Switching KiwiSaver – the hidden cost and how to avoid it

Article written by Anthony Edmonds – 24 April 2024

According to the Financial Markets Authority (FMA), New Zealanders made around 500,000 individual changes to their KiwiSaver investments last financial year. While changing your KiwiSaver investment approach is theoretically free, the snail pace at which it happens can result in some significant costs to investors.

There are two main ways people make changes to their KiwiSaver investments:

- Switches: Moving from one KiwiSaver investment fund into another fund, all while staying in the same scheme (e.g. going from a Conservative Fund to a Balanced Fund)

- Transfers: Moving from one KiwiSaver investment fund into another fund offered by a different scheme (e.g. going from the Milford Conservative Fund to the Fisher Funds Growth Fund)

There were around 130,000 transfers and almost 370,000 switches in the last financial year, including over 40,000 that switched KiwiSaver investments multiple times in the same year.

This suggests that a sizable number of Kiwis may not appreciate the real cost of flip-flopping on their investment decision making.

The out of market cost

When you transfer from one KiwiSaver scheme to another, it takes up to 10 business days to take effect. In that time, your money is effectively out of the market, which has a cost in terms of missing out on any market movements. Switching funds is faster – around 3 days – but that can still be significant, especially for those making multiple switches within a year.

According to the FMA, nearly 6,000 investors switched their KiwiSaver investment funds five times or more last year. Assuming it takes three days minimum to process each switch, this could mean they were out of market for at least 15 business days.

The exact out-of-market cost of this break will depend on what those investors were invested in, and the market performance on those days.

However, if we take the S&P 500 as an example, we can see that someone that was fully invested throughout all of 2023 would’ve enjoyed a roughly 24% gain on their investment.

If a person was out of the market for just ten of the S&P 500’s best market-performing days of 2023, that annual return goes from 24% to less than 4% – a nearly 90% drop-off in returns for just 10 days – the same amount of time it can take to transfer from one KiwiSaver Scheme to another.

Missing 15 of the S&P 500’s best market performing days in the year would result in your 2023 return being negative – “returning” almost -4% for the year. For those that made multiple changes to their KiwiSaver investments during the year, 15 days out of the market wasn’t hard to achieve.

Applying these return figures to the average KiwiSaver portfolio value of around $30,000, the investor that was out of the market for just those 10 best days would have had a measly $1,000 gain over 2023. If they’d remained invested for the whole year, they would have generated a $7,000 gain.

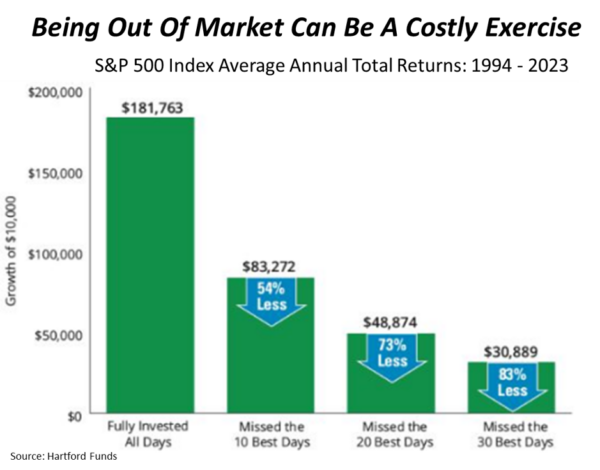

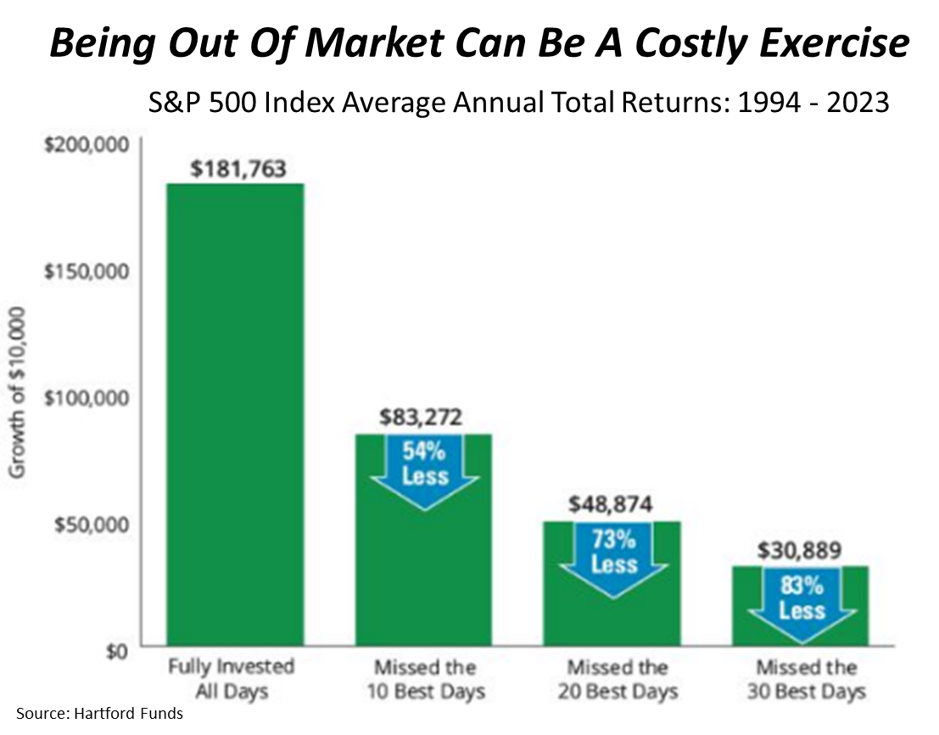

These sizable out-of-market costs aren’t an isolated event either just because 2023 was a gangbuster year for markets. In fact, the substantial cost of missing key market days can also be seen when we look back further in time, and is even more pronounced over longer-term horizons.

For example, looking at the S&P 500’s performance across the past 30 years, missing out on just the best 10 days would lead to a 54% lower investment portfolio, while missing out on just 20 days would result in a 73% lower balance.

When should you change your KiwiSaver investments?

To avoid the out-of-market costs, ideally there should be little need to make changes to your KiwiSaver investments.

The numbers suggest Kiwis understand this. The FMA highlighted that over the 2023 reporting period, there were 19.1% fewer switches compared to 2022, while the number of people transferring between KiwiSaver providers was down 16.8% year-on-year.

Your KiwiSaver portfolio should align with your investment objectives and risk preferences, which shouldn’t change drastically from one year to the next.

But you do need to understand what those objectives are when you first join KiwiSaver. If investors don’t do this first, then they may want to change at some point in the future when they do give it some thought.

There are other good reasons why someone may want to change their KiwiSaver investments.

Changing investment needs (i.e. buying a house, having kids or retiring), issues with the value and service from your current provider, as well as fees and performance could all be valid reasons for a change.

However, because typical KiwiSaver schemes limit your investment choices to just the ones offered by a single manager (typically the promoter of the scheme), changing investment managers will typically also require a transfer from one KiwiSaver scheme to another – and a potentially expensive 10 days out of the market.

It may well be that a change can lead to greater future returns, but that should also be weighed up against the cost of that change.

The sensible solution

At InvestNow, we’ve always championed offering greater investment value and choice. We believe investors shouldn’t be tied to a single fund manager’s investment options, which is typically the case with most KiwiSaver providers.

So, in 2020, we built our own KiwiSaver scheme that has investment options from more than 15 leading investment managers wrapped up inside it.

This enables investors to diversify their KiwiSaver investments among different investment managers – capturing the skills and benefits that their different investment expertise brings – which can help mitigate risk and provide better returns in rocky climates.

It also means that when you do want to change investment managers, it’s a simple fund switch rather than a scheme transfer – so you’re only out of the market for three days as opposed to 10. This minimises the hidden cost of changing your KiwiSaver investments and maximises the time your money is working towards funding the retirement of your choice.

To learn more about how the InvestNow KiwiSaver Scheme can help you stay invested in the market for longer and get the most out of retirement, visit investnow.co.nz/kiwisaver.

The information and opinions in this publication are based on sources that InvestNow believes are reliable and accurate. InvestNow makes no representations or warranties of any kind as to the accuracy or completeness of the information contained in this publication and disclaim liability for any loss, damage, cost or expense that may arise from any reliance on the information or any opinions, conclusions or recommendations contained in it, whether that loss or damage is caused by any fault or negligence on the part of InvestNow, or otherwise, except for any statutory liability which cannot be excluded. All opinions reflect InvestNow’s judgment on the date of this publication and are subject to change without notice. This disclaimer extends to any entity that may distribute this publication. The information in this publication is not intended to be financial advice for the purposes of the Financial Markets Conduct Act 2013, as amended by the Financial Services Legislation Amendment Act 2019. In particular, in preparing this document, InvestNow did not take into account the investment objectives, financial situation and particular needs of any particular person. Professional investment advice from an appropriately qualified adviser should be taken before making any investment.

Switching KiwiSaver – the hidden cost and how to avoid it

Article written by Anthony Edmonds – 24 April 2024

According to the Financial Markets Authority (FMA), New Zealanders made around 500,000 individual changes to their KiwiSaver investments last financial year. While changing your KiwiSaver investment approach is theoretically free, the snail pace at which it happens can result in some significant costs to investors.

There are two main ways people make changes to their KiwiSaver investments:

- Switches: Moving from one KiwiSaver investment fund into another fund, all while staying in the same scheme (e.g. going from a Conservative Fund to a Balanced Fund)

- Transfers: Moving from one KiwiSaver investment fund into another fund offered by a different scheme (e.g. going from the Milford Conservative Fund to the Fisher Funds Growth Fund)

There were around 130,000 transfers and almost 370,000 switches in the last financial year, including over 40,000 that switched KiwiSaver investments multiple times in the same year.

This suggests that a sizable number of Kiwis may not appreciate the real cost of flip-flopping on their investment decision making.

The out of market cost

When you transfer from one KiwiSaver scheme to another, it takes up to 10 business days to take effect. In that time, your money is effectively out of the market, which has a cost in terms of missing out on any market movements. Switching funds is faster – around 3 days – but that can still be significant, especially for those making multiple switches within a year.

According to the FMA, nearly 6,000 investors switched their KiwiSaver investment funds five times or more last year. Assuming it takes three days minimum to process each switch, this could mean they were out of market for at least 15 business days.

The exact out-of-market cost of this break will depend on what those investors were invested in, and the market performance on those days.

However, if we take the S&P 500 as an example, we can see that someone that was fully invested throughout all of 2023 would’ve enjoyed a roughly 24% gain on their investment.

If a person was out of the market for just ten of the S&P 500’s best market-performing days of 2023, that annual return goes from 24% to less than 4% – a nearly 90% drop-off in returns for just 10 days – the same amount of time it can take to transfer from one KiwiSaver Scheme to another.

Missing 15 of the S&P 500’s best market performing days in the year would result in your 2023 return being negative – “returning” almost -4% for the year. For those that made multiple changes to their KiwiSaver investments during the year, 15 days out of the market wasn’t hard to achieve.

Applying these return figures to the average KiwiSaver portfolio value of around $30,000, the investor that was out of the market for just those 10 best days would have had a measly $1,000 gain over 2023. If they’d remained invested for the whole year, they would have generated a $7,000 gain.

These sizable out-of-market costs aren’t an isolated event either just because 2023 was a gangbuster year for markets. In fact, the substantial cost of missing key market days can also be seen when we look back further in time, and is even more pronounced over longer-term horizons.

For example, looking at the S&P 500’s performance across the past 30 years, missing out on just the best 10 days would lead to a 54% lower investment portfolio, while missing out on just 20 days would result in a 73% lower balance.

When should you change your KiwiSaver investments?

To avoid the out-of-market costs, ideally there should be little need to make changes to your KiwiSaver investments.

The numbers suggest Kiwis understand this. The FMA highlighted that over the 2023 reporting period, there were 19.1% fewer switches compared to 2022, while the number of people transferring between KiwiSaver providers was down 16.8% year-on-year.

Your KiwiSaver portfolio should align with your investment objectives and risk preferences, which shouldn’t change drastically from one year to the next.

But you do need to understand what those objectives are when you first join KiwiSaver. If investors don’t do this first, then they may want to change at some point in the future when they do give it some thought.

There are other good reasons why someone may want to change their KiwiSaver investments.

Changing investment needs (i.e. buying a house, having kids or retiring), issues with the value and service from your current provider, as well as fees and performance could all be valid reasons for a change.

However, because typical KiwiSaver schemes limit your investment choices to just the ones offered by a single manager (typically the promoter of the scheme), changing investment managers will typically also require a transfer from one KiwiSaver scheme to another – and a potentially expensive 10 days out of the market.

It may well be that a change can lead to greater future returns, but that should also be weighed up against the cost of that change.

The sensible solution

At InvestNow, we’ve always championed offering greater investment value and choice. We believe investors shouldn’t be tied to a single fund manager’s investment options, which is typically the case with most KiwiSaver providers.

So, in 2020, we built our own KiwiSaver scheme that has investment options from more than 15 leading investment managers wrapped up inside it.

This enables investors to diversify their KiwiSaver investments among different investment managers – capturing the skills and benefits that their different investment expertise brings – which can help mitigate risk and provide better returns in rocky climates.

It also means that when you do want to change investment managers, it’s a simple fund switch rather than a scheme transfer – so you’re only out of the market for three days as opposed to 10. This minimises the hidden cost of changing your KiwiSaver investments and maximises the time your money is working towards funding the retirement of your choice.

To learn more about how the InvestNow KiwiSaver Scheme can help you stay invested in the market for longer and get the most out of retirement, visit investnow.co.nz/kiwisaver.