penalty, intimidation, withholding identity documents).

Over the last few years, the risks of modern slavery have been brought to the forefront – first by the UK passing their Modern Slavery Act (MSA) in 2015, and then Australia following suit in 2018. The first round of Australian Modern Slavery statements has been published over the last year just as the world has grappled with the COVID pandemic.

The pandemic has been a cause of severe distress all over the world but especially in this context. It has proven to be a huge obstacle for the ongoing anti-slavery efforts along with having increased the vulnerable population and exposed them to new risks. Therefore, it became imperative to take a closer look at the implications of the MSA on the New Zealand market.

Research

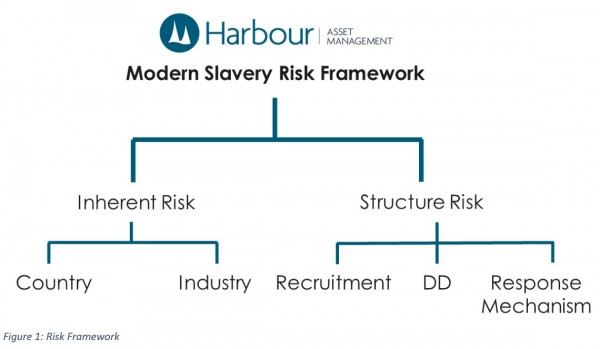

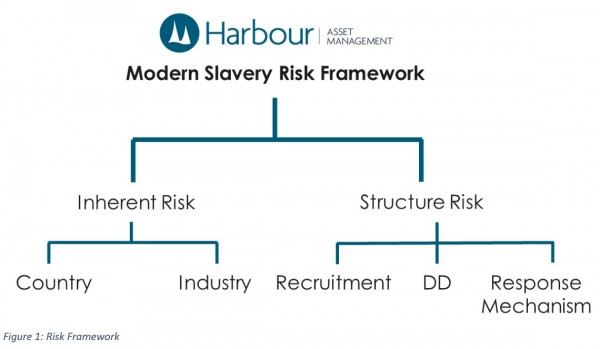

In the New Zealand context, the risk of modern slavery that a company is exposed to stems mostly from their supply chains. From our research, we explored the different kinds of risk of modern slavery a company could be exposed to and formed a survey to assess their current practices. We engaged with a diversified sample of 16 companies listed on the NZX and, from the survey responses, established a framework to analyse two broad risk categories that we define as Inherent and Structure Risk.

The inherent risk assessed the risk involved based on the industries and countries a company’s supply chain was based in. These risks were calculated based on the work by the WalkFree Foundation1. There are two indicators under inherent risk – Country and Industry. Country Risk takes the Government framework of each of the countries that a company would be engaging with at some level into account based on the Government Response Rating by WalkFree Foundation. Industry Risk reflects the risk a company would be exposed to due to an At-Risk industry with incidents in At-Risk or High-Risk countries.

A company can be exposed to high inherent risk, but may manage it well by introducing policies in their structure. These policies can be divided into three broad sub-categories – recruiting, due diligence, and response mechanism. The Australian MSA places emphasis on the details of due diligence and response mechanism especially and, as such, we took a careful look at these policies through our survey. We asked the companies about their supplier ethical codes, modern slavery risk assessment training policies, policies to evaluate their supply partners, the frequency of evaluations, and response mechanism in case of a modern slavery incident.

While most of these indicators were relatively straightforward to assess, the response mechanism proved challenging given there are multiple ways to respond. One of the major concerns is that it could lead to a culture of avoiding the detection of modern slavery incidents rather than successfully identifying and remediating them. While it might be the safest and the quickest way for the companies to pressure responsible parties to take action, it only takes into consideration the goodwill and market reputation of the companies and not the wellbeing of the victims. We therefore evaluated it on a scale of low to high risk which heavily depended on the respondents’ answers. Respondents that were assigned high risk for response mechanism were the companies that did not have any response mechanism in place at present.

Findings

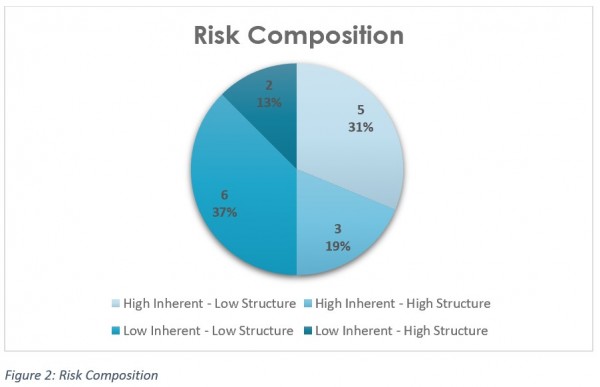

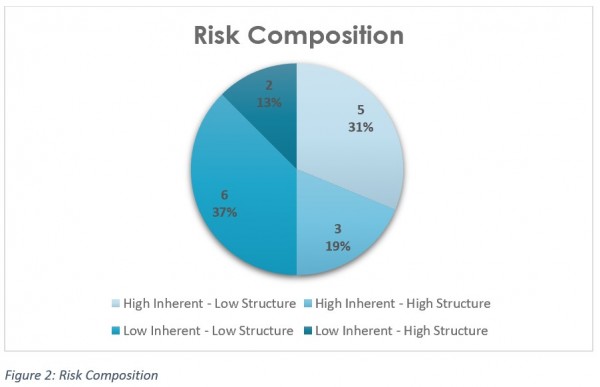

Although half of the respondents have a high inherent risk, only three of these eight companies have high structural risk as well. It implies that the majority of the companies with high inherent risk are aware of the exposure and are managing it well through their practices. 37% of the total respondents have low inherent and structure risk – these companies are managing their structure well even without the inherent risk being high.

From the survey responses we established a few more interesting statistics:

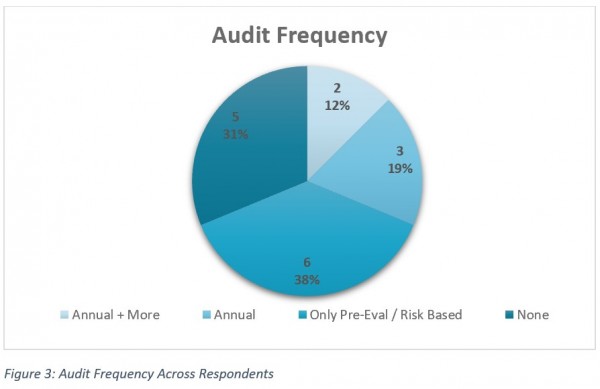

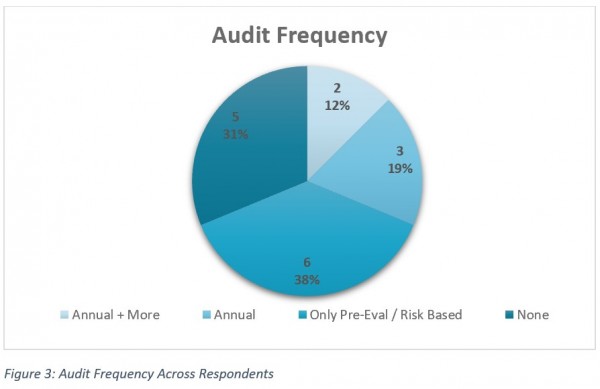

- 69% of the respondents do not regularly monitor or evaluate their supply chain partners.

- 75% of the respondents do not currently have modern slavery risk assessment training for their employees.

- 38% of the respondents do not currently have a response mechanism in place in case of a modern slavery incident.

Conclusion

ESG themes have become mainstream in the investing landscape for the last few years now but only recently has the focus started to shift towards the “S”. Unlike environmental reporting which has become relatively more standardised, the social metrics are quite often erratic and not uniformly reported. In our data collection, we observed that only 44% of the sample self-reports indicators that are not required by the regulatory bodies. Even with the presence of the Global Reporting Initiative (GRI) framework there are no uniform approaches to calculate the social indicators. The varied methodologies in calculating social metrics emphasise the need for a more standardised framework to observe employee wellbeing – especially employee engagement.

While Australasia may be perceived as having a low Modern Slavery prevalence, it is still exposed to the risk of modern slavery through its supply chains. MSA Australia is accordingly a useful framework to promote action against the problem of modern slavery in supply chains for New Zealand companies. However, there is further scope to cover more companies under a reporting umbrella. Aside from that, a guidance framework similar to the Taskforce on Climate-related Financial Disclosures could be established specifically for Modern Slavery Statements to encourage self-reporting by organisations that aren’t necessarily obliged to provide them.

Companies who do find themselves facing high levels of modern slavery risk who are not adequately addressing the risk may be exposed to significant reputational damage which can impact their social license to operate. There may also be costs associated with victim support and legal proceedings if incidents of modern slavery are uncovered, directly affecting the profitability of companies. This reinforces the need to invest in companies with robust employee and supplier relations with appropriate controls in place to mitigate the risk of modern slavery across their operations and supply chains. Collectively, this will help contribute to the UN Sustainable Development Goal 8 ‘Decent Work and Economic Growth’, particularly the underlying target (8.7) to end modern slavery, trafficking and child labour.

Sources

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.

InvestNow News – 4th February – Harbour Asset Management – Social Spotlight III: Modern Slavery

Article written by Jorge Waayman, Harbour Asset Management – 2nd February 2022

The Harbour Social Spotlight is a three-part series summarising our recent research project into ESG-related issues. (Part 1, Part 2)

- Modern slavery is a key social issue still occurring today and is a core aspect to be addressed as part of the United Nation’s Sustainable Development Goals

- In our final article following our research project on social aspects, we summarise our findings on modern slavery prevention practices across a sample of the New Zealand market

- We found that the majority of the respondents do not regularly monitor or evaluate their supply chain partners

- Approximately one third of the respondents do not currently have a response mechanism in place in case of a modern slavery incident

- Modern slavery incidents may lead to costs associated with victim support, legal proceedings as well as reputational damage

Introduction

Modern slavery is the exploitation of human capital for professional or personal gain. Some of the modern slavery incidents are more blatant like child labour, child marriage, human trafficking, etc. whereas some of them are more difficult to identify such as bonded labour, descent-based slavery and labour under coercion (threat of penalty, intimidation, withholding identity documents).

Over the last few years, the risks of modern slavery have been brought to the forefront – first by the UK passing their Modern Slavery Act (MSA) in 2015, and then Australia following suit in 2018. The first round of Australian Modern Slavery statements has been published over the last year just as the world has grappled with the COVID pandemic.

The pandemic has been a cause of severe distress all over the world but especially in this context. It has proven to be a huge obstacle for the ongoing anti-slavery efforts along with having increased the vulnerable population and exposed them to new risks. Therefore, it became imperative to take a closer look at the implications of the MSA on the New Zealand market.

Research

In the New Zealand context, the risk of modern slavery that a company is exposed to stems mostly from their supply chains. From our research, we explored the different kinds of risk of modern slavery a company could be exposed to and formed a survey to assess their current practices. We engaged with a diversified sample of 16 companies listed on the NZX and, from the survey responses, established a framework to analyse two broad risk categories that we define as Inherent and Structure Risk.

The inherent risk assessed the risk involved based on the industries and countries a company’s supply chain was based in. These risks were calculated based on the work by the WalkFree Foundation1. There are two indicators under inherent risk – Country and Industry. Country Risk takes the Government framework of each of the countries that a company would be engaging with at some level into account based on the Government Response Rating by WalkFree Foundation. Industry Risk reflects the risk a company would be exposed to due to an At-Risk industry with incidents in At-Risk or High-Risk countries.

A company can be exposed to high inherent risk, but may manage it well by introducing policies in their structure. These policies can be divided into three broad sub-categories – recruiting, due diligence, and response mechanism. The Australian MSA places emphasis on the details of due diligence and response mechanism especially and, as such, we took a careful look at these policies through our survey. We asked the companies about their supplier ethical codes, modern slavery risk assessment training policies, policies to evaluate their supply partners, the frequency of evaluations, and response mechanism in case of a modern slavery incident.

While most of these indicators were relatively straightforward to assess, the response mechanism proved challenging given there are multiple ways to respond. One of the major concerns is that it could lead to a culture of avoiding the detection of modern slavery incidents rather than successfully identifying and remediating them. While it might be the safest and the quickest way for the companies to pressure responsible parties to take action, it only takes into consideration the goodwill and market reputation of the companies and not the wellbeing of the victims. We therefore evaluated it on a scale of low to high risk which heavily depended on the respondents’ answers. Respondents that were assigned high risk for response mechanism were the companies that did not have any response mechanism in place at present.

Findings

Although half of the respondents have a high inherent risk, only three of these eight companies have high structural risk as well. It implies that the majority of the companies with high inherent risk are aware of the exposure and are managing it well through their practices. 37% of the total respondents have low inherent and structure risk – these companies are managing their structure well even without the inherent risk being high.

From the survey responses we established a few more interesting statistics:

- 69% of the respondents do not regularly monitor or evaluate their supply chain partners.

- 75% of the respondents do not currently have modern slavery risk assessment training for their employees.

- 38% of the respondents do not currently have a response mechanism in place in case of a modern slavery incident.

Conclusion

ESG themes have become mainstream in the investing landscape for the last few years now but only recently has the focus started to shift towards the “S”. Unlike environmental reporting which has become relatively more standardised, the social metrics are quite often erratic and not uniformly reported. In our data collection, we observed that only 44% of the sample self-reports indicators that are not required by the regulatory bodies. Even with the presence of the Global Reporting Initiative (GRI) framework there are no uniform approaches to calculate the social indicators. The varied methodologies in calculating social metrics emphasise the need for a more standardised framework to observe employee wellbeing – especially employee engagement.

While Australasia may be perceived as having a low Modern Slavery prevalence, it is still exposed to the risk of modern slavery through its supply chains. MSA Australia is accordingly a useful framework to promote action against the problem of modern slavery in supply chains for New Zealand companies. However, there is further scope to cover more companies under a reporting umbrella. Aside from that, a guidance framework similar to the Taskforce on Climate-related Financial Disclosures could be established specifically for Modern Slavery Statements to encourage self-reporting by organisations that aren’t necessarily obliged to provide them.

Companies who do find themselves facing high levels of modern slavery risk who are not adequately addressing the risk may be exposed to significant reputational damage which can impact their social license to operate. There may also be costs associated with victim support and legal proceedings if incidents of modern slavery are uncovered, directly affecting the profitability of companies. This reinforces the need to invest in companies with robust employee and supplier relations with appropriate controls in place to mitigate the risk of modern slavery across their operations and supply chains. Collectively, this will help contribute to the UN Sustainable Development Goal 8 ‘Decent Work and Economic Growth’, particularly the underlying target (8.7) to end modern slavery, trafficking and child labour.

Sources

IMPORTANT NOTICE AND DISCLAIMER

Harbour Asset Management Limited is the issuer and manager of the Harbour Investment Funds. Investors must receive and should read carefully the Product Disclosure Statement, available at www.harbourasset.co.nz. We are required to publish quarterly Fund updates showing returns and total fees during the previous year, also available at www.harbourasset.co.nz. Harbour Asset Management Limited also manages wholesale unit trusts. To invest as a Wholesale Investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013. This publication is provided in good faith for general information purposes only. Information has been prepared from sources believed to be reliable and accurate at the time of publication, but this is not guaranteed. Information, analysis or views contained herein reflect a judgement at the date of publication and are subject to change without notice. This is not intended to constitute advice to any person. To the extent that any such information, analysis, opinions or views constitutes advice, it does not take into account any person’s particular financial situation or goals and, accordingly, does not constitute financial advice under the Financial Markets Conduct Act 2013. This does not constitute advice of a legal, accounting, tax or other nature to any persons. You should consult your tax adviser in order to understand the impact of investment decisions on your tax position. The price, value and income derived from investments may fluctuate and investors may get back less than originally invested. Where an investment is denominated in a foreign currency, changes in rates of exchange may have an adverse effect on the value, price or income of the investment. Actual performance will be affected by fund charges as well as the timing of an investor’s cash flows into or out of the Fund.. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. Neither Harbour Asset Management Limited nor any other person guarantees repayment of any capital or any returns on capital invested in the investments. To the maximum extent permitted by law, no liability or responsibility is accepted for any loss or damage, direct or consequential, arising from or in connection with this or its contents.

Leave A Comment