KiwiSaver in suspense: Why contribution holidays have expensive endings

Article written by InvestNow – 31 July 2023

In 2019 the government formally rebranded the popular KiwiSaver ‘contribution holiday’ as ‘savings suspension’ in an attempt to make the option seem less attractive, and hopefully discourage people from taking up the option of halting their KiwiSaver contributions.

The brand twist did not make an immediate impact: whether they viewed it as getting suspended or going on holiday, the number of KiwiSaver members pausing contributions actually increased by almost 1,000 in the 12 months after the name change, to hit almost 136,800 by June 2020, according to Inland Revenue Department (IRD) statistics.

As at June 30, 2021, the holiday/suspension figures dropped to about 114,500, perhaps reflecting the then-booming markets or possibly due to an IRD administrative change introduced the previous year that warped the statistical series.

Either way, by the following June 30, 2022, the number of KiwiSaver members on a contributions break had dropped below 100,000 for the first time since 2012.

But the members-on-suspension trend is on the rise again, clocking in at almost 103,600 at the end of May 2023 (up close to 3,000 compared to the same month in 2022), in a worrying, if not surprising, indication that the cost-of-living crisis is eating into long-term-saving plans.

Statistics NZ figures show the price-squeeze is real enough with the cost-of-living for the average Kiwi household increasing 6.7 per cent over the 12 months to the end of March 2023.

Piggybank in the middle

KiwiSaver likely represents a soft target for many cash-strapped New Zealanders struggling to make ends meet as living expenses continue to soar.

Indeed, KiwiSaver providers are starting to see a surge in members applying for financial hardship withdrawals this year, which shows in IRD data: over 2,500 members tapped their KiwiSaver accounts on hardship grounds this May versus about 1,370 in the same month last year.

The law rightly sets a high bar for allowing financial hardship payments given early withdrawals will substantially reduce the amount of money available for members in retirement.

In spite of the early withdrawal risks, however, the tug-of-war between the urgent financial demands of now and generating future retirement income continues to drag on.

For example, the National Party tabled an election policy in July that would open up KiwiSaver to withdrawals to fund rental bonds.

The National plan received little enthusiasm from either the public or investment industry, but the ensuing debate highlighted the limits and dangers of treating KiwiSaver as a piggybank to cover all manner of short-term financial stresses.

How gap years can leave a big hole in retirement

If the long-term impact of emptying retirement savings accounts to pay for current expenses might seem obvious, the costs of contribution vacations are more subtle.

Unlike financial hardship withdrawals, all KiwiSaver members are free to take a contribution holiday at their leisure. The KiwiSaver Act sets the standard suspension timeframe between a minimum of 3 months to a maximum of 1 year per suspension application, but members can simply extend year-on-year as long as required, with no limit.

Stopping KiwiSaver contributions undoubtedly leaves members with more money in the hand: based on an annual salary in NZ of $80,000 and an employee contribution rate of 3 per cent, workers would pocket a further $1,880.40 each year that previously would’ve gone to their KiwiSaver accounts.

The cash-in-hand does not come for free, though, with potential downsides including:

- Losing matching employer contributions – employers stop paying the mandatory 3 per cent co-contributions for KiwiSaver members on savings suspensions. Depending on the employment agreement, this could represent a real income reduction;

- Missing out on the $521 plus annual government KiwiSaver top–up – the so-called ‘member tax credit’ is paid each year by the government in line with employee (or voluntary) contributions up to just over $1,042, maxing-out at $521 and a few cents; and,

- Foregone investment returns – halting contributions will inevitably leave members with less capital accruing long-term returns.

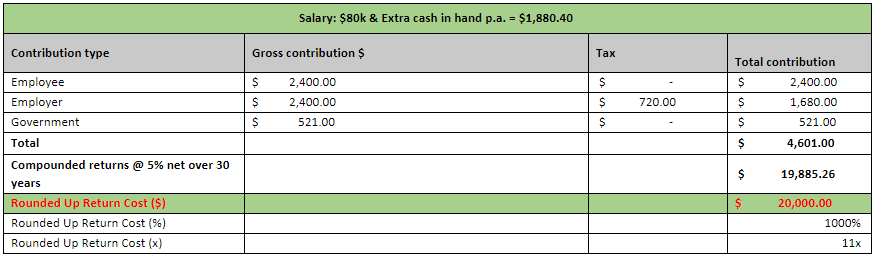

To expand on the final point – and putting the pieces together – a one-year KiwiSaver contribution holiday for someone on an $80,000 salary, aged 35, might play out like so:

Extra cash in hand per year = $1,880.40 after tax, noting that if it were contributed to KiwiSaver the full pre-tax amount would go into their KiwiSaver portfolio

But in exchange for $1,880.40 now, the KiwiSaver opportunity cost comes to:

In short, the decision to stop contributions for just one year in this scenario has reduced the future KiwiSaver balance at the current access age of 65 by just under $20,000.

The result illustrates the first of the InvestNow 10 investment principles, which centres on the importance of starting early and making regular contributions as “compound returns pile up over time so the sooner the better”.

Individual circumstances vary, of course, and there may be compelling reasons why making a legal KiwiSaver withdrawal or pausing contributions is the best option.

However, the idealised example above underscores why anybody feeling the cost-of-living squeeze should consider very carefully before taking a contributions holiday: the suspense could kill off a comfortable retirement.

“I know I’ll miss out on the compound returns and employer contributions, but we just didn’t have much of a choice at the moment. My wife isn’t working, and we needed the cash in hand to pay the mortgage.

To make up for it, I’ll need to bump up my contribution rate when my savings suspension ends”. says an InvestNow KiwiSaver Scheme investor currently on a savings suspension.

Mike Heath, InvestNow General Manager responds “We understand that when push comes to shove, sometimes we’ll need to make some tough choices, but we strongly discourage people from taking contribution holidays or saving suspensions if they have other options. We can’t stress enough the long-term value and importance of consistent investment habits.

That being said, it’s great to hear there is general awareness from our customers about what’s needed to get back on track following a savings suspension – specifically referring to the InvestNow customer who told us they planned to bump up their contribution rate when they started contributing again”

KiwiSaver in suspense: Why contribution holidays have expensive endings

Article written by InvestNow – 31 July 2023

In 2019 the government formally rebranded the popular KiwiSaver ‘contribution holiday’ as ‘savings suspension’ in an attempt to make the option seem less attractive, and hopefully discourage people from taking up the option of halting their KiwiSaver contributions.

The brand twist did not make an immediate impact: whether they viewed it as getting suspended or going on holiday, the number of KiwiSaver members pausing contributions actually increased by almost 1,000 in the 12 months after the name change, to hit almost 136,800 by June 2020, according to Inland Revenue Department (IRD) statistics.

As at June 30, 2021, the holiday/suspension figures dropped to about 114,500, perhaps reflecting the then-booming markets or possibly due to an IRD administrative change introduced the previous year that warped the statistical series.

Either way, by the following June 30, 2022, the number of KiwiSaver members on a contributions break had dropped below 100,000 for the first time since 2012.

But the members-on-suspension trend is on the rise again, clocking in at almost 103,600 at the end of May 2023 (up close to 3,000 compared to the same month in 2022), in a worrying, if not surprising, indication that the cost-of-living crisis is eating into long-term-saving plans.

Statistics NZ figures show the price-squeeze is real enough with the cost-of-living for the average Kiwi household increasing 6.7 per cent over the 12 months to the end of March 2023.

Piggybank in the middle

KiwiSaver likely represents a soft target for many cash-strapped New Zealanders struggling to make ends meet as living expenses continue to soar.

Indeed, KiwiSaver providers are starting to see a surge in members applying for financial hardship withdrawals this year, which shows in IRD data: over 2,500 members tapped their KiwiSaver accounts on hardship grounds this May versus about 1,370 in the same month last year.

The law rightly sets a high bar for allowing financial hardship payments given early withdrawals will substantially reduce the amount of money available for members in retirement.

In spite of the early withdrawal risks, however, the tug-of-war between the urgent financial demands of now and generating future retirement income continues to drag on.

For example, the National Party tabled an election policy in July that would open up KiwiSaver to withdrawals to fund rental bonds.

The National plan received little enthusiasm from either the public or investment industry, but the ensuing debate highlighted the limits and dangers of treating KiwiSaver as a piggybank to cover all manner of short-term financial stresses.

How gap years can leave a big hole in retirement

If the long-term impact of emptying retirement savings accounts to pay for current expenses might seem obvious, the costs of contribution vacations are more subtle.

Unlike financial hardship withdrawals, all KiwiSaver members are free to take a contribution holiday at their leisure. The KiwiSaver Act sets the standard suspension timeframe between a minimum of 3 months to a maximum of 1 year per suspension application, but members can simply extend year-on-year as long as required, with no limit.

Stopping KiwiSaver contributions undoubtedly leaves members with more money in the hand: based on an annual salary in NZ of $80,000 and an employee contribution rate of 3 per cent, workers would pocket a further $1,880.40 each year that previously would’ve gone to their KiwiSaver accounts.

The cash-in-hand does not come for free, though, with potential downsides including:

- Losing matching employer contributions – employers stop paying the mandatory 3 per cent co-contributions for KiwiSaver members on savings suspensions. Depending on the employment agreement, this could represent a real income reduction;

- Missing out on the $521 plus annual government KiwiSaver top–up – the so-called ‘member tax credit’ is paid each year by the government in line with employee (or voluntary) contributions up to just over $1,042, maxing-out at $521 and a few cents; and,

- Foregone investment returns – halting contributions will inevitably leave members with less capital accruing long-term returns.

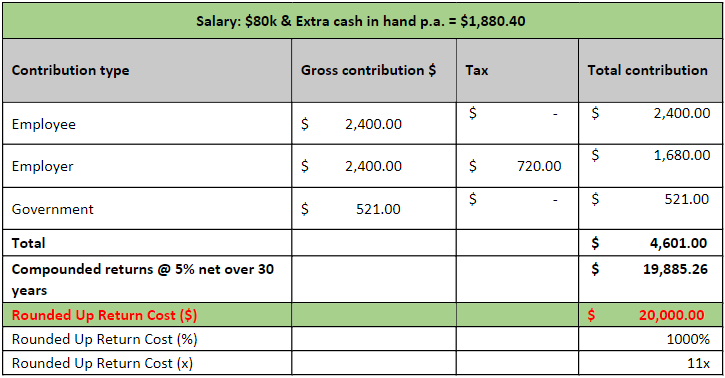

To expand on the final point – and putting the pieces together – a one-year KiwiSaver contribution holiday for someone on an $80,000 salary, aged 35, might play out like so:

Extra cash in hand per year = $1,880.40 after tax, noting that if it were contributed to KiwiSaver the full pre-tax amount would go into their KiwiSaver portfolio

But in exchange for $1,880.40 now, the KiwiSaver opportunity cost comes to:

In short, the decision to stop contributions for just one year in this scenario has reduced the future KiwiSaver balance at the current access age of 65 by just under $20,000.

The result illustrates the first of the InvestNow 10 investment principles, which centres on the importance of starting early and making regular contributions as “compound returns pile up over time so the sooner the better”.

Individual circumstances vary, of course, and there may be compelling reasons why making a legal KiwiSaver withdrawal or pausing contributions is the best option.

However, the idealised example above underscores why anybody feeling the cost-of-living squeeze should consider very carefully before taking a contributions holiday: the suspense could kill off a comfortable retirement.

“I know I’ll miss out on the compound returns and employer contributions, but we just didn’t have much of a choice at the moment. My wife isn’t working, and we needed the cash in hand to pay the mortgage.

To make up for it, I’ll need to bump up my contribution rate when my savings suspension ends”. says an InvestNow KiwiSaver Scheme investor currently on a savings suspension.

Mike Heath, InvestNow General Manager responds “We understand that when push comes to shove, sometimes we’ll need to make some tough choices, but we strongly discourage people from taking contribution holidays or saving suspensions if they have other options. We can’t stress enough the long-term value and importance of consistent investment habits.

That being said, it’s great to hear there is general awareness from our customers about what’s needed to get back on track following a savings suspension – specifically referring to the InvestNow customer who told us they planned to bump up their contribution rate when they started contributing again”