Manager Panel – Investing principles

Welcome to the June 2022 Manager Panel! Each month, where relevant, InvestNow will ask some of our fund managers some questions surrounding a topic. This month we asked Vault Digital Funds, TAHITO, QuayStreet Asset Management (QuayStreet) and ANZ Investments, about what they each think are common investing mistakes, what are three investing principles that they each live by and how they each incorporate these investing principles into the way they invest. Check out the questions and answers below.

Vinnie Gardiner, Founder and CEO – Vault Digital Funds

Q1. What are three common investing mistakes a lot of people make?

Q1. What are three common investing mistakes a lot of people make?

- Investment vehicles

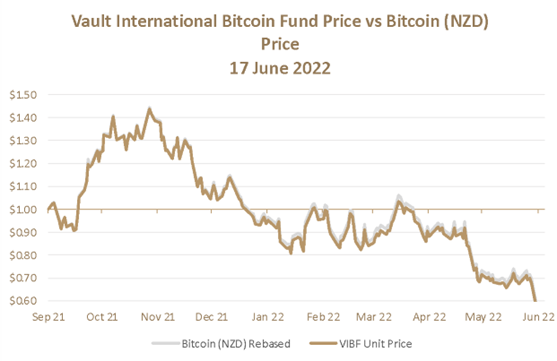

Many investors don’t take the time to understand the differences between investment vehicles. Take the Vault International Bitcoin Fund (VIBF) for example, the headline returns (before fees) are within 0.5% of investing directly in bitcoin – the Fund is very closely tracking the bitcoin price, despite its high volatility. Digging a little deeper, investors will see investing via VIBF or directly in Bitcoin are treated very differently for tax purposes. Since VIBF is not liable for Capital Gains Tax, the after tax returns can be significantly greater when compared with direct BTC investment.

- Investment Objectives

While many investors understand the need for investment objectives, they are often distracted from their investment goals by market noise. We often talk to investors who have invested in bitcoin due to its medium to long term potential, who then over analyse the short term price movements of their investment. With a long term (buy and hold) view, it is important investors keep their eyes on the investment horizon and not be distracted by short term volatility. Just remember, with a volatile investment like bitcoin, be sure you invest an appropriate amount of your portfolio.

- Timing the market vs time in the market

Many investors try to pick the market or “buy the dips”. With the best research, the best infrastructure, and a career’s worth of experience, many professional investors still find it difficult to consistently make good investment decisions. For the average investor to expect to beat the market on a regular basis is just unrealistic. A strategy often employed by investors is dollar cost averaging. This involves making smaller, regular, investments over time rather than trying to pick the best time to make one large investment. By doing this, an investor achieves an average cost of investment, eliminating the need to try to pick the perfect time to invest.

Q2. What are three investing principles that Vault Digital Funds lives by?

Investors who have reviewed our website (www.vaultdigitalfunds.com) will be familiar with our drive to provide a bitcoin investment vehicle that is Simple, Smart and Trusted.

- Simple. Buying a unit in a PIE Fund (not Bitcoin directly), means investors can gain exposure to digital assets investing without the challenges of buying, storing, and safekeeping digital currencies directly.

Many will be aware of the issues of sending money to offshore exchanges and the risks that entails. The education factor and hardware costs of ensuring your bitcoin is held in safe self custody is quite high for the average investor. Many take risks they are unaware of; VIBF negates these risks.

- Smart. VIBF is a PIE fund taxed in accordance with the Fair Dividend Rate method. This means investors pay no capital gains tax on gains made on the VIBF. There will be an annual “deemed” dividend of 5%pa, and investors would pay a maximum of 28% tax on that 5% dividend. This results in a maximum tax rate of 1.4% pa compared with up to 39% tax on any taxable gains when investing directly in Bitcoin.

- Trusted. Vault has worked with Implemented Investment Solutions, who are the issuer and manager of VIBF, to offer a PIE investment fund that operates within New Zealand’s regulatory frameworks.

Q3. How does Vault Digital Funds incorporate each of these investing principles into the way they invest?

Application of our 3 driving principles is very simple. Since we are a passive tracker of bitcoin, you won’t find us making subjective investment decisions or trying to beat the market. The hard work was done upfront with the design and structure of the fund, and our job now is to ensure that the fund does what it says on the tin, ie, closely tracks the bitcoin price. Since launch in September 2021, VIBF has very closely tracked the price of Bitcoin (NZD), typically to within 0.5% when adjusted for fees.

For more information please visit www.vaultdigitalfunds.com

Graph of the VIBF price vs Bitcoin, since inception

Disclaimer

At Vault Digital Funds we want you to make an informed choice as to whether investing in Bitcoin, or the VIBF, is right for you. This is a highly speculative investment. Bitcoin is a highly volatile asset. This means the VIBF will not be appropriate for all investors. You should read the disclosure material before investing. You should also seek advice from an independent financial adviser to help you make investment decisions.

Temuera Hall, Co-Founder and Managing Director – TAHITO

Q1. What are three common investing mistakes a lot of people make?

Q1. What are three common investing mistakes a lot of people make?

I’ll be a little provocative here;

Not having an investment purpose beyond one’s individual needs.

Short termism, get rich quick mentality, driven by the emotions of selfishness, greed and apathy.

Iho taketaketia tō kaupapa (Know what you’re doing before you do anything). Have a plan understand your risk and volatility tolerance, take advice. What is the potential to lose all or some of your investment? To quote the obvious: ‘Failing to plan is planning to fail’. ‘You can’t manage what isn’t measure’.

Q2. What are three investing principles that TAHITO lives by?

Our TAHITO Investment Principles are premised by our Indigenous Māori philosophy. Here’s a small insight to ‘Ngā Ruahine’ (female ancestors) behaviours;

Manahua te tapu o Apakura o te aroha – Empowering love and compassion

Hineahuone o te kura – Represents nature and knowledge of all things natural

Hinetītama o te tapu – Sacredness and purity along with its influences and procedures

Hinenuitepō o te wairua e – Eternity and spirituality

Manahua te tapu o Mahuika o te mauhī – Empowering passion and desire

Murirangawhenua o te kauwae – Proving Purpose, a sense of drive and resolve

Hineteiwaiwa o te kotahi – Unity, connectedness, relationships

Hineraukatauri o te rerehua e – Blossoming, thriving, beauty

The TAHITO investment philosophy focuses on providing high quality ethical investment services to investors. It is based on the following principles;

- We are ethical investors. We actively seek companies that are well run and meet our stringent Māori ethical screening tests.

- We are values-based investors. We invest in high quality investments that display connectivity and relational behaviours and qualities, have, or are committed to, a low environmental impact and have a high-level of social and corporate responsibility.

- We integrate MSCI Environmental Social and Governance (ESG) research on a values basis in our ethical screening.

- All securities undergo fundamental valuation and financial quality analysis.

- We take a long-term view.

- We are active investors.

- We have a disciplined approach to risk management.

Q3. How does TAHITO incorporate each of these investing principles into the way they invest?

To understand how our investing principles are applied we need to first understand Aroha and Mauri.

‘Life force is fed by connection. Mauri is lifeforce, (it’s your vitality or spiritual essence), Aroha is connection (also love and compassion) – Aroha feeds Mauri.’ Therefore by increasing your Aroha or connection – with people and the environment, you increase your mauri or lifeforce and we are on track to making the world a better place.

Arguably it is the loss of connection that underpins the major issues we face across the world, from climate change to loneliness. We believe that by re-connecting you can drive positive change in economics, finance and all societal behaviours.

The investment process which underpins TAHITO is effectively measuring ‘Aroha Connection’. We call it Te Kōwhiringa Tapu’, which literally means careful selection. We are measuring the transition of companies from the ‘substantive’, internally focused, self-absorbed behaviours, to the ideal ‘Relational’, externally connected, collective, compassionate behaviours.

Our first fund is TAHITO Te Tai o Rehua (Tai o Rehua is the Māori name for the Tasman Sea). It is a Australasian equities fund.

We have develop our own taxonomy. We use ethical and sustainable screens in selecting investments, for which Māori indigenous values, principles and behaviours serve as the foundation. At a technical level we apply a positive scoring system that integrates ESG on a values basis.

ESG measures primarily indicate the level of risk exposure relative to key ESG criteria, therefore ESG measures alone do not indicate that a company has attained sustainable, ethical and or impactful standards.

Our TAHITO positive screening measures are both quantitative and qualitative. The quantitative TAHITO scores (T Score) are obtained using research from the MSCI ESG system. The qualitative T Score (or Mauri screens) are obtained by direct research. Securities are ranked by their total T Score.

Māori ethics put people and the environment first because both are fundamental to living and thriving. This thinking is implicit in the ancestral Māori worldview which centres on connection and the interdependence of all things.

Andrew South, Director and Chief Investment Officer – QuayStreet

Q1. What are three common investing mistakes a lot of people make?

Q1. What are three common investing mistakes a lot of people make?

Some common mistakes we often see investors make are: 1) a focus on short-term performance. By that we mean chasing yesterday’s winners. 2) Chasing the current ‘hot stock’ or investment theme without regard to the price you’re paying. 3) Not being properly diversified. Investors are often overly concentrated in one stock or sector, which can magnify gains, but also results in higher volatility and exposure to capital losses if the investment thesis doesn’t work out. Over the past couple of years, there have been a lot of spectacular gains made in fashionable sectors and assets such as unprofitable tech and software stocks, cryptocurrencies, and NFTs. Now, quite a few of these have rapidly fallen out of fashion and those gains have all but evaporated, in some cases backsliding into steep losses.

Q2. What are three investing principles that QuayStreet lives by?

QuayStreet’s underlying investment philosophy is that an actively managed and concentrated selection of investments can provide higher returns than the market. This doesn’t mean that markets are inefficient; rather it is more about recognising that at different points in an investment cycle, different securities or asset classes offer better attractive risk-adjusted returns than others. This is particularly true for an investor with a longer-term investment horizon.

Three investing principles that QuayStreet lives by are:

- A focus on ‘quality’ businesses. We take a long-term view and focus on the underlying value and qualities of our investments. We target companies with robust and sustainable business models that are trading at a fair price or a price below their intrinsic value.

- Concentrate on our best investment ideas. We have a high level of conviction in our investment ideas, which is reflected by larger investments in a smaller number of securities. Our Funds tend to be more concentrated than other funds in the market, however they always maintain an appropriate level of diversification.

- An active approach to investment management. We aim to deliver returns above the Fund benchmarks by being actively involved with and engaged in investment selection, asset allocation, and risk management. We focus on assets we believe will outperform and adjust exposure accordingly to prevailing market conditions. When market changes present attractive opportunities, we are able to take advantage of these. The key feature of active investing is that there’s someone behind the wheel steering in response to changing conditions, whereas a passive investment such as an ETF is essentially on auto-pilot with limited ability to manoeuvre.

Q3. How does QuayStreet incorporate each of these investing principles into the way they invest?

Our investment principles are firmly embedded in our investment process, which incorporates both qualitative and quantitative analysis of investment attributes. A few of the attributes we focus on to identify quality businesses are things like unique competitive advantage, consistent performance on earnings and ability to generate value through growth. We also pay a lot of attention to how companies are run, and look for competent leadership, disciplined capital management and strong or improving governance as pointers to quality in that respect. Beyond this, we also incorporate external factors such as technological, social, demographic, and regulatory influences which could create additional opportunities or risks for a company or industry.

The guiding belief is that if you’re going to put hard-earned money behind something, you want to make sure you’ve done your homework. To tie it all together, our attitude is that a well thought-out process, applied uniformly helps to reduce undue bias and inadvertent trend-following when selecting investments. The way we invest revolves around putting quality at the centre of this process.

Paul Huxford, Chief Investment Officer – ANZ Investments

Q1. What are three common investing mistakes a lot of people make?

Q1. What are three common investing mistakes a lot of people make?

There are many common mistakes that investors make with their money, such as constantly checking on their investments, chasing trends, having unclear investment goals or following bad advice from social media. However, when markets turn volatile – as they are currently – we see the following three mistakes a bit more:

Making changes to their investments when markets fall: Unfortunately, we see a lot of investors changing their choice of funds upon the first signs of volatility, moving out of growth-oriented funds and into more conservative ones. While some avoid the worst of the falls, many do not realise that ‘timing the market’ involves making two good decisions – when to exit the market, but more importantly, when to get back in. It’s hard to predict when markets will change direction and always trying to pick the best time to change funds comes with risks. We recommend investors check they’re in the right fund for their risk tolerance and their investment timeframe, and be prepared to ride out any bumps along the way.

Stopping contributions, or delaying investment all together: We see this all the time, however, we would encourage investors to keep up their contributions through periods of market declines, because investing through a downturn means you can pick up quality investments at lower prices. Not only that, but it helps create good investment habits, and sets you up for a better retirement in the long term. For those who may be avoiding investing altogether, it’s worth considering that downturns are sometimes the best time to be getting into the markets – especially if they’re investing for the long term.

Not rebalancing your investment portfolio regularly: Rebalancing is the process of returning your portfolio to its target allocation. Investors don’t need to do it all the time, but if they don’t do it for months it can easily get out of line. Often it’s hard for investors to do this – because they have to sell out of their better-performing investments and buy into worse-performing ones. However, by not rebalancing, they run the risk of being overweight to certain asset classes at market peaks, and underweight at market lows. We encourage all investors to consider rebalancing when constructing their own portfolios.

Q2. What are three investing principles that ANZ Investments lives by?

At ANZ Investments, our investment philosophy is built around active investment management, with a particular focus on three key principles; quality, liquidity and diversification. It’s these factors which, we believe, allow us to deliver strong long-term investment performance and helps us manage risk and protect as much of our clients’ capital as possible during times of market volatility.

Let’s look at these three key principles.

Quality: Holding high quality investment assets means our investors should be better able to absorb any volatility in the prices of those investments. In tough market conditions, such as those we’re seeing at the moment, high quality investment assets tend to hold their value better than low quality assets. Low quality assets on the other hand tend to be more volatile, meaning investors who hold them are likely to be in for a rollercoaster ride. Something else that’s really important to note is that the prices of higher quality assets tend to bounce back more quickly as markets recover.

Liquidity: When we talk about liquidity, we usually refer to how quickly we can buy or sell investments. Investing in highly liquid investments means we can divest quickly if we need to, or if our view on a company or an asset class changes. Investing in illiquid investments means there’s a chance we may not be able to ‘get out’ of an investment, and investors could be forced to hold onto it if the price of that investment continues to fall.

Diversification: Holding many different investments helps to smooth out the returns for our clients. Importantly, it means that if the price of one investment falls in value, its weaker performance can be absorbed by other better-performing investments elsewhere. Diversification ensures our clients have exposure to companies operating in different industries and geographic regions. In the case of our diversified funds, this also means our clients have a spread of different types of investments, such as bonds, shares, listed property and listed infrastructure.

Q3. How does ANZ Investments incorporate each of these investing principles into the way they invest?

At ANZ Investments, we consider quality, liquidity and diversification in every single aspect of our decision making, including when:

- deciding which asset classes to invest in,

- selecting individual investments for the portfolios we manage directly, and

- choosing third-party investment managers to work with.

For example, all of ANZ Investments’ diversified portfolios have a larger allocation to international assets – because we believe international markets offer better quality, liquidity and diversification than the domestic market alone. However, there are many other ways that this plays out in our portfolios and in the funds we offer our investors.

It includes our GDP-weighted approach to managing international bonds, and the fact we only invest in high quality investment grade securities within our bond funds; the way we only invest in listed property investments and not in direct property; the avoidance of cryptocurrencies; and our multi-manager approach to investing in international equities – where we have appointed four quality investment managers, each with different but complementary styles that can offset each other in different markets conditions.

Not only that, but our size and scale allows us to have individual investment mandates with some of the world’s best investment managers – meaning we have ultimate control over how our funds – and therefore client money – is invested, and this includes in the application of our responsible investment policy.

Paul Huxford is Chief Investment Officer at ANZ Investments. He has overall investment responsibility for ANZ Investments across all asset classes, in addition to managing the investment team. He joined ANZ Investments in 2018 with over 30 years of global capital markets risk experience in Europe, Asia, Australia and New Zealand.

Manager Panel – Investing principles

Welcome to the June 2022 Manager Panel! Each month, where relevant, InvestNow will ask some of our fund managers some questions surrounding a topic. This month we asked Vault Digital Funds, TAHITO, QuayStreet Asset Management (QuayStreet) and ANZ Investments, about what they each think are common investing mistakes, what are three investing principles that they each live by and how they each incorporate these investing principles into the way they invest. Check out the questions and answers below.

Vinnie Gardiner, Founder and CEO – Vault Digital Funds

Q1. What are three common investing mistakes a lot of people make?

Q1. What are three common investing mistakes a lot of people make?

- Investment vehicles

Many investors don’t take the time to understand the differences between investment vehicles. Take the Vault International Bitcoin Fund (VIBF) for example, the headline returns (before fees) are within 0.5% of investing directly in bitcoin – the Fund is very closely tracking the bitcoin price, despite its high volatility. Digging a little deeper, investors will see investing via VIBF or directly in Bitcoin are treated very differently for tax purposes. Since VIBF is not liable for Capital Gains Tax, the after tax returns can be significantly greater when compared with direct BTC investment.

- Investment Objectives

While many investors understand the need for investment objectives, they are often distracted from their investment goals by market noise. We often talk to investors who have invested in bitcoin due to its medium to long term potential, who then over analyse the short term price movements of their investment. With a long term (buy and hold) view, it is important investors keep their eyes on the investment horizon and not be distracted by short term volatility. Just remember, with a volatile investment like bitcoin, be sure you invest an appropriate amount of your portfolio.

- Timing the market vs time in the market

Many investors try to pick the market or “buy the dips”. With the best research, the best infrastructure, and a career’s worth of experience, many professional investors still find it difficult to consistently make good investment decisions. For the average investor to expect to beat the market on a regular basis is just unrealistic. A strategy often employed by investors is dollar cost averaging. This involves making smaller, regular, investments over time rather than trying to pick the best time to make one large investment. By doing this, an investor achieves an average cost of investment, eliminating the need to try to pick the perfect time to invest.

Q2. What are three investing principles that Vault Digital Funds lives by?

Investors who have reviewed our website (www.vaultdigitalfunds.com) will be familiar with our drive to provide a bitcoin investment vehicle that is Simple, Smart and Trusted.

- Simple. Buying a unit in a PIE Fund (not Bitcoin directly), means investors can gain exposure to digital assets investing without the challenges of buying, storing, and safekeeping digital currencies directly.

Many will be aware of the issues of sending money to offshore exchanges and the risks that entails. The education factor and hardware costs of ensuring your bitcoin is held in safe self custody is quite high for the average investor. Many take risks they are unaware of; VIBF negates these risks.

- Smart. VIBF is a PIE fund taxed in accordance with the Fair Dividend Rate method. This means investors pay no capital gains tax on gains made on the VIBF. There will be an annual “deemed” dividend of 5%pa, and investors would pay a maximum of 28% tax on that 5% dividend. This results in a maximum tax rate of 1.4% pa compared with up to 39% tax on any taxable gains when investing directly in Bitcoin.

- Trusted. Vault has worked with Implemented Investment Solutions, who are the issuer and manager of VIBF, to offer a PIE investment fund that operates within New Zealand’s regulatory frameworks.

Q3. How does Vault Digital Funds incorporate each of these investing principles into the way they invest?

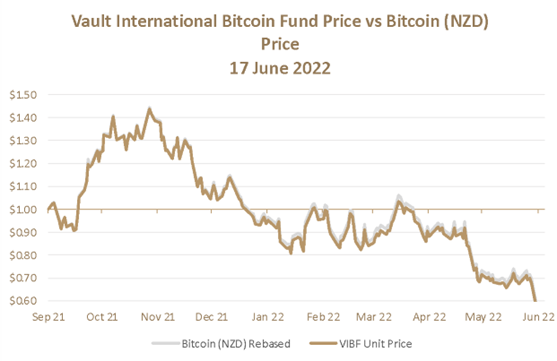

Application of our 3 driving principles is very simple. Since we are a passive tracker of bitcoin, you won’t find us making subjective investment decisions or trying to beat the market. The hard work was done upfront with the design and structure of the fund, and our job now is to ensure that the fund does what it says on the tin, ie, closely tracks the bitcoin price. Since launch in September 2021, VIBF has very closely tracked the price of Bitcoin (NZD), typically to within 0.5% when adjusted for fees.

For more information please visit www.vaultdigitalfunds.com

Graph of the VIBF price vs Bitcoin, since inception

Disclaimer

At Vault Digital Funds we want you to make an informed choice as to whether investing in Bitcoin, or the VIBF, is right for you. This is a highly speculative investment. Bitcoin is a highly volatile asset. This means the VIBF will not be appropriate for all investors. You should read the disclosure material before investing. You should also seek advice from an independent financial adviser to help you make investment decisions.

Temuera Hall, Co-Founder and Managing Director – TAHITO

Q1. What are three common investing mistakes a lot of people make?

Q1. What are three common investing mistakes a lot of people make?

I’ll be a little provocative here;

Not having an investment purpose beyond one’s individual needs.

Short termism, get rich quick mentality, driven by the emotions of selfishness, greed and apathy.

Iho taketaketia tō kaupapa (Know what you’re doing before you do anything). Have a plan understand your risk and volatility tolerance, take advice. What is the potential to lose all or some of your investment? To quote the obvious: ‘Failing to plan is planning to fail’. ‘You can’t manage what isn’t measure’.

Q2. What are three investing principles that TAHITO lives by?

Our TAHITO Investment Principles are premised by our Indigenous Māori philosophy. Here’s a small insight to ‘Ngā Ruahine’ (female ancestors) behaviours;

Manahua te tapu o Apakura o te aroha – Empowering love and compassion

Hineahuone o te kura – Represents nature and knowledge of all things natural

Hinetītama o te tapu – Sacredness and purity along with its influences and procedures

Hinenuitepō o te wairua e – Eternity and spirituality

Manahua te tapu o Mahuika o te mauhī – Empowering passion and desire

Murirangawhenua o te kauwae – Proving Purpose, a sense of drive and resolve

Hineteiwaiwa o te kotahi – Unity, connectedness, relationships

Hineraukatauri o te rerehua e – Blossoming, thriving, beauty

The TAHITO investment philosophy focuses on providing high quality ethical investment services to investors. It is based on the following principles;

- We are ethical investors. We actively seek companies that are well run and meet our stringent Māori ethical screening tests.

- We are values-based investors. We invest in high quality investments that display connectivity and relational behaviours and qualities, have, or are committed to, a low environmental impact and have a high-level of social and corporate responsibility.

- We integrate MSCI Environmental Social and Governance (ESG) research on a values basis in our ethical screening.

- All securities undergo fundamental valuation and financial quality analysis.

- We take a long-term view.

- We are active investors.

- We have a disciplined approach to risk management.

Q3. How does TAHITO incorporate each of these investing principles into the way they invest?

To understand how our investing principles are applied we need to first understand Aroha and Mauri.

‘Life force is fed by connection. Mauri is lifeforce, (it’s your vitality or spiritual essence), Aroha is connection (also love and compassion) – Aroha feeds Mauri.’ Therefore by increasing your Aroha or connection – with people and the environment, you increase your mauri or lifeforce and we are on track to making the world a better place.

Arguably it is the loss of connection that underpins the major issues we face across the world, from climate change to loneliness. We believe that by re-connecting you can drive positive change in economics, finance and all societal behaviours.

The investment process which underpins TAHITO is effectively measuring ‘Aroha Connection’. We call it Te Kōwhiringa Tapu’, which literally means careful selection. We are measuring the transition of companies from the ‘substantive’, internally focused, self-absorbed behaviours, to the ideal ‘Relational’, externally connected, collective, compassionate behaviours.

Our first fund is TAHITO Te Tai o Rehua (Tai o Rehua is the Māori name for the Tasman Sea). It is a Australasian equities fund.

We have develop our own taxonomy. We use ethical and sustainable screens in selecting investments, for which Māori indigenous values, principles and behaviours serve as the foundation. At a technical level we apply a positive scoring system that integrates ESG on a values basis.

ESG measures primarily indicate the level of risk exposure relative to key ESG criteria, therefore ESG measures alone do not indicate that a company has attained sustainable, ethical and or impactful standards.

Our TAHITO positive screening measures are both quantitative and qualitative. The quantitative TAHITO scores (T Score) are obtained using research from the MSCI ESG system. The qualitative T Score (or Mauri screens) are obtained by direct research. Securities are ranked by their total T Score.

Māori ethics put people and the environment first because both are fundamental to living and thriving. This thinking is implicit in the ancestral Māori worldview which centres on connection and the interdependence of all things.

Andrew South, Director and Chief Investment Officer – QuayStreet

Q1. What are three common investing mistakes a lot of people make?

Q1. What are three common investing mistakes a lot of people make?

Some common mistakes we often see investors make are: 1) a focus on short-term performance. By that we mean chasing yesterday’s winners. 2) Chasing the current ‘hot stock’ or investment theme without regard to the price you’re paying. 3) Not being properly diversified. Investors are often overly concentrated in one stock or sector, which can magnify gains, but also results in higher volatility and exposure to capital losses if the investment thesis doesn’t work out. Over the past couple of years, there have been a lot of spectacular gains made in fashionable sectors and assets such as unprofitable tech and software stocks, cryptocurrencies, and NFTs. Now, quite a few of these have rapidly fallen out of fashion and those gains have all but evaporated, in some cases backsliding into steep losses.

Q2. What are three investing principles that QuayStreet lives by?

QuayStreet’s underlying investment philosophy is that an actively managed and concentrated selection of investments can provide higher returns than the market. This doesn’t mean that markets are inefficient; rather it is more about recognising that at different points in an investment cycle, different securities or asset classes offer better attractive risk-adjusted returns than others. This is particularly true for an investor with a longer-term investment horizon.

Three investing principles that QuayStreet lives by are:

- A focus on ‘quality’ businesses. We take a long-term view and focus on the underlying value and qualities of our investments. We target companies with robust and sustainable business models that are trading at a fair price or a price below their intrinsic value.

- Concentrate on our best investment ideas. We have a high level of conviction in our investment ideas, which is reflected by larger investments in a smaller number of securities. Our Funds tend to be more concentrated than other funds in the market, however they always maintain an appropriate level of diversification.

- An active approach to investment management. We aim to deliver returns above the Fund benchmarks by being actively involved with and engaged in investment selection, asset allocation, and risk management. We focus on assets we believe will outperform and adjust exposure accordingly to prevailing market conditions. When market changes present attractive opportunities, we are able to take advantage of these. The key feature of active investing is that there’s someone behind the wheel steering in response to changing conditions, whereas a passive investment such as an ETF is essentially on auto-pilot with limited ability to manoeuvre.

Q3. How does QuayStreet incorporate each of these investing principles into the way they invest?

Our investment principles are firmly embedded in our investment process, which incorporates both qualitative and quantitative analysis of investment attributes. A few of the attributes we focus on to identify quality businesses are things like unique competitive advantage, consistent performance on earnings and ability to generate value through growth. We also pay a lot of attention to how companies are run, and look for competent leadership, disciplined capital management and strong or improving governance as pointers to quality in that respect. Beyond this, we also incorporate external factors such as technological, social, demographic, and regulatory influences which could create additional opportunities or risks for a company or industry.

The guiding belief is that if you’re going to put hard-earned money behind something, you want to make sure you’ve done your homework. To tie it all together, our attitude is that a well thought-out process, applied uniformly helps to reduce undue bias and inadvertent trend-following when selecting investments. The way we invest revolves around putting quality at the centre of this process.

Paul Huxford, Chief Investment Officer – ANZ Investments

Q1. What are three common investing mistakes a lot of people make?

Q1. What are three common investing mistakes a lot of people make?

There are many common mistakes that investors make with their money, such as constantly checking on their investments, chasing trends, having unclear investment goals or following bad advice from social media. However, when markets turn volatile – as they are currently – we see the following three mistakes a bit more:

Making changes to their investments when markets fall: Unfortunately, we see a lot of investors changing their choice of funds upon the first signs of volatility, moving out of growth-oriented funds and into more conservative ones. While some avoid the worst of the falls, many do not realise that ‘timing the market’ involves making two good decisions – when to exit the market, but more importantly, when to get back in. It’s hard to predict when markets will change direction and always trying to pick the best time to change funds comes with risks. We recommend investors check they’re in the right fund for their risk tolerance and their investment timeframe, and be prepared to ride out any bumps along the way.

Stopping contributions, or delaying investment all together: We see this all the time, however, we would encourage investors to keep up their contributions through periods of market declines, because investing through a downturn means you can pick up quality investments at lower prices. Not only that, but it helps create good investment habits, and sets you up for a better retirement in the long term. For those who may be avoiding investing altogether, it’s worth considering that downturns are sometimes the best time to be getting into the markets – especially if they’re investing for the long term.

Not rebalancing your investment portfolio regularly: Rebalancing is the process of returning your portfolio to its target allocation. Investors don’t need to do it all the time, but if they don’t do it for months it can easily get out of line. Often it’s hard for investors to do this – because they have to sell out of their better-performing investments and buy into worse-performing ones. However, by not rebalancing, they run the risk of being overweight to certain asset classes at market peaks, and underweight at market lows. We encourage all investors to consider rebalancing when constructing their own portfolios.

Q2. What are three investing principles that ANZ Investments lives by?

At ANZ Investments, our investment philosophy is built around active investment management, with a particular focus on three key principles; quality, liquidity and diversification. It’s these factors which, we believe, allow us to deliver strong long-term investment performance and helps us manage risk and protect as much of our clients’ capital as possible during times of market volatility.

Let’s look at these three key principles.

Quality: Holding high quality investment assets means our investors should be better able to absorb any volatility in the prices of those investments. In tough market conditions, such as those we’re seeing at the moment, high quality investment assets tend to hold their value better than low quality assets. Low quality assets on the other hand tend to be more volatile, meaning investors who hold them are likely to be in for a rollercoaster ride. Something else that’s really important to note is that the prices of higher quality assets tend to bounce back more quickly as markets recover.

Liquidity: When we talk about liquidity, we usually refer to how quickly we can buy or sell investments. Investing in highly liquid investments means we can divest quickly if we need to, or if our view on a company or an asset class changes. Investing in illiquid investments means there’s a chance we may not be able to ‘get out’ of an investment, and investors could be forced to hold onto it if the price of that investment continues to fall.

Diversification: Holding many different investments helps to smooth out the returns for our clients. Importantly, it means that if the price of one investment falls in value, its weaker performance can be absorbed by other better-performing investments elsewhere. Diversification ensures our clients have exposure to companies operating in different industries and geographic regions. In the case of our diversified funds, this also means our clients have a spread of different types of investments, such as bonds, shares, listed property and listed infrastructure.

Q3. How does ANZ Investments incorporate each of these investing principles into the way they invest?

At ANZ Investments, we consider quality, liquidity and diversification in every single aspect of our decision making, including when:

- deciding which asset classes to invest in,

- selecting individual investments for the portfolios we manage directly, and

- choosing third-party investment managers to work with.

For example, all of ANZ Investments’ diversified portfolios have a larger allocation to international assets – because we believe international markets offer better quality, liquidity and diversification than the domestic market alone. However, there are many other ways that this plays out in our portfolios and in the funds we offer our investors.

It includes our GDP-weighted approach to managing international bonds, and the fact we only invest in high quality investment grade securities within our bond funds; the way we only invest in listed property investments and not in direct property; the avoidance of cryptocurrencies; and our multi-manager approach to investing in international equities – where we have appointed four quality investment managers, each with different but complementary styles that can offset each other in different markets conditions.

Not only that, but our size and scale allows us to have individual investment mandates with some of the world’s best investment managers – meaning we have ultimate control over how our funds – and therefore client money – is invested, and this includes in the application of our responsible investment policy.

Paul Huxford is Chief Investment Officer at ANZ Investments. He has overall investment responsibility for ANZ Investments across all asset classes, in addition to managing the investment team. He joined ANZ Investments in 2018 with over 30 years of global capital markets risk experience in Europe, Asia, Australia and New Zealand.

Leave A Comment