Frequently asked questions:

- Account Questions

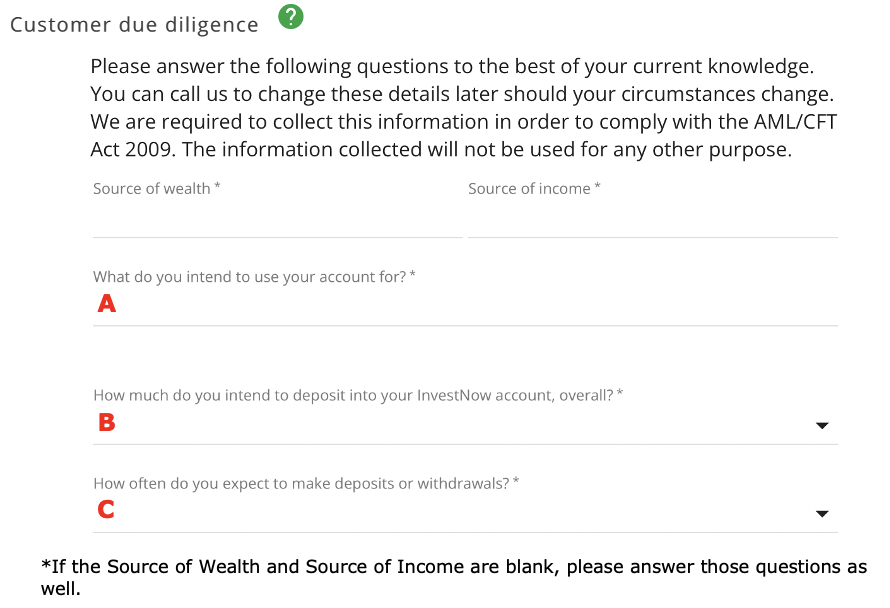

- Anti-Money Laundering (AML)

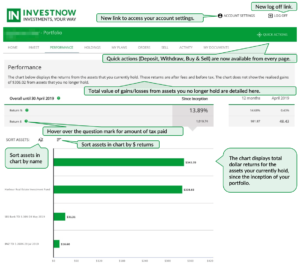

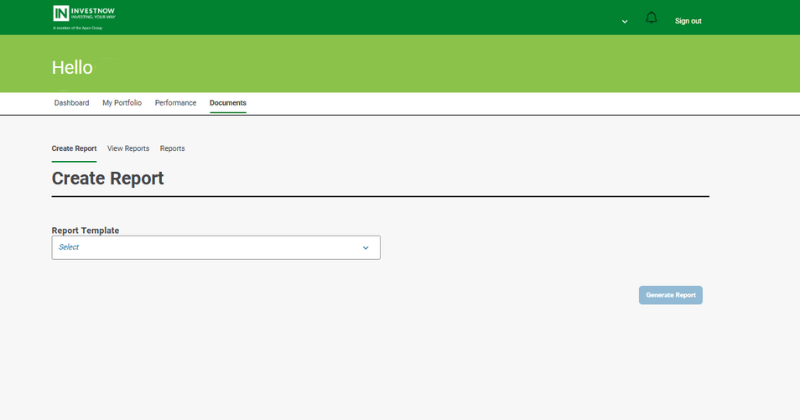

- Investment Portfolio Management Questions

- KiwiSaver

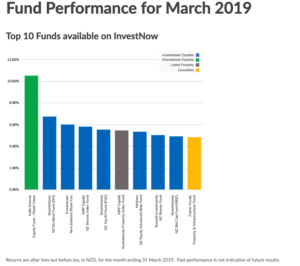

- Product/Choosing Products Questions

- Questions about InvestNow

- Tax Questions

- Term Definitions

Because there are no fees or costs associated with your InvestNow account, even if you have no money or managed funds in the account, there is no need to close your account.

However, should you wish to do so please contact us on 0800 499 466 or contact@investnow.co.nz

When are my buy and sells completed?

The cut-off time for the receipt of buy or sell orders and cleared funds for all Funds is currently 12pm NZ time (Monday to Friday, excluding national public holidays).

If buy or sell orders are accepted before the cut-off time for a Fund on a valuation day, units will normally be issued or redeemed price determined at the end of that day.

Please note that this does not apply to Russell Investments, Antipodes Partners, Elevation Capital or Pie Funds:

- Russell Investments NZ PIE funds – for orders in these funds, if they are loaded before the cut-off time, units will normally be issued at the following day’s valuation.

- Antipodes Global Value Fund – PIE – for orders in these funds, if they are loaded before the cut-off time, units will normally be issued at the following day’s valuation.

- Elevation Capital – orders are processed monthly, please see FAQ here for more details

- Pie Funds Management – sell orders in these funds, if they are loaded before the cut-off time, will usually be priced after 8 working days and paid on the 10th working day

For some funds, there will be a buy spread and/or a sell spread – this is a charge built into the buy or sell price that covers the costs of processing your order. You can see a list of the buy and sell spreads for InvestNow funds here.

Your buy and sell orders will usually be processed within the timeframes below (working days) for each of the Fund Managers.

Please Note:

- The first working day is the working day after you have placed your buy or sell order, with that order having been placed and authorised before 12pm.

- If the units and/or gross sale proceeds are not received in time on the final business day, the units and/or net sale proceeds may not be visible in your account until the next business day.

Please note the Fund prices shown may differ from your buy or sell order unit price.

Orders will not be processed on public holidays, and there can potentially be other delays due to additional tasks being carried out by the fund managers – we would not expect these delays to be any longer than a few business days.

| Fund | Description | Type | Manager | Sector | PDS Fee | QFU Fee | Buy/Sell Spread* | 1 Month | 3 Months | 6 Months | 1 Year | 3 Years | 5 Years | 10 Years | Risk Indicator | Target Growth/Income Assets | Management Style | Fund Type | Net Assets | Inception Date | Distribution Frequency | Buy Timeframe | Sell Timeframe | Available in the InvestNow KiwiSaver Scheme? | Smart Investor | External Website | PDS |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ACI Conservative Fund | The ACI Conservative Fund aims to achieve a rate of return (net of fees but before tax) of at least 1.75% per annum above inflation (as measured by Statistics New Zealand’s Consumer Price Index) over the longer term. The Fund’s objective is to provide relatively consistent returns, with some capital growth over the long term. Exposure to asset classes is achieved by primarily investing in DFA Australia Limited (Dimensional) funds, utilising their Sustainability Trusts where available. The allocations include a bias towards international diversification. Dimensional funds have an increased exposure to shares in small companies, value companies and companies with higher profitability with the objective of benefitting from a premium return from these companies over time. Such premiums are not always present year on year, which can drive shorter term differences in returns. | Managed Funds | Stewart Group | Diversified | 1.20% | 1.50% | 0.20% / 0.20% | 0.20% | 0.15% | 3.86% | 6.09% | – | – | – | 4 | 33% / 67% | Active | PIE | $4.0M | 06/04/2023 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13499/OFR13507/FND43018/ | https://acifunds.co.nz/ | https://cdn.investnow.co.nz/20251203102836/20251127_-_ACI_Funds_-_PDS.pdf |

| ACI Growth Fund | The ACI Growth Fund aims to achieve a rate of return (net of fees but before tax) of at least 4.5% per annum above inflation (as measured by Statistics New Zealand’s Consumer Price Index) over the longer term. The Fund invests predominantly in growth assets such as New Zealand, Australian, international shares and property but includes some income assets. The allocations include a bias towards international diversification, and exposure to these asset classes is achieved by primarily investing in DFA Australia Limited (Dimensional) Funds, utilising their Sustainability Trusts where available. Dimensional funds have an increased exposure to shares in small companies, value companies and companies with higher profitability with the objective of benefitting from a premium return from these companies over time. Such premiums are not always present year on year, which can drive shorter term differences in returns. | Managed Funds | Stewart Group | Diversified | 1.30% | 1.61% | 0.20% / 0.20% | -0.06% | 0.58% | 8.85% | 12.26% | – | – | – | 4 | 90% / 10% | Active | PIE | $7.3M | 06/04/2023 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13499/OFR13507/FND43019/ | https://acifunds.co.nz/ | https://cdn.investnow.co.nz/20251203102836/20251127_-_ACI_Funds_-_PDS.pdf |

| AMP Aggressive Managed Fund | To provide a well-diversified portfolio that aims to provide growth, primarily through holding growth assets. The fund has a low allocation to income assets. | Managed Funds | AMP | Diversified | 0.80% | 0.80% | 0% / 0% | −0.23% | −0.03% | 8.26% | 12.27% | – | – | – | 4 | 94.68% / 5.32% | Active | PIE | $12M | 21/10/2024 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13265/OFR13331/FND51805/ | https://www.amp.co.nz/returns-and-unit-prices/amf/amp-aggressive-managed-fund | https://cdn.investnow.co.nz/20250619161509/AMP_Managed_Funds_-_Product_Disclosure_Statement-29-May-2025.pdf |

| AMP Balanced Managed Fund | To provide a well-diversified portfolio that has a balance of risk through holding growth assets and an allocation to lower-risk income assets. | Managed Funds | AMP | Diversified | 0.80% | 0.81% | 0% / 0% | −0.16% | −0.29% | 5.88% | 8.92% | 10.83% | – | – | 4 | 57.8% / 42.2% | Active | PIE | $43.38M | 18/05/2022 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13265/OFR13331/FND38914/ | https://www.amp.co.nz/returns-and-unit-prices/amf/amp-balanced-managed-fund | https://cdn.investnow.co.nz/20250619161509/AMP_Managed_Funds_-_Product_Disclosure_Statement-29-May-2025.pdf |

| AMP Growth Managed Fund | To provide a well-diversified portfolio that aims to provide growth, primarily through holding growth assets diversified with a lower allocation to lower-risk income assets. | Managed Funds | AMP | Diversified | 0.80% | 0.81% | 0% / 0% | −0.17% | −0.01% | 7.43% | 10.67% | 13.07% | – | – | 4 | 78% / 22% | Active | PIE | $44.89M | 18/05/2022 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13265/OFR13331/FND38239/ | https://www.amp.co.nz/returns-and-unit-prices/amf/amp-growth-managed-fund.html | https://cdn.investnow.co.nz/20250619161509/AMP_Managed_Funds_-_Product_Disclosure_Statement-29-May-2025.pdf |

| AMP International Shares Managed Fund | To provide a well-diversified portfolio that has exposure to diversified international equities of companies listed on stock exchanges. | Managed Funds | AMP | International Equities | 0.79% | 0.78% | 0% / 0% | -0.49% | 0.41% | 8.68% | 13.67% | – | – | – | 5 | 100% / 0% | Active | PIE | $11.3M | 21/10/2024 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13265/OFR13331/FND51820/ | https://www.amp.co.nz/returns-and-unit-prices/amf/amp-international-shares-managed-fund | https://cdn.investnow.co.nz/20250619161509/AMP_Managed_Funds_-_Product_Disclosure_Statement-29-May-2025.pdf |

| Antipodes Global Value Fund – PIE | The aim of the Fund is to achieve absolute returns in excess of the MSCI All Country World Net Index in NZD (the Index) over the investment cycle (typically 3-5 years). The Fund invests in the Antipodes Global Fund – Long – UCITS, S Class (Underlying Fund) and cash or cash equivalent securities. The Underlying Fund’s investment exposure is predominantly to a broad range of international shares listed on stock exchanges in developed and emerging markets. The Underlying Fund may use exchange traded derivatives for risk management purposes and to achieve equity exposure. | Managed Funds & KiwiSaver | Antipodes | International Equities | 0.95% | 1.08% | 0.075% / 0.075% | 2.27% | 7.03% | 22.26% | 30.73% | 21.86% | 16.60% | – | 4 | 100% / 0% | Active | PIE | $122.61M | 25/07/2018 | – | 3 Days | 4 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH12434/OFR12435/FND10581/ | https://antipodes.com/nz-pie-funds/antipodes-global-fund-long-pie/ | https://cdn.investnow.co.nz/20250905095933/20250903-Antipodes-PDS.pdf |

| ANZ Investments OneAnswer Australian Share Fund | The Australian Share Fund invests mainly in Australian equities. Investments may include equities in companies that are listed or are soon to be listed on the Australian stock exchange, and cash and cash equivalents. | Managed Funds | ANZ | Australasian Equities | 1.11% | 1.09% | 0% / 0% | 1.55% | 1.38% | 5.03% | 8.69% | 6.48% | 9.79% | 5.78% | 5 | 100% / 0% | Active | PIE | $22.9M | 29/02/1996 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH11065/OFR11077/FND2210/ | https://www.anz.co.nz/comms/investments/investment-funds/ | https://cdn.investnow.co.nz/20251023140608/OASAC-PDS_1025.pdf |

| ANZ Investments OneAnswer Balanced Growth Fund | The Balanced Growth Fund invests mainly in growth assets (equities, listed property and listed infrastructure), with some exposure to income assets (cash and cash equivalents and fixed interest). The fund also has a small exposure to alternative assets. | Managed Funds | ANZ | Diversified | 0.97% | 0.98% | 0% / 0% | 0.27% | 0.51% | 5.35% | 8.21% | 8.36% | 5.46% | 6.96% | 4 | 63% / 37% | Active | PIE | $47.66M | 15/04/2010 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH11064/OFR11075/FND2216/ | https://www.anz.co.nz/comms/investments/investment-funds/ | https://cdn.investnow.co.nz/20251023140608/OASAC-PDS_1025.pdf |

| ANZ Investments OneAnswer International Share Fund | The International Share Fund invests mainly in international equities. Investments may include equities in companies that are listed or are soon to be listed on a stock exchange, and cash and cash equivalents. | Managed Funds | ANZ | International Equities | 1.06% | 1.00% | 0% / 0% | −1.76% | −0.76% | 9.13% | 11.02% | 15.34% | 11.71% | 11.69% | 5 | 100% / 0% | Active | PIE | $171.7M | 12/05/1997 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH11065/OFR11077/FND2211/ | https://www.anz.co.nz/comms/investments/investment-funds/ | https://cdn.investnow.co.nz/20251023140608/OASAC-PDS_1025.pdf |

| ANZ Investments OneAnswer New Zealand Share Fund | The New Zealand Share Fund invests mainly in New Zealand equities. Investments may include equities in companies that are listed or intend to list on the New Zealand stock exchange, and cash and cash equivalents. | Managed Funds | ANZ | Australasian Equities | 1.10% | 1.05% | 0% / 0% | −0.80% | 0.32% | 6.47% | 5.49% | 4.50% | 0.50% | 8.11% | 5 | 100% / 0% | Active | PIE | $52.93M | 31/03/1991 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH11065/OFR11077/FND2208/ | https://www.anz.co.nz/comms/investments/investment-funds/ | https://cdn.investnow.co.nz/20251023140608/OASAC-PDS_1025.pdf |

| ANZ Investments OneAnswer Property Securities Fund | The Property Securities Fund invests mainly in New Zealand and Australian listed property assets. Investments may include companies, funds or trusts that invest in property and are listed or intend to list, and cash and cash equivalents. | Managed Funds | ANZ | Listed Property | 1.10% | 1.06% | 0% / 0% | −3.17% | −5.78% | 2.53% | 4.99% | 2.53% | −2.46% | 4.52% | 5 | 100% / 0% | Active | PIE | $48.66M | 30/11/1994 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH11065/OFR11077/FND2206/ | https://www.anz.co.nz/comms/investments/investment-funds/ | https://cdn.investnow.co.nz/20251023140608/OASAC-PDS_1025.pdf |

| Aurellan Global Shares Fund | The Fund provides diversified exposure to global equities using a manager‑of‑managers approach, selecting specialist active managers across growth, value and quantitative styles. It aims to outperform the MSCI ACWI (unhedged) over rolling five‑year periods. | Managed Funds | Aurellan | International Equities | 1.12% | 1.12% | 0.20% / 0.20% | - | - | - | - | - | - | - | 5 | 100% / 0% | Active | PIE | $ - | 02/12/2025 | - | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH14022/OFR14038/FND60479/ | https://www.aurellan.com/ | https://cdn.investnow.co.nz/20260202103837/Aurellan_Investment_Funds_-_PDS_-_2_December_2025.pdf |

| Aurellan Hedged Global Shares Fund | The Fund offers diversified global equity exposure through a manager‑of‑managers model, with most major foreign currency risks hedged back to NZD. It aims to outperform the MSCI ACWI hedged to NZD over rolling five‑year periods. | Managed Funds | Aurellan | International Equities | 1.12% | 1.12% | 0.20% / 0.20% | - | - | - | - | - | - | - | 5 | 100% / 0% | Active | PIE | $ - | 02/12/2025 | - | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH14022/OFR14038/FND60480/ | https://www.aurellan.com/ | https://cdn.investnow.co.nz/20260202103837/Aurellan_Investment_Funds_-_PDS_-_2_December_2025.pdf |

| Bitcoin ETF PIE Fund | The Fund is designed to provide investors with exposure to Bitcoin within a PIE compliant fund. This is achieved by investing in one or more listed offshore domiciled funds which invest directly in Bitcoin (each an “Underlying Fund” and together the “Underlying Funds”). The Fund targets a return before fees and tax that broadly tracks the S&P Bitcoin Index in New Zealand dollars. This is a highly speculative investment. Bitcoin is a highly volatile asset. This means the Fund will not be appropriate for all investors. | Managed Funds | Raise | Other | 0.95% | 1.01% | 0.05% / 0.05% | −9.09% | −27.92% | −30.16% | −23.31% | 55.47% | – | – | 7 | 100% / 0% | Active | PIE | $24.71M | 14/09/2021 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13147/OFR13173/FND35080/ | https://www.bitcoinpiefund.co.nz/ | https://cdn.investnow.co.nz/20260113174603/20260112-Raise-PDS.pdf |

| Brandywine Global Opportunistic Fixed Income Fund | The Fund invests in a diversified portfolio of international fixed income securities, derivatives and cash. The investment objective of the Fund is to earn a return before fees and taxes in excess of the Bloomberg Global Aggregate Index – New Zealand dollar Hedged over rolling five-year periods. | Managed Funds | Franklin Templeton | International Fixed Interest | 0.76% | 0.77% | 0.075% / 0.075% | 1.40% | 0.97% | 2.94% | 6.87% | 2.38% | −0.10% | – | 4 | 0% / 100% | Active | PIE | $300.25M | 27/03/2018 | Semi-annually | 2 Days | 3 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH12302/OFR12303/FND8399/ | https://www.fundrock.com/fundrock-new-zealand/fundrock-new-zealand-managers/franklin-resources-inc/ | https://cdn.investnow.co.nz/20250313164642/Franklin-Templeton-Investment-Funds-PDS-13-March-2025.pdf |

| Castle Point 5 Oceans Fund | The 5 Oceans Fund is a diversified fund that provides exposure to a range of growth and defensive assets both globally and locally. The fund can invest both in direct securities and selected managed funds. The objective of the fund is to generate a positive return above cash with a focus on protecting investors capital. | Managed Funds & KiwiSaver | Castle Point | Diversified | 1.31% | 1.18% | 0.30% / 0.30% | 1.12% | 1.90% | 6.20% | 9.95% | 6.72% | 5.17% | – | 3 | 57.85% / 42.15% | Active | PIE | $80.95M | 25/10/2016 | Monthly | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10745/OFR10746/FND1223/ | https://www.castlepointfunds.com/5-oceans-fund | https://cdn.investnow.co.nz/20250905095937/5_Oceans_PDS_-_July_2025.pdf |

| Castle Point Trans-Tasman Fund | The Trans-Tasman Fund invests in New Zealand and Australian Listed Companies and is benchmarked to the S&P/NZX 50 Index (incl Imputation Credits). The performance objective of the Fund is to outperform the benchmark over rolling three-year periods after all fees (and other expenses) but before tax. While the Fund is expected to be fully invested into equities (max 25% in Australia), it can hold some cash or cash equivalents (0-10%). | Managed Funds & KiwiSaver | Castle Point | Australasian Equities | 1.07% | 1.08% | 0.30% / 0.30% | −0.72% | −2.01% | 3.50% | 3.42% | 3.20% | −0.44% | – | 5 | 98% / 2% | Active | PIE | $12.76M | 20/11/2018 | Quarterly | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10745/OFR10746/FND12482/ | https://www.castlepointfunds.com/trans-tasman-fund | https://cdn.investnow.co.nz/20250317152154/Trans-Tasman_PDS_-_February_2025.pdf |

| Devon Alpha Fund | The Fund aims to generate capital growth over the long term by actively investing in a concentrated portfolio of 10-15 New Zealand and Australian shares and holding cash when appropriate investment opportunities cannot be identified. | Managed Funds | Devon | Australasian Equities | 1.85% | 1.31% | 0% / 0% | 0.58% | −0.29% | 1.34% | 1.79% | 5.91% | 7.92% | 7.96% | 5 | 0%-100% / 0%-100% | Active | PIE | $158.01M | 03/06/2010 | Semi-annually | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10753/OFR10754/FND667/ | https://devonfunds.co.nz/alpha-fund | Devon_Investment_Funds_Product_Disclosure_Statement_23-Dec-25.pdf |

| Devon Australian Fund | The Fund aims to generate capital growth over the long term by actively managing Australian equity investments. The Australian market offers exposure to a number of sectors that are not available in New Zealand. | Managed Funds | Devon | Australasian Equities | 1.60% | 1.32% | 0% / 0% | −0.96% | −2.67% | 3.19% | 6.62% | 9.66% | 11.02% | 8.37% | 5 | 80%-100% / 0%-20% | Active | PIE | $10.53M | 20/08/2010 | Semi-annually | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10753/OFR10754/FND1502/ | https://devonfunds.co.nz/australian-fund | Devon_Investment_Funds_Product_Disclosure_Statement_23-Dec-25.pdf |

| Devon Dividend Yield Fund | A select portfolio of New Zealand and Australian listed equity securities chosen for their attractive dividend yields, with some growth prospects to maintain the dividend yield and capital value in real terms. | Managed Funds | Devon | Australasian Equities | 1.19% | 1.06% | 0% / 0% | −1.47% | −1.44% | 10.24% | 17.17% | 8.30% | 7.78% | 7.79% | 5 | 90%-100% / 0%-10% | Active | PIE | $17.11M | 20/12/2012 | Quarterly | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10753/OFR10754/FND1504/ | https://devonfunds.co.nz/dividend-yield-fund | Devon_Investment_Funds_Product_Disclosure_Statement_23-Dec-25.pdf |

| Devon Trans-Tasman Fund | The Fund aims to generate capital growth over the long term by actively investing in a portfolio of New Zealand and Australian shares. The Fund tends to be fully invested in shares but can hold cash. | Managed Funds | Devon | Australasian Equities | 1.61% | 1.32% | 0% / 0% | 0.43% | 1.61% | 8.22% | 9.62% | 8.93% | 8.78% | 9.33% | 5 | 50%-100% / 0%-50% | Active | PIE | $140.36M | 30/09/1998 | Semi-annually | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10753/OFR10754/FND1505/ | https://devonfunds.co.nz/trans-tasman-fund | Devon_Investment_Funds_Product_Disclosure_Statement_23-Dec-25.pdf |

| Dexus Global REIT Fund | The Dexus Global REIT Fund is an income focused property securities fund that invests in a portfolio of Real Estate Investment Trusts (REITs) listed in North America, Europe and Asia Pacific. | Managed Funds | Dexus | Listed Property | 0.98% | N/A | 0.15% / 0.15% | −2.90% | −0.95% | 8.38% | 8.20% | 8.33% | 10.21% | – | 0 | 98% / 2% | Active | AUT | $25.83M | 01/04/2020 | Monthly | 3 Days | 3 Days | No | N/A | https://www.dexus.com/investor-centre/investments/dexus-global-reit-fund | https://cdn.investnow.co.nz/20250619161459/31032025-DXGRF-PDS-and-Product-Guide.pdf |

| Elevation Capital Global Shares Fund | The strategy of the Fund is to mainly invest in shares (equity securities). The manager's bottom-up, proprietary research may lead the Fund to investment opportunities in medium and smaller capitalisation shares in out-of-favour or overlooked industries and sectors. It may also lead us to invest in emerging market economies. The Fund has no geographic limitations on investment. The Fund invests “long” only and is indifferent to index compositions. “Long only” means the manager looks to buy what they believe to be well-priced securities – the manager does not look to take “short” positions in overvalued securities. | Managed Funds | Elevation | International Equities | 1.80% | 1.80% | 0% / 0% | −0.82% | −0.85% | 9.41% | 5.98% | 8.26% | 7.83% | 7.79% | 6 | 95% / 5% | Active | PIE | $24.48M | 09/12/2008 | Annually | 6 Days (Month End) | 6 Days (Month End) | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH11207/OFR11348/FND3120/ | https://globalsharesfund.com/ | https://cdn.investnow.co.nz/20251223135248/Elevation_Capital_Global_Shares_Fund_-_PDS_-_Dated_11_December_2025.pdf |

| Ellerston Global Mid Small Cap Fund | The Fund seeks to provide long term capital growth by investing in 20 – 40 securities with a global mid small cap bias. Securities within the portfolio are typically global leaders in their markets with stronger growth than most businesses. The strategy is not to assemble a group of stocks that replicate any particular geography, theme or index; consequently, the portfolio will not replicate a benchmark and is likely to be different to what may constitute other Global equity products, making it suitable for inclusion within a diversified portfolio. | Managed Funds | Ellerston | International Equities | 1.78% | N/A | 0.25% / 0.25% | 1.05% | 0.22% | 13.22% | 18.79% | 14.83% | 8.90% | – | 0 | 80%-100% / 0%-20% | Active | AUT | $28.78M | 01/03/2017 | Semi-annually | 3 Days | 4 Days | No | N/A | https://ellerstoncapital.com/funds/global-mid-small-cap-fund/ | https://cdn.investnow.co.nz/20250930104258/2025-Ellerston-Global-Mid-Small-Cap-Fund_Long-Form-PDS_FINAL.pdf |

| Fisher Funds Australian Growth Fund | The Australian Growth Fund gives investors targeted access to a hand-picked portfolio of quality growing Australian businesses. These companies are often overlooked by investors as they are not familiar with them or there is limited research available. | Managed Funds | Fisher Funds | Australasian Equities | 1.48% | 0.87% | 0% / 0% | −3.27% | −8.35% | −12.15% | −12.96% | 4.09% | 4.76% | 8.34% | 5 | 100% / 0% | Active | PIE | $87.41M | 15/06/2005 | – | 3 Days | 3 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10640/OFR10667/FND1209/ | https://fisherfunds.co.nz/funds-and-performance/australian-growth-fund | https://cdn.investnow.co.nz/20251001105310/Fisher_Funds_Managed_Funds_PDS_30_Sep_2025.pdf |

| Fisher Funds BondPlus Fund | The BondPlus Fund invests in international fixed interest assets and seeks to provide moderate protection for your investment, while also generating modest returns over the long term. The Fund’s assets are managed by external managers, PIMCO and Wellington. | Managed Funds | Fisher Funds | International Fixed Interest | 1.27% | 1.26% | 0% / 0% | 0% | −0.27% | 1.62% | 3.02% | 3.02% | −0.80% | 1.49% | 3 | 0% / 100% | Active | PIE | $100.18M | 01/11/1990 | – | 3 Days | 3 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10642/OFR10748/FND1065/ | https://fisherfunds.co.nz/investment/investment-series | https://cdn.investnow.co.nz/20251001105318/Fisher_Funds_Investment_Series_PDS_30_Sep_2025.pdf |

| Fisher Funds CashPlus Fund | The CashPlus Fund aims to provide protection for your investment and a return that is better than 90-day bank bills by investing in New Zealand cash and New Zealand fixed interest assets. | Managed Funds | Fisher Funds | Cash and Cash Equivalents | 0.84% | 0.83% | 0% / 0% | 0.16% | 0.50% | 1.38% | 3.20% | 4.57% | 2.92% | 2.35% | 1 | 0% / 100% | Active | PIE | $12.9M | 30/04/2008 | – | 3 Days | 3 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10642/OFR10748/FND1060/ | https://fisherfunds.co.nz/investment/investment-series | https://cdn.investnow.co.nz/20251001105318/Fisher_Funds_Investment_Series_PDS_30_Sep_2025.pdf |

| Fisher Funds Conservative Fund | The Fisher Funds Conservative Fund is a diversified portfolio that aims to provide moderate protection for your investment, while also providing a modest level of return over the short to medium term. It invests in mainly income assets (target 72.5%) with a small amount in growth assets (target 27.5%). | Managed Funds & KiwiSaver | Fisher Funds | Diversified | 1.36% | 1.35% | 0% / 0% | −0.22% | −0.59% | 1.85% | 3.45% | 5.49% | 2.35% | – | 3 | 20% / 80% | Active | PIE | $119.76M | 31/07/2018 | – | 3 Days | 3 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10640/OFR10667/FND11124/ | https://fisherfunds.co.nz/investment/managed-funds/investment-options/#Conservative | https://cdn.investnow.co.nz/20251001105310/Fisher_Funds_Managed_Funds_PDS_30_Sep_2025.pdf |

| Fisher Funds Global Fund | The Global Fund aims to achieve capital growth over the long term by investing in international shares only. | Managed Funds | Fisher Funds | International Equities | 1.64% | 1.64% | 0% / 0% | −0.89% | 0.29% | 6.73% | 5% | 13.07% | 9.16% | 10.35% | 5 | 100% / 0% | Active | PIE | $161.5M | 29/11/1985 | – | 3 Days | 3 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10642/OFR10748/FND1068/ | https://fisherfunds.co.nz/investment/investment-series | https://cdn.investnow.co.nz/20251001105318/Fisher_Funds_Investment_Series_PDS_30_Sep_2025.pdf |

| Fisher Funds Growth Fund | The Fisher Funds Growth Fund is a diversified portfolio that aims to grow your investment with more focus on capital growth over the long term. It invests in mainly growth assets. | Managed Funds & KiwiSaver | Fisher Funds | Diversified | 1.41% | 1.46% | 0% / 0% | −1.14% | −1.44% | 1.62% | 1.12% | 8.82% | 5.27% | – | 4 | 80% / 20% | Active | PIE | $339.49M | 31/07/2018 | – | 3 Days | 3 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10640/OFR10667/FND11126/ | https://fisherfunds.co.nz/investment/managed-funds/investment-options/#Growth | https://cdn.investnow.co.nz/20251001105310/Fisher_Funds_Managed_Funds_PDS_30_Sep_2025.pdf |

| Fisher Funds Income Fund | The Income Fund aims to preserve your capital while generating positive, better than bank returns. We do this by actively managing a hand-picked portfolio of cash and fixed interest securities from around the world. | Managed Funds | Fisher Funds | International Fixed Interest | 0.99% | 0.99% | 0% / 0% | 0.00% | 0.19% | 1.94% | 4.53% | 6.44% | 2.93% | 3.45% | 3 | 0% / 100% | Active | PIE | $43.27M | 18/04/2011 | – | 3 Days | 3 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10640/OFR10667/FND1212/ | https://fisherfunds.co.nz/funds-and-performance/income-fund | https://cdn.investnow.co.nz/20251001105310/Fisher_Funds_Managed_Funds_PDS_30_Sep_2025.pdf |

| Fisher Funds International Growth Fund | The International Growth Fund gives investors access to a portfolio of quality international companies through a single tax efficient investment. The global stage offers us access to a wider universe of investment opportunities and we have the flexibility to invest anywhere outside of New Zealand and Australia. | Managed Funds | Fisher Funds | International Equities | 1.44% | 1.31% | 0% / 0% | −3.03% | −2.98% | 0.29% | −6.25% | 9.65% | 4.03% | 9.55% | 6 | 100% / 0% | Active | PIE | $81.46M | 07/11/2007 | – | 3 Days | 3 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10640/OFR10667/FND1210/ | https://fisherfunds.co.nz/funds-and-performance/international-growth-fund | https://cdn.investnow.co.nz/20251001105310/Fisher_Funds_Managed_Funds_PDS_30_Sep_2025.pdf |

| Fisher Funds New Zealand Fixed Income Trust | The New Zealand Fixed Income Trust aims to provide protection for your investment, while also generating a stable level of return over the long term. It invests in New Zealand fixed interest assets only. | Managed Funds | Fisher Funds | New Zealand Fixed Interest | 0.97% | 0.97% | 0% / 0% | −0.38% | −1.41% | 1.85% | 4.52% | 5.00% | 0.51% | 2.39% | 3 | 0% / 100% | Active | PIE | $80.14M | 20/07/2011 | – | 3 Days | 3 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10642/OFR10748/FND1064/ | https://fisherfunds.co.nz/investment/investment-series | https://cdn.investnow.co.nz/20251001105318/Fisher_Funds_Investment_Series_PDS_30_Sep_2025.pdf |

| Fisher Funds New Zealand Growth Fund | The New Zealand Growth Fund is our flagship fund. It was established in 1998 and invests in a hand-picked portfolio of approximately 20 quality New Zealand growth companies at any one time. | Managed Funds | Fisher Funds | Australasian Equities | 1.42% | 1.42% | 0% / 0% | −3.55% | −4.54% | −5.62% | −8.23% | 5.37% | 0.05% | 9.23% | 5 | 100% / 0% | Active | PIE | $175.03M | 10/08/1998 | – | 3 Days | 3 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10640/OFR10667/FND1208/ | https://fisherfunds.co.nz/funds-and-performance/new-zealand-growth-fund | https://cdn.investnow.co.nz/20251001105310/Fisher_Funds_Managed_Funds_PDS_30_Sep_2025.pdf |

| Fisher Funds Property & Infrastructure Fund | The Fund comprises a hand-picked portfolio of listed property and infrastructure assets from New Zealand and around the world. We think of this Fund as the ‘backbone’ Fund of our managed funds range because these assets are the backbone of economies and indeed it’s reasonable for this Fund to be the backbone of your portfolio as well. | Managed Funds | Fisher Funds | Listed Property | 1.64% | 1.53% | 0% / 0% | 1.23% | 0.75% | 2.35% | 6.16% | 6.53% | 6.25% | 9.67% | 5 | 100% / 0% | Active | PIE | $166.14M | 05/12/2008 | – | 3 Days | 3 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10640/OFR10667/FND1630/ | https://fisherfunds.co.nz/funds-and-performance/property-and-infrastructure-fund | https://cdn.investnow.co.nz/20251001105310/Fisher_Funds_Managed_Funds_PDS_30_Sep_2025.pdf |

| Fisher Funds Trans Tasman Equity Trust | The Trans Tasman Equity Trust aims to achieve capital growth over the long term by investing in a mix of New Zealand shares (target weighting 70%) and Australian shares (target weighting 30%). | Managed Funds | Fisher Funds | Australasian Equities | 1.63% | 1.63% | 0% / 0% | −3.42% | −6.51% | −9.38% | −11.02% | 4.67% | 1.84% | 9.15% | 5 | 100% / 0% | Active | PIE | $72.35M | 29/11/1985 | – | 3 Days | 3 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10642/OFR10748/FND1067/ | https://fisherfunds.co.nz/investment/investment-series | https://cdn.investnow.co.nz/20251001105318/Fisher_Funds_Investment_Series_PDS_30_Sep_2025.pdf |

| Foundation Series Balanced Fund | The Fund aims for mid-range long-run returns by investing in a diversified portfolio with a balance of income and growth assets. The Fund incorporates certain responsible investment considerations and is exposed to investment strategies that seek to limit exposure to companies involved in specific business practices. The Fund’s objective is to perform broadly in line with the return of its investment benchmark before fees and tax over the long-term. The Fund’s investment benchmark is the weighted average return (before tax, fees and other expenses) of the asset class benchmark indices, which includes both New Zealand as well as international fixed interest and equity asset classes. The long-term returns from the Foundation Series Balanced Fund are likely to be lower and more stable than those of the Foundation Series Growth Fund. | Managed Funds & KiwiSaver | InvestNow | Diversified | 0.37% | 0.36% | 0% / 0% | −0.61% | −0.52% | 4.99% | 7.31% | 10.73% | 6.24% | – | 4 | 60% / 40% | Passive | PIE | $46.7M | 02/09/2020 | – | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13175/OFR12915/FND20381/ | https://www.fundrock.com/fundrock-new-zealand-funds/foundation-series-balanced-fund/ | https://cdn.investnow.co.nz/20260130134419/20260130-Foundation-Series-Funds-Diversified-Funds-PDS.pdf |

| Foundation Series Global ESG Fund | The Fund aims for high long-run returns by investing in Exchange-Traded Funds (‘ETFs’) that invests in shares of large, mid-sized and small companies listed on international stock markets. The Fund incorporates certain responsible investment considerations and is exposed to investment strategies that seek to limit exposure to companies involved in particular business practices. The Fund’s objective is to perform broadly in line with the return of its investment benchmark before fees and tax over the long-term. The Fund’s investment benchmark is a composite index consisting of 67% FTSE USA All Cap Choice TR NZD Index and 33% FTSE Global All Cap ex USA Choice TR NZD Index. | Managed Funds & KiwiSaver | InvestNow | International Equities | 0.10% | 0.10% | 0% / 0% | -2.91% | -2.45% | 9.48% | – | – | – | – | 5 | 100% / 0% | Passive | PIE | $5.70M | 04/03/2025 | – | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13175/OFR12915/FND56007/ | https://www.fundrock.com/fundrock-new-zealand-funds/foundation-series-global-esg-fund/ | https://cdn.investnow.co.nz/20260130134412/20260130-Foundation-Series-Funds-Core-Equity-Funds-2-PDS.pdf |

| Foundation Series Growth Fund | The Fund aims for high long-run returns by investing in a diversified portfolio weighted towards growth assets but with some income asset exposure. The Fund incorporates certain responsible investment considerations and is exposed to investment strategies that seek to limit exposure to companies involved in specific business practices. The Fund’s objective is to perform broadly in line with the return of its investment benchmark before fees and tax over the long-term. The Fund’s investment benchmark is the weighted average return (before tax, fees and other expenses) of the asset class benchmark indices, which includes both New Zealand as well as international fixed interest and equity asset classes. The long-term returns from the Foundation Series Growth Fund are likely to be higher and less stable than those of the Foundation Series Balanced Fund. | Managed Funds & KiwiSaver | InvestNow | Diversified | 0.37% | 0.38% | 0% / 0% | −0.84% | −0.47% | 5.97% | 8.15% | 12.80% | 8.27% | – | 4 | 80% / 20% | Passive | PIE | $63.83M | 02/09/2020 | – | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13175/OFR12915/FND20382/ | https://www.fundrock.com/fundrock-new-zealand-funds/foundation-series-growth-fund/ | https://cdn.investnow.co.nz/20260130134419/20260130-Foundation-Series-Funds-Diversified-Funds-PDS.pdf |

| Foundation Series Hedged Total World Fund | The Fund aims for high long-run returns by investing in an Exchange-Traded Fund (‘ETF’) that invests in shares of large, mid-sized and small companies listed on international stock markets. The Fund’s objective is to perform broadly in line with the return of its investment benchmark before fees and tax over the long-term. The Fund aims to have all foreign currency exposure hedged to the New Zealand dollar. The Fund’s investment benchmark is the Morningstar Global All Cap Target Market Exposure NR Hedged NZD Index. | Managed Funds & KiwiSaver | InvestNow | International Equities | 0.06% | 0.07% | 0% / 0% | 2.28% | 2.79% | 11.35% | 17.62% | – | – | – | 6 | 100% / 0% | Passive | PIE | $81.58M | 05/02/2024 | – | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13175/OFR12915/FND47038/ | https://www.fundrock.com/fundrock-new-zealand-funds/foundation-series-hedged-total-world-fund/ | https://cdn.investnow.co.nz/20260130134403/20260130-Foundation-Series-Funds-Core-Equity-Funds-1-PDS.pdf |

| Foundation Series Hedged US 500 Fund | The Fund aims for high long-run returns by investing in an Exchange-Traded Fund (‘ETF’) that invests in shares of the largest companies listed on stock markets in the United States. The Fund’s objective is to perform broadly in line with the return of its investment benchmark before fees and tax over the long-term. The Fund aims to have all foreign currency exposure hedged to the New Zealand dollar. The Fund’s investment benchmark is the Morningstar US Target Market Exposure TR Hedged NZD Index. | Managed Funds & KiwiSaver | InvestNow | International Equities | 0.03% | 0.03% | 0% / 0% | 1.26% | 1.22% | 9.19% | 14.32% | – | – | – | 6 | 100% / 0% | Passive | PIE | $41.94M | 05/02/2024 | – | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13175/OFR12915/FND47037/ | https://www.fundrock.com/fundrock-new-zealand-funds/foundation-series-hedged-us-500-fund/ | https://cdn.investnow.co.nz/20260130134403/20260130-Foundation-Series-Funds-Core-Equity-Funds-1-PDS.pdf |

| Foundation Series High Growth Fund | The Fund aims for high long-run returns by investing in a diversified portfolio of predominantly growth assets but with a small amount of income asset exposure. The Fund incorporates certain responsible investment considerations and is exposed to investment strategies that seek to limit exposure to companies involved in specific business practices. The Fund’s objective is to perform broadly in line with the return of its investment benchmark before fees and tax over the long-term. The Fund’s investment benchmark is the weighted average return (before tax, fees and other expenses) of the asset class benchmark indices. The long-term returns from the Foundation Series High Growth Fund are likely to be higher and less stable than those of the Foundation Series Growth Fund. | Managed Funds & KiwiSaver | InvestNow | Diversified | 0.37% | 0.37% | 0% / 0% | -1.12% | -0.85% | 8.47% | – | – | – | – | 5 | 98% / 2% | Passive | PIE | $9.0M | 04/03/2025 | – | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13175/OFR12915/FND56009/ | https://www.fundrock.com/fundrock-new-zealand-funds/foundation-series-high-growth-fund/ | https://cdn.investnow.co.nz/20260130134419/20260130-Foundation-Series-Funds-Diversified-Funds-PDS.pdf |

| Foundation Series Nasdaq-100 Fund | The Fund aims for high long-run returns by investing in an Exchange-Traded Fund (‘ETF’) that invests in shares of the largest non-financial companies listed on the Nasdaq stock exchange. The Fund’s objective is to perform broadly in line with the return of its investment benchmark before fees and tax over the long-term. The Fund’s investment benchmark is the Nasdaq-100 Notional Net Return Index®. | Managed Funds & KiwiSaver | InvestNow | International Equities | 0.15% | 0.15% | 0% / 0% | -3.76% | -6.26% | 7.69% | – | – | – | – | 6 | 100% / 0% | Passive | PIE | $23.2M | 05/06/2025 | – | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13175/OFR12915/FND57410/ | https://www.fundrock.com/fundrock-new-zealand-funds/foundation-series-nasdaq-100-fund/ | https://cdn.investnow.co.nz/20260130134412/20260130-Foundation-Series-Funds-Core-Equity-Funds-2-PDS.pdf |

| Foundation Series Total World Fund | The Fund aims for high long-run returns by investing in an Exchange-Traded Fund (‘ETF’) that invests in shares of large, mid-sized and small companies listed on international stock markets. The Fund’s objective is to perform broadly in line with the return of its investment benchmark before fees and tax over the long-term. The Fund’s investment benchmark is the Morningstar Global All Cap Target Market Exposure NR NZD Index. | Managed Funds & KiwiSaver | InvestNow | International Equities | 0.06% | 0.07% | 0% / 0% | −1.98% | −1.28% | 10.47% | 14.47% | 21.23% | – | – | 5 | 100% / 0% | Passive | PIE | $469.81M | 07/11/2022 | – | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13175/OFR12915/FND40819/ | https://www.fundrock.com/fundrock-new-zealand-funds/foundation-series-total-world-fund/ | https://cdn.investnow.co.nz/20260130134403/20260130-Foundation-Series-Funds-Core-Equity-Funds-1-PDS.pdf |

| Foundation Series US 500 Fund | The Fund aims for high long-run returns by investing in an Exchange-Traded Fund (‘ETF’) that invests in shares of the largest companies listed on stock markets in the United States. The Fund’s objective is to perform broadly in line with the return of its investment benchmark before fees and tax over the long-term. The Fund’s investment benchmark is the Morningstar US Target Market Exposure TR NZD Index. | Managed Funds & KiwiSaver | InvestNow | International Equities | 0.03% | 0.03% | 0% / 0% | −3.56% | −3.67% | 7.45% | 8.74% | 23.75% | – | – | 5 | 100% / 0% | Passive | PIE | $230.38M | 07/11/2022 | – | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13175/OFR12915/FND40818/ | https://www.fundrock.com/fundrock-new-zealand-funds/foundation-series-us-500-fund/ | https://cdn.investnow.co.nz/20260130134403/20260130-Foundation-Series-Funds-Core-Equity-Funds-1-PDS.pdf |

| Foundation Series US Dividend Equity Fund | The Fund aims for high long-run returns by investing in an Exchange-Traded Fund (‘ETF’) that invests in high dividend yielding shares issued by companies in the United States that have a record of consistently paying dividends. The Fund’s objective is to perform broadly in line with the return of its investment benchmark before fees and tax over the long-term. The Fund’s investment benchmark is the Dow Jones U.S. Dividend 100 Index (NZD) TR. | Managed Funds & KiwiSaver | InvestNow | International Equities | 0.06% | 0.06% | 0% / 0% | 3.35% | 5.72% | 10.13% | – | – | – | – | 5 | 100% / 0% | Passive | PIE | $8.70M | 04/03/2025 | Quarterly | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13175/OFR12915/FND56008/ | https://www.fundrock.com/fundrock-new-zealand-funds/foundation-series-us-dividend-equity-fund/ | https://cdn.investnow.co.nz/20260130134412/20260130-Foundation-Series-Funds-Core-Equity-Funds-2-PDS.pdf |

| Generate Focused Growth Managed Fund | The Fund aims to provide a higher return over the long term. It invests in an actively managed portfolio made up predominantly of growth assets with a minor allocation of income assets. | Managed Funds & KiwiSaver | Generate | Diversified | 1.31% | 1.39% | 0% / 0% | −0.98% | −0.96% | 4.85% | 5.39% | 15% | 8.31% | – | 5 | 95% / 5% | Active | PIE | $115.46M | 01/11/2019 | – | 3 Days | 3 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH12736/OFR12737/FND15960/ | https://www.generatewealth.co.nz/managed-funds | https://cdn.investnow.co.nz/20251203102931/Generate_Unit_Trust_Managed_FundsPDS_1-12-2025.pdf |

| Harbour Balanced Growth Fund | To outperform the benchmark before fees and tax over a rolling 5-year period. It is designed as a standalone diversified fund, and can also be mixed with other funds to add diversity to an investor’s overall portfolio. The Fund utilises high conviction investments managed by Harbour, complemented with global managers such as T. Rowe Price, Baillie Gifford and Western Asset Management. It has a target allocation of 70% to growth assets that is actively managed to respond to market conditions. | Managed Funds & KiwiSaver | Harbour | Diversified | 1.01% | 1.01% | 0% / 0% | −0.30% | 0.31% | 5.49% | 6.60% | 7.32% | 2.46% | – | 4 | 70% / 30% | Active | PIE | $59.04M | 01/11/2019 | Monthly | 2 Days | 3 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10815/OFR10909/FND16569/ | https://www.harbourasset.co.nz/our-funds/active-growth-fund/ | https://cdn.investnow.co.nz/20251121155443/Harbour_Product_Disclosure_Statement_-_Diversified_Funds_-_21_November_2025.pdf |

| Harbour Australasian Equity Focus Fund | A concentrated ‘best ideas’ growth fund holding Australasian listed equities (usually 15 to 25) which receive a high rating from our in-house analysts. The Fund is designed to deliver strong growth over the long term, through investing in a smaller number of high quality companies with strong growth prospects. | Managed Funds & KiwiSaver | Harbour | Australasian Equities | 1.34% | 1.20% | 0% / 0% | −3.31% | −6.95% | −6.01% | −11.70% | 2.18% | 0.76% | 8.13% | 5 | 95% / 5% | Active | PIE | $23.54M | 10/04/2014 | – | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10815/OFR10909/FND1425/ | https://www.harbourasset.co.nz/our-funds/aus-equity-focus-fund/ | https://cdn.investnow.co.nz/20251121155453/Harbour_Product_Disclosure_Statement_-_Australasian_Equities_and_Fixed_Interest_-_21_November_2025.pdf |

| Harbour Australasian Equity Fund | An actively managed growth fund, providing exposure to Australasian listed equities (usually 25 to 45 at a time). This Fund is designed to provide long-term capital growth through investing in New Zealand and Australian stocks with strong growth potential. It aims to outperform the local equity market. | Managed Funds | Harbour | Australasian Equities | 1.10% | 1.10% | 0% / 0% | −1.89% | −3.33% | −1.10% | −4.72% | 3.24% | 0.50% | 8.25% | 5 | 98% / 2% | Active | PIE | $111.29M | 11/04/2010 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10815/OFR10909/FND1421/ | https://www.harbourasset.co.nz/our-funds/aus-equity-fund/ | https://cdn.investnow.co.nz/20251121155453/Harbour_Product_Disclosure_Statement_-_Australasian_Equities_and_Fixed_Interest_-_21_November_2025.pdf |

| Harbour Australasian Equity Income Fund | The Fund is designed to generate attractive levels of quarterly income from a diversified portfolio of New Zealand and Australian listed equities that pay sustainable and growing dividend yields as well as holding cash and fixed interest securities. | Managed Funds | Harbour | Australasian Equities | 1.08% | 1.08% | 0% / 0% | −1.76% | −3.28% | 2.90% | 5.43% | 5.42% | 5.21% | 7.79% | 4 | 90% / 10% | Active | PIE | $37.29M | 01/11/2011 | Quarterly | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10815/OFR10909/FND1424/ | https://www.harbourasset.co.nz/our-funds/equity-income-fund/ | https://cdn.investnow.co.nz/20251121155453/Harbour_Product_Disclosure_Statement_-_Australasian_Equities_and_Fixed_Interest_-_21_November_2025.pdf |

| Harbour Income Fund | A diversified fund designed for investors who want to generate a steady and sustainable income across all market cycles, without sacrificing capital growth. It aims to exceed the Official Cash Rate plus 3.5% per annum (over rolling 3-year periods). | Managed Funds | Harbour | Diversified | 0.66% | 0.64% | 0% / 0% | −0.40% | −1.06% | 2.35% | 4.49% | 7.09% | 4.80% | 5.64% | 3 | 32% / 68% | Active | PIE | $296.95M | 28/10/2015 | Monthly | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10815/OFR10909/FND1422/ | https://www.harbourasset.co.nz/our-funds/income-fund/ | https://cdn.investnow.co.nz/20251121155443/Harbour_Product_Disclosure_Statement_-_Diversified_Funds_-_21_November_2025.pdf |

| Harbour Long Short Fund | An actively managed fund which invests principally, through both long and short positions, in listed Australasian equities. This Fund is designed to deliver positive absolute returns through the economic cycle with low volatility and low correlation of returns with equity markets. | Managed Funds | Harbour | Australasian Equities | 1.45% | 1.17% | 0% / 0% | −1.02% | −1.68% | 2.27% | 0.54% | 4.39% | 3.41% | – | 4 | 30% / 70% | Active | PIE | $5.36M | 03/01/2019 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10815/OFR10909/FND12572/ | https://www.harbourasset.co.nz/our-funds/long-short-fund/ | https://cdn.investnow.co.nz/20251121155453/Harbour_Product_Disclosure_Statement_-_Australasian_Equities_and_Fixed_Interest_-_21_November_2025.pdf |

| Harbour NZ Core Fixed Interest Fund | An actively managed fund that holds a mix of New Zealand Government and corporate bonds, designed as a risk-diversifier for those investors that also hold riskier assets such as equities and property. | Managed Funds & KiwiSaver | Harbour | New Zealand Fixed Interest | 0.65% | 0.65% | 0% / 0% | −0.22% | −1.21% | 2.36% | 4.88% | 5.23% | 1.12% | 2.64% | 3 | 0% / 100% | Active | PIE | $296.48M | 24/05/2011 | Quarterly | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10815/OFR10909/FND1412/ | https://www.harbourasset.co.nz/our-funds/core-fixed-interest-fund/ | https://cdn.investnow.co.nz/20251121155453/Harbour_Product_Disclosure_Statement_-_Australasian_Equities_and_Fixed_Interest_-_21_November_2025.pdf |

| Harbour NZ Corporate Bond Fund | A fixed interest fund that is designed to provide income through the yields available from investment-grade New Zealand corporate bonds. | Managed Funds | Harbour | New Zealand Fixed Interest | 0.47% | 0.46% | 0% / 0% | −0.22% | −0.72% | 2.26% | 5.31% | 5.93% | 1.89% | 3.08% | 3 | 0% / 100% | Active | PIE | $619.15M | 16/02/2009 | Quarterly | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10815/OFR10909/FND1413/ | https://www.harbourasset.co.nz/our-funds/corporate-bond-fund/ | https://cdn.investnow.co.nz/20251121155453/Harbour_Product_Disclosure_Statement_-_Australasian_Equities_and_Fixed_Interest_-_21_November_2025.pdf |

| Harbour NZ Index Shares Fund | This Fund is designed to provide low-cost exposure to the New Zealand share market by passively tracking the S&P/NZX 50 Portfolio Index. This index contains the top 50 companies listed on the NZX, but with a 5% cap on each company. | Managed Funds | Harbour | Australasian Equities | 0.21% | 0.21% | 0% / 0% | −1.54% | −1.15% | 6.05% | 6.25% | 4.46% | 1.39% | 8.22% | 5 | 99% / 1% | Passive | PIE | $720.17M | 03/12/2014 | Semi-annually | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10815/OFR10909/FND1423/ | https://www.harbourasset.co.nz/our-funds/index-shares/ | https://cdn.investnow.co.nz/20251121155453/Harbour_Product_Disclosure_Statement_-_Australasian_Equities_and_Fixed_Interest_-_21_November_2025.pdf |

| Harbour Real Estate Investment Fund | An actively managed fund that invests in listed companies which derive their economic value predominantly from owning or controlling real estate. The Fund provides investors with easier access to a diversified portfolio of different types of commercial and industrial property. | Managed Funds | Harbour | Listed Property | 0.74% | 0.76% | 0% / 0% | −3.62% | −6.44% | 1.60% | 3.97% | 3.58% | 0.01% | – | 5 | 97.5% / 2.5% | Active | PIE | $141.19M | 01/10/2018 | Semi-annually | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10815/OFR10909/FND11581/ | https://www.harbourasset.co.nz/our-funds/harbour-real-estate-investment-fund/ | https://cdn.investnow.co.nz/20251121155453/Harbour_Product_Disclosure_Statement_-_Australasian_Equities_and_Fixed_Interest_-_21_November_2025.pdf |

| Harbour Sustainable Impact Fund | A diversified fund designed for investors who want to grow their wealth and make a positive impact. This net carbon neutral fund aims to exceed the Official Cash Rate + 4% over rolling 5-year periods. It is also designed to make a positive impact as measured against UN Sustainable Development Goals, focusing on areas like climate change mitigation, natural capital, resource sustainability, thriving communities & infrastructure, and social inclusion. The fund includes exposure to global shares through Mirova and T. Rowe Price, Australasian shares and bonds/private credit managed by Harbour, and venture capital through Icehouse Ventures. | Managed Funds | Harbour | Diversified | 1.24% | 1.31% | 0% / 0% | −0.17% | −1.18% | 0.12% | 0.11% | 4.09% | – | – | 4 | 55%-72.5% / 27.5%-45% | Active | PIE | $8.83M | 30/11/2021 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10815/OFR10909/FND36270/ | https://www.harbourasset.co.nz/our-funds/sustainable-impact-fund/ | https://cdn.investnow.co.nz/20251121155436/Harbour_Product_Disclosure_Statement_-_Global_Funds_-_21_November_2025.pdf |

| Harbour Sustainable NZ Shares Fund | The fund invests in companies in the S&P NZX Portfolio Index, with exclusions to companies including but not limited to large carbon emitters, producers of alcohol, gambling services, controversial weapons and military equipment, pornography, firearms, tobacco, recreational cannabis, child labour, companies with human and animal right violations. There will also be positive and negative tilts to the remaining companies based on Harbour’s proprietary Corporate Behaviour Score. The Fund has the ability to implement securities lending. | Managed Funds | Harbour | Australasian Equities | 0.26% | 0.26% | 0% / 0% | −1.86% | −2.02% | 5.46% | 5.01% | 4.22% | – | – | 5 | 99% / 1% | Active | PIE | $400.08M | 07/04/2021 | Semi-annually | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10815/OFR10909/FND22696/ | https://www.harbourasset.co.nz/our-funds/harbour-sustainable-nz-shares-fund/ | https://cdn.investnow.co.nz/20251121155453/Harbour_Product_Disclosure_Statement_-_Australasian_Equities_and_Fixed_Interest_-_21_November_2025.pdf |

| Harbour T. Rowe Price Global Equity Fund | A high conviction, truly global equity portfolio seeking to invest in companies with above-average and sustainable growth characteristics. The Fund invests in a broadly diversified portfolio of global equities, typically comprising around 150 stocks. | Managed Funds & KiwiSaver | Harbour | International Equities | 1.20% | 1.19% | 0% / 0% | −2.76% | −4.16% | 5.52% | 5.92% | 17.76% | 8.51% | 13.13% | 5 | 98% / 2% | Active | PIE | $687.75M | 21/10/2015 | – | 2 Days | 3 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10815/OFR10909/FND1426/ | https://www.harbourasset.co.nz/our-funds/global-equity-fund/ | https://cdn.investnow.co.nz/20251121155436/Harbour_Product_Disclosure_Statement_-_Global_Funds_-_21_November_2025.pdf |

| Harbour T. Rowe Price Global Equity Fund – Hedged | A high conviction, truly global equity portfolio seeking to invest in companies with above-average and sustainable growth characteristics. The Fund invests in a broadly diversified portfolio of global equities, typically comprising around 150 stocks, and is 100% hedged to NZD. | Managed Funds | Harbour | International Equities | 1.22% | 1.22% | 0% / 0% | 1.67% | 0.14% | 6.44% | 9.06% | 14.03% | – | – | 6 | 95% / 5% | Active | PIE | $256.23M | 01/10/2021 | – | 2 Days | 3 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10815/OFR10909/FND35147/ | https://www.harbourasset.co.nz/our-funds/global-equity-fund/ | https://cdn.investnow.co.nz/20251121155436/Harbour_Product_Disclosure_Statement_-_Global_Funds_-_21_November_2025.pdf |

| Hunter Global Fixed Interest Fund | The Fund invests in a portfolio of international fixed income securities, derivatives and cash. The investment objective of the Fund is to provide a total return, before costs and tax, 1% p.a. higher than the Bloomberg Barclays Global Aggregate Index - 100% New Zealand dollar hedged over a rolling three year period. | Managed Funds & KiwiSaver | Harbour | International Fixed Interest | 0.53% | 0.53% | 0% / 0.10% | 0.12% | 0.14% | 2.55% | 4.66% | 4.56% | 0.37% | – | 4 | 0% / 100% | Active | PIE | $1,154.18M | 15/03/2017 | Semi-annually | 2 Days | 3 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH11176/OFR11173/FND2387/ | https://hunterinvestments.co.nz/hunter-fund/ | https://cdn.investnow.co.nz/20250224112008/Hunter-Global-Fixed-Interest-Fund-PDS.pdf |

| India Avenue Equity Fund | The Fund seeks to provide long-term capital growth to clients by investing in listed shares of companies benefitting from strong economic growth in India. We believe India’s growth creates a vibrant ecosystem for companies to grow their profits from growing consumption, infrastructure, technology and financial needs of a significant (over 1.3 billion people) and youthful (50% aged 26 or below) population. By investing in a diverse portfolio of companies, it is our belief that we can generate outperformance of our passive, market-capitalization weighted benchmark (MSCI India), with less volatility, over rolling 5 year periods. | Managed Funds | India Avenue | International Equities | 1.50% | N/A | 0.35% / 0.35% | −9.41% | −9.12% | −5.36% | −7.50% | 14.39% | 13.60% | – | 0 | 70%-100% / 0%-30% | Active | AUT | $61.97M | 06/09/2016 | Annually | 3 Days | 4 Days | No | N/A | https://indiaavenueinvest.com/our-fund/ | https://cdn.investnow.co.nz/20210601165208/India-Avenue-Equity-Fund-Retail-Class-NZ-PDS.pdf |

| Lighthouse Global Equity Fund | The Fund invests in very large capitalisation stocks and ETFs listed on the NYSE and Nasdaq stock markets. The investment objective of the Fund is to deliver long-run pre-tax returns (after fees and expenses) that are at least 2% pa above the return of the MSCI All Country World Net Index, and to minimise the Fund’s “losing years” – that is financial years where investors receive a negative return, or loss, rather than a positive return. The Fund may use leverage of up to 30% of NAV. The Fund’s foreign currency exposures are not hedged back to New Zealand dollars. | Managed Funds | Lighthouse | International Equities | 1.05% | 1.03% | 0.10% / 0.10% | −10.05% | −18.99% | −10.64% | −10.10% | 27.91% | – | – | 7 | 98% / 2% | Active | PIE | $21.62M | 01/03/2021 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH13048/OFR13049/FND22649/ | https://lighthousefunds.nz/our-managed-fund | https://cdn.investnow.co.nz/20250717100949/20250709-Lighthouse-PDS.pdf |

| Mercer All Country Global Shares Index Fund | The fund is a passively managed international shares portfolio that is designed to track the return of the MSCI All Country World ex Tobacco Index. The fund targets a position of being 69% gross hedged to the New Zealand dollar. The hedges are based on the currency components of the underlying index. | Managed Funds & KiwiSaver | Mercer | International Equities | 0.43% | 0.43% | 0.11% / 0.23% | 1.01% | 1.64% | 10.83% | 15.95% | 19.06% | 12.23% | – | 5 | 100% / 0% | Passive | PIE | $103.53M | 27/11/2017 | Semi-annually | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10307/OFR10322/FND8207/ | https://www.multimanager.mercer.co.nz/funds/overview.html | https://cdn.investnow.co.nz/20260130145012/Mercer-Investment-Funds-PDS-%E2%80%93-Index-Funds.pdf |

| Mercer Core Global Shares Fund | The fund invests in shares listed on share markets predominately in developed economies. The portfolio uses multiple managers and is diversified by region, manager and investment approaches. | Managed Funds | Mercer | International Equities | 1.25% | 1.26% | 0.13% / 0.11% | −1.88% | −0.92% | 10.74% | 14.07% | 23.89% | 17.06% | 13.72% | 5 | 100% / 0% | Active | PIE | $62.61M | 26/11/2007 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10307/OFR10322/FND84/ | https://www.multimanager.mercer.co.nz/funds/overview.html | https://cdn.investnow.co.nz/20260130145101/Mercer-Investment-Funds-PDS-%E2%80%93-Global-Shares-Funds.pdf |

| Mercer Core Hedged Global Shares Fund | The fund invests in shares listed on share markets predominately in developed economies, and is fully hedged to the New Zealand dollar. The portfolio uses multiple managers and is diversified by region, manager and investment approaches. | Managed Funds | Mercer | International Equities | 1.45% | 1.48% | 0.13% / 0.11% | 4.03% | 4.85% | 12.03% | 18.69% | 18.48% | 11.31% | 11.85% | 6 | 100% / 0% | Active | PIE | $19.56M | 26/11/2007 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10307/OFR10322/FND85/ | https://www.multimanager.mercer.co.nz/funds/overview.html | https://cdn.investnow.co.nz/20260130145101/Mercer-Investment-Funds-PDS-%E2%80%93-Global-Shares-Funds.pdf |

| Mercer Responsible Balanced Fund | The fund is a diversified portfolio with a slightly higher allocation to a mix of growth assets (e.g., shares and listed property) relative to a mix of income assets (e.g., cash and fixed income). The fund has been certified by the Responsible Investment Association of Australasia. | Managed Funds & KiwiSaver | Mercer | Diversified | 1.26% | 1.27% | 0.11% / 0.11% | −0.42% | −0.60% | 4.06% | 6.31% | 7.74% | 5.19% | 6.40% | 4 | 60% / 40% | Active | PIE | $30.46M | 11/08/2009 | – | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10307/OFR10322/FND101/ | https://www.multimanager.mercer.co.nz/funds/overview.html | https://cdn.investnow.co.nz/20251203103242/Mercer-Investment-Funds-PDS-%E2%80%93-Mercer-Responsible-Balanced-Fund.pdf |

| Mercer Responsible Global Shares Fund | The fund invests in shares listed on international share markets managed within a sustainable approach. The fund is managed to specific ‘sustainable investment’ criteria which prohibits investments in certain companies or activities, and encourages investment in companies with strong environmental, social and governance characteristics. This fund has additional exclusions applied as described in our Sustainable Investment Policy and has been certified by the Responsible Investment Association of Australasia (RIAA). | Managed Funds | Mercer | International Equities | 1.69% | 1.71% | 0.13% / 0.11% | 0.89% | 1.65% | 10.13% | 14.70% | 17.41% | 12.44% | 11.62% | 5 | 100% / 0% | Active | PIE | $13.73M | 06/11/2007 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10307/OFR10322/FND87/ | https://www.multimanager.mercer.co.nz/funds/overview.html | https://cdn.investnow.co.nz/20260130145101/Mercer-Investment-Funds-PDS-%E2%80%93-Global-Shares-Funds.pdf |

| Mercer Responsible Hedged Global Fixed Interest Index Fund | The fund is a passively managed international fixed interest portfolio that is designed to track the return of the Bloomberg Barclays MSCI Global Aggregate SRI Select ex Fossil Fuels Index. The fund is fully hedged to New Zealand dollars. As described in our Sustainable Investment Policy, this fund is managed to specific ‘sustainable investment’ criteria which prohibits investments in certain companies or activities, and encourages investment in companies with strong environmental, social and governance characteristics. | Managed Funds & KiwiSaver | Mercer | International Fixed Interest | 0.44% | 0.44% | 0.08% / 0.08% | 0.05% | −0.31% | 1.37% | 3.02% | 2.97% | −0.82% | – | 4 | 0% / 100% | Passive | PIE | $519.71M | 27/11/2017 | Semi-annually | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10307/OFR10322/FND8206/ | https://www.multimanager.mercer.co.nz/funds/overview.html | https://cdn.investnow.co.nz/20260130145012/Mercer-Investment-Funds-PDS-%E2%80%93-Index-Funds.pdf |

| Mercer Responsible Trans-Tasman Shares Fund | The fund is a diversified portfolio of predominantly New Zealand shares across a range of industries and sectors. The portfolio may also invest in Australian shares. The fund is managed to specific ‘sustainable investment’ criteria which prohibits investments in certain companies or activities, and encourages investment in companies with strong environmental, social and governance factors and also actively engages on key thematic engagements each year. This fund has additional exclusions applied as described in our Sustainable Investment Policy and has been certified by the Responsible Investment Association of Australasia (RIAA). | Managed Funds | Mercer | Australasian Equities | 1.04% | 1.07% | 0.28% / 0.28% | −1.97% | −2.59% | 1.55% | −1.95% | 4.76% | 1.24% | 8.93% | 5 | 100% / 0% | Active | PIE | $34.11M | 12/12/2012 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10307/OFR10322/FND94/ | https://www.multimanager.mercer.co.nz/funds/overview.html | https://cdn.investnow.co.nz/20251203103008/Mercer-Investment-Funds-PDS-NZ-Australian-Shares-Funds.pdf |

| Mercer Global Shares Fund | The fund invests in international shares listed on share markets around the world by using investment managers from around the world which are combined in a multi-manager fund. | Managed Funds | Mercer | International Equities | 1.25% | 1.27% | 0.13% / 0.12% | 1.96% | 2.55% | 11.99% | 18.05% | 20.32% | 13.01% | 12.60% | 5 | 100% / 0% | Active | PIE | $32.7M | 13/12/1994 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10307/OFR10322/FND83/ | https://www.multimanager.mercer.co.nz/funds/overview.html | https://cdn.investnow.co.nz/20260130145101/Mercer-Investment-Funds-PDS-%E2%80%93-Global-Shares-Funds.pdf |

| Mercer Income Generator Fund | The fund aims to provide a gross fixed monthly income in excess of bank deposit rates, along with a positive return on capital over the long term. To achieve this, the fund invests in a diversified mix of growth and defensive assets, with a focus on reliable income generation. | Managed Funds | Mercer | Diversified | 1.26% | 1.29% | 0.15% / 0.15% | −0.33% | −0.44% | 2.26% | 3.34% | 4.41% | 3.16% | 5.49% | 4 | 40% / 60% | Active | PIE | $24.96M | 30/06/2014 | Monthly | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10307/OFR10322/FND89/ | https://www.multimanager.mercer.co.nz/funds/overview.html | https://cdn.investnow.co.nz/20251203103124/Mercer-Investment-Funds-PDS-%E2%80%93-Goals-Based-Funds.pdf |

| Mercer Global Listed Infrastructure Fund | The fund invests in infrastructure securities in both developed and emerging markets across a range of sectors. This provides access to a range of infrastructure sectors across geographic regions, with active portfolio management that seeks to target excess returns and predictable, stable cash flows. | Managed Funds | Mercer | Other | 1.35% | 1.36% | 0.25% / 0.26% | 2.56% | 2.71% | 4.64% | 12.76% | 7.05% | 9.53% | 8.39% | 5 | 100% / 0% | Active | PIE | $84.17M | 07/09/2012 | Semi-annually | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10307/OFR10322/FND98/ | https://www.multimanager.mercer.co.nz/funds/overview.html | https://cdn.investnow.co.nz/20251203103327/Mercer-Investment-Funds-PDS-%E2%80%93-Property-and-Infrastructure-Funds.pdf |

| Mercer Global Listed Real Estate Fund | The fund invests in a global portfolio of property securities listed on stock exchanges around the world. It aims to generate medium to high returns over the long term by investing in a broad range of property regions, sectors and securities through a single fund. | Managed Funds & KiwiSaver | Mercer | Listed Property | 1.34% | 1.35% | 0.25% / 0.26% | 1.85% | 2.21% | 6.21% | 7.51% | 4.59% | 3.52% | 4.11% | 6 | 100% / 0% | Active | PIE | $67.41M | 29/11/2007 | Semi-annually | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10307/OFR10322/FND97/ | https://www.multimanager.mercer.co.nz/funds/overview.html | https://cdn.investnow.co.nz/20251203103327/Mercer-Investment-Funds-PDS-%E2%80%93-Property-and-Infrastructure-Funds.pdf |

| Mercer Macquarie NZ Cash Fund | The fund is an actively managed portfolio of bank bills, floating rate notes and short term securities and liquid deposits and is a very low risk product that targets capital security. | Managed Funds & KiwiSaver | Mercer | Cash and Cash Equivalents | 0.30% | 0.30% | 0% / 0% | 0.19% | 0.61% | 1.48% | 3.30% | 4.72% | 3.41% | 3% | 2 | 0% / 100% | Active | PIE | $279.07M | 01/06/1995 | Semi-annually | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10307/OFR10322/FND78/ | https://www.multimanager.mercer.co.nz/funds/overview.html | https://cdn.investnow.co.nz/20251203103030/Mercer-Investment-Funds-PDS-%E2%80%93-Cash-and-Fixed-Interest-Funds.pdf |

| Mercer Macquarie NZ Fixed Interest Fund | The fund is an actively managed portfolio of fixed interest securities, focusing predominantly on government bonds and corporate securities in the New Zealand market. | Managed Funds & KiwiSaver | Mercer | New Zealand Fixed Interest | 0.61% | 0.61% | 0.07% / 0.07% | −0.28% | −1.30% | 2.04% | 4.66% | 4.69% | 0.55% | 2.35% | 3 | 0% / 100% | Active | PIE | $235.16M | 05/06/1995 | Semi-annually | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10307/OFR10322/FND79/ | https://www.multimanager.mercer.co.nz/funds/overview.html | https://cdn.investnow.co.nz/20251203103030/Mercer-Investment-Funds-PDS-%E2%80%93-Cash-and-Fixed-Interest-Funds.pdf |

| Mercer Macquarie NZ Short Duration Fund | The fund is an actively managed portfolio of fixed interest securities, focusing predominantly on corporate securities in the New Zealand and Australian market with a shorter average maturity than a standard fixed interest fund. | Managed Funds | Mercer | New Zealand Fixed Interest | 0.67% | 0.69% | 0.05% / 0.05% | −0.03% | −0.09% | 2.03% | 4.49% | 5.49% | 2.62% | 2.90% | 2 | 0% / 100% | Active | PIE | $48.29M | 28/09/2007 | Semi-annually | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10307/OFR10322/FND80/ | https://www.multimanager.mercer.co.nz/funds/overview.html | https://cdn.investnow.co.nz/20251203103030/Mercer-Investment-Funds-PDS-%E2%80%93-Cash-and-Fixed-Interest-Funds.pdf |

| Mercer NZ Shares Passive Fund | The fund is a passively managed New Zealand shares portfolio that is designed to track the return of the S&P/NZX 50 Index. | Managed Funds & KiwiSaver | Mercer | Australasian Equities | 0.49% | 0.36% | 0.30% / 0.30% | −1.51% | −0.94% | 4.21% | 3.03% | 4.22% | 0.83% | – | 5 | 100% / 0% | Passive | PIE | $42.83M | 27/11/2017 | Semi-annually | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10307/OFR10322/FND8205/ | https://www.multimanager.mercer.co.nz/funds/overview.html | https://cdn.investnow.co.nz/20260130145012/Mercer-Investment-Funds-PDS-%E2%80%93-Index-Funds.pdf |

| Milford Active Growth Fund | The Fund’s objective is to provide annual returns of 10% after the base fund fee but before tax and before the performance fee, over the minimum recommended investment timeframe of seven years. It is a diversified fund that primarily invests in equities, with a moderate allocation to fixed interest securities. | Managed Funds & KiwiSaver | Milford | Diversified | 1.25% | 1.05% | 0.10%* | −0.05% | 0.38% | 4.89% | 10.10% | 11.77% | 9.58% | 10.31% | 4 | 78% / 22% | Active | PIE | $6,111.49M | 01/10/2007 | – | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10700/OFR10702/FND753/ | https://milfordasset.com/funds-performance/active-growth-fund | https://cdn.investnow.co.nz/20250619161529/Milford_Investment_Funds_-_Product_Disclosure_Statement_-_18_June_2025.pdf |

| Milford Aggressive Fund | The Fund’s objective is to maximise capital growth after the base fund fee but before tax and before any indirect performance fee, over the minimum recommended investment timeframe of ten years. It primarily invests in international equities, with a moderate allocation to Australasian equities. | Managed Funds & KiwiSaver | Milford | Diversified | 1.15% | 1.15% | 0.09%* | −0.79% | −1.78% | 2.68% | 5.11% | 12.51% | – | – | 5 | 95% / 5% | Active | PIE | $3,788.85M | 21/06/2021 | – | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10700/OFR10702/FND23786/ | https://milfordasset.com/funds-performance/aggressive-fund | https://cdn.investnow.co.nz/20250619161529/Milford_Investment_Funds_-_Product_Disclosure_Statement_-_18_June_2025.pdf |

| Milford Australian Absolute Growth Fund | The Fund’s targets an absolute return with an annualised return objective of 5% above the New Zealand Official Cash Rate while seeking to protect capital after the base fund fee but before tax and before the performance fee, over rolling three year periods. The Fund has a minimum recommended investment timeframe of seven years. It is a diversified fund that primarily invests in Australasian equities, complemented by selective exposure to international equities, fixed interest securities and cash. | Managed Funds | Milford | Australasian Equities | 1.30% | 1.05% | 0.12%* | 1.98% | 2.40% | 4.36% | 8.66% | 6.95% | 7.12% | – | 4 | 82.5% / 17.5% | Active | PIE | $180.27M | 01/03/2018 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10700/OFR10702/FND9239/ | https://milfordasset.com/funds-performance/australian-absolute-growth-fund | https://cdn.investnow.co.nz/20250619161529/Milford_Investment_Funds_-_Product_Disclosure_Statement_-_18_June_2025.pdf |

| Milford Balanced Fund | The Fund’s objective is to provide capital growth after management and administration charges but before tax and before the performance fee over the minimum recommended investment timeframe of five years. It is a diversified fund that primarily invests in equities, with a significant allocation to fixed interest securities. | Managed Funds & KiwiSaver | Milford | Diversified | 1.07% | 1.06% | 0.12%* | 0.18% | −0.21% | 2.94% | 7% | 8.64% | 6.87% | 8.18% | 4 | 61% / 39% | Active | PIE | $2,607.72M | 01/04/2010 | – | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10700/OFR10702/FND513/ | https://milfordasset.com/funds-performance/balanced-fund | https://cdn.investnow.co.nz/20250619161529/Milford_Investment_Funds_-_Product_Disclosure_Statement_-_18_June_2025.pdf |

| Milford Cash Fund | The Fund’s objective is to provide a return above the New Zealand Official Cash Rate. It primarily invests in New Zealand cash, short-dates debt securities and term deposits. | Managed Funds | Milford | Cash and Cash Equivalents | 0.20% | 0.20% | 0.00%* | 0.20% | 0.63% | 1.43% | 3.31% | 4.76% | 3.48% | – | 1 | 0% / 100% | Active | PIE | $937.76M | 01/03/2019 | – | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10700/OFR10702/FND13445/ | https://milfordasset.com/funds-performance/cash-fund | https://cdn.investnow.co.nz/20250619161529/Milford_Investment_Funds_-_Product_Disclosure_Statement_-_18_June_2025.pdf |

| Milford Conservative Fund | The Fund’s objective is to provide a moderate return and protect capital after management and administration charges but before tax over the minimum recommended investment timeframe of three years. It is a diversified fund that primarily invests in fixed interest securities, with a moderate allocation to equities. | Managed Funds & KiwiSaver | Milford | Diversified | 0.85% | 0.87% | 0.12%* | 0.15% | −0.59% | 1.31% | 4.80% | 6.32% | 3.51% | 5.09% | 3 | 18% / 82% | Active | PIE | $916.01M | 01/09/2015 | Quarterly | 2 Days | 2 Days | Yes | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10700/OFR10702/FND752/ | https://milfordasset.com/funds-performance/conservative-fund | https://cdn.investnow.co.nz/20250619161529/Milford_Investment_Funds_-_Product_Disclosure_Statement_-_18_June_2025.pdf |

| Milford Diversified Income Fund | The Fund’s objective is to provide income and capital growth after the base fund fee but before tax and before the performance fee, over the minimum recommended investment timeframe of four years. It is a diversified fund that primarily invests in fixed interest and equity income-generating securities. | Managed Funds | Milford | Diversified | 0.85% | 0.65% | 0.15%* | 0.59% | 0.31% | 2.36% | 6.89% | 6.83% | 5.08% | 6.93% | 3 | 40% / 60% | Active | PIE | $3,538.33M | 01/04/2010 | Quarterly | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10700/OFR10702/FND515/ | https://milfordasset.com/funds-performance/diversified-income-fund | https://cdn.investnow.co.nz/20250619161529/Milford_Investment_Funds_-_Product_Disclosure_Statement_-_18_June_2025.pdf |

| Milford Global Corporate Bond Fund | The Fund’s objective is to protect capital and generate a positive, NZD hedged return after management and administration charges but before tax that exceeds the relevant benchmark over the minimum recommended investment timeframe of three years. | Managed Funds | Milford | International Fixed Interest | 0.85% | 0.85% | 0.12%* | 0.30% | 0.26% | 3% | 6.06% | 5.78% | 2.00% | – | 3 | 0% / 100% | Active | PIE | $413.49M | 01/02/2017 | Quarterly | 2 Days | 2 Days | No | https://smartinvestor.sorted.org.nz/kiwisaver-and-managed-funds/SCH10700/OFR10702/FND9241/ | https://milfordasset.com/funds-performance/global-corporate-bond-fund | https://cdn.investnow.co.nz/20250619161529/Milford_Investment_Funds_-_Product_Disclosure_Statement_-_18_June_2025.pdf |